To stop consumer prices falling, the country must stop property sales flagging

为了阻止消费者价格下跌,国家必须阻止房地产销售疲软

Aug 10th 2023 | HONG KONG 经济学人

音频版播放

It can sometimes be difficult to wrap one’s head around the world’s second biggest economy. But three headlines in the space of two days—August 8th and 9th—captured the predicament that China now faces. Exports fell by more than 14% in dollar terms. Country Garden, one of the country’s biggest property developers, missed two coupon payments on its dollar bonds. And annual consumer-price inflation turned negative. In sum: China’s export boom is long over. Its property slump is not. And, therefore, deflation beckons.

有时很难完全理解世界第二大经济体。但两天内的三个头条新闻——8月8日和9日——抓住了中国现在面临的困境。以美元计算,出口下降了14%以上。中国最大的房地产开发商之一碧桂园两次未能支付其美元债券的息票。年度消费者价格通胀转为负值。总而言之:中国的出口繁荣早已结束。它的财产暴跌却并非如此。因此,通货紧缩正在招手。

Ever since China imposed its first brutally effective lockdown on Wuhan in early 2020, its economy has been out of sync with the rest of the world’s. When the country abandoned its ruinous zero-covid controls at the end of last year, many economists hoped that the exceptionalism would continue, and that China would stage a rapid recovery, even as other big economies courted recession. The expectation also raised a fear. Analysts worried that China’s renewed appetite for commodities and other goods would put upward pressure on global inflation, making the lives of central bankers elsewhere even harder. Neither the hopes for growth nor the fears of inflation have been realised.

自从2020年初中国对武汉实施首次残酷有效的封锁以来,其经济一直与世界其他地区不同步。当中国去年底放弃毁灭性的零新冠控制措施时,许多经济学家希望这种例外论能够继续下去,即使其他大型经济体陷入衰退,中国也能实现快速复苏。这种期待也引发了恐惧。分析师担心,中国对大宗商品和其他商品的兴趣重燃,会给全球通胀带来上行压力,让其他国家央行行长的日子更加艰难。增长的希望和通货膨胀的担忧都没有实现。

Instead, China is now struggling to meet the government’s modest growth target of 5% for 2023 (“modest” because last year provides such a low base for comparison). Far from becoming an inflationary force in the global economy, the country is now flirting with falling prices.

相反,中国现在正在努力实现政府设定的 2023 年 5% 的温和增长目标(“温和”是因为去年提供的比较基数如此之低)。该国非但没有成为全球经济的通胀力量,反而正在面临物价下跌。

According to the data released on August 9th, consumer prices dropped by 0.3% in July compared with a year earlier. Viewed in isolation, that is no great cause for alarm. A solitary month of mild deflation is not sufficient to turn China into the next Japan. Consumer inflation has been negative before—in 30 months this century, and as recently as 2021. Moreover, July’s figure says almost as much about pork’s past as it does about China’s economic future. Prices for the country’s favourite meat were unusually high in July last year. They have since fallen by a quarter, contributing to the negative headline number.

8月9日公布的数据显示,7月份居民消费价格同比下降0.3%。孤立地看,这并没有什么值得警惕的。仅仅一个月的温和通缩不足以让中国变成下一个日本。消费者通胀此前曾出现过负值——本世纪的 30 个月内,以及最近的 2021 年。此外,7 月份的数据几乎既反映了猪肉的过去,也反映了中国经济的未来。去年七月,该国最受欢迎的肉类价格异常高。此后,它们下降了四分之一,导致总体数字为负。

But consumer prices are not the only ones in the trough. The prices charged by producers (at the proverbial “factory gate”) have now declined year-on-year for ten months in a row. Those fetched by China’s exports dropped by more than 10% in July, according to estimates by analysts at ubs, a bank. And the gdp deflator, a broad measure that covers all the goods and services produced in the country, fell by 1.4% in the second quarter compared with a year earlier. That is only its sixth decline this century and its steepest since 2009.

但消费者价格并不是唯一陷入低谷的因素。生产商(在众所周知的“工厂门口”)收取的价格现已连续十个月同比下降。据瑞银银行分析师估计,7 月份中国出口额下降了 10% 以上。 GDP平减指数是一项涵盖该国生产的所有商品和服务的广泛指标,第二季度与去年同期相比下降了1.4%。这只是本世纪第六次下降,也是 2009 年以来最大幅度的下降。

Many economists foresaw the drop in pork and food prices. They assumed, however, that it would be offset by a faster increase in the cost of services, as China’s economy gathered steam. They also expected that the property market would stabilise, which would prop up demand for other goods, both upstream (in products such as steel and construction equipment) and down (in those such as furniture and household appliances).

许多经济学家预计猪肉和食品价格将会下跌。然而,他们认为,随着中国经济的增长,服务成本的更快增长将抵消这一影响。他们还预计房地产市场将趋于稳定,这将提振对上游(钢铁和建筑设备等产品)和下游(家具和家用电器等产品)其他商品的需求。

After a brief revival in the early months of the year, property sales are faltering again. Those in 30 big cities fell by 28% in July compared with the year before. Declines in rents and the prices of household appliances both contributed to the negative turn in consumer prices in July. Country Garden also blamed “a deterioration in sales”, among other things, for its failure to pay its bondholders on the expected date this month. The company has a 30-day grace period before it falls into default.

经过今年头几个月的短暂复苏后,房地产销售再次陷入困境。 7月30个大城市同比下降28%。租金和家电价格的下降共同推动了7月份居民消费价格的负转。碧桂园还指责“销售恶化”等原因导致其未能在本月的预期日期向债券持有人付款。该公司在违约前有 30 天的宽限期。

China’s government is also now up against the clock. In recent weeks a rotating cast of committees, ministries and commissions has unveiled a variety of measures to improve the economy. A 31-point plan to encourage private enterprise announced that the government would remove barriers to entry and strengthen intellectual-property rights. A 20-point plan to expand consumption touted cheaper tickets for scenic spots, among other goodies. A 26-point plan to increase labour mobility promised to make it easier for rural migrants to settle in cities (and easier for foreign businesspeople to get visas).

中国政府现在也在争分夺秒。最近几周,一些委员会、部委和委员会轮流公布了一系列改善经济的措施。一项鼓励私营企业的31条计划宣布,政府将消除准入壁垒,加强知识产权保护。一项扩大消费的20点计划还推出了更便宜的景点门票等优惠。一项旨在提高劳动力流动性的 26 点计划承诺让农民工更容易在城市定居(也让外国商人更容易获得签证)。

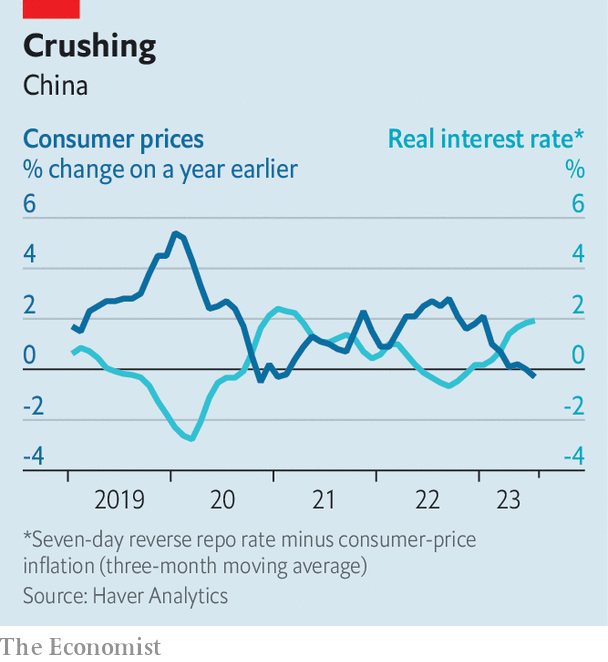

Yet if the property market does not improve, deflationary pressure will persist. The longer it lasts, the more difficult it will be to reverse. Thus a more forceful fiscal and monetary push is required. ubs calculates that the government’s deficit, broadly defined, shrank in the first half of this year, providing less support to the economy. Meanwhile, the central bank has barely cut interest rates, reducing its short-term policy rate from 2% to 1.9%. That is not enough to keep up with the decline in inflation, which means the real cost of borrowing is rising (see chart). In order to defeat deflation, the budget deficit will have to widen. And the central bank’s efforts will need to go beyond 0.1 point. ■

但如果房地产市场不改善,通缩压力将持续存在。持续的时间越长,扭转就越困难。因此,需要更有力的财政和货币推动。瑞银计算得出,今年上半年政府的广义赤字有所缩减,对经济的支持减少。与此同时,央行几乎没有降息,将短期政策利率从2%降至1.9%。这还不足以跟上通货膨胀的下降,这意味着借贷的实际成本正在上升(见图表)。为了战胜通货紧缩,预算赤字必须扩大。而央行的努力需要超过0.1个百分点。 ■