The economy and asset prices have proved more resilient than feared

事实证明,经济和资产价格比人们担心的更有弹性

Aug 1st 2023

Stockmarkets, the economist Paul Samuelson once quipped, have predicted nine out of the last five recessions. Today they stand accused of crying wolf yet again. Pessimism seized trading floors around the world in 2022, as asset prices plunged, consumers howled and recessions seemed all but inevitable. Yet so far Germany is the only big economy to have actually experienced one—and a mild one at that. In a growing number of countries, it is now easier to imagine a “soft landing”, in which central bankers succeed in quelling inflation without quashing growth. Markets, accordingly, have spent months in party mode. Taking the summer lull as a chance to reflect on the year so far, here are some of the things investors have learned.

经济学家保罗·萨缪尔森(Paul Samuelson)曾打趣道,股市在过去五次经济衰退中预测了九次。今天,他们再次被指责“狼来了”。 2022 年,随着资产价格暴跌、消费者哀嚎、经济衰退似乎不可避免,悲观情绪席卷了全球交易大厅。但迄今为止,德国是唯一一个真正经历过这种情况的大型经济体,而且是温和的情况。在越来越多的国家,现在更容易想象“软着陆”,即央行行长成功抑制通胀而不抑制经济增长。因此,市场已经度过了数月的狂欢。以夏季的平静期为契机,回顾今年迄今为止的情况,以下是投资者学到的一些东西。

The Fed was serious…

美联储是认真的……

Interest-rate expectations began the year in an odd place. The Federal Reserve had spent the previous nine months tightening its monetary policy at the quickest pace since the 1980s. And yet investors remained stubbornly unconvinced of the central bank’s hawkishness. At the start of 2023, market prices implied that rates would peak below 5% in the first half of the year, then the Fed would start cutting. The central bank’s officials, in contrast, thought rates would finish the year above 5% and that cuts would not follow until 2024.

今年年初的利率预期很奇怪。过去 9 个月,美联储以 20 世纪 80 年代以来最快的速度收紧货币政策。然而投资者仍然顽固地不相信央行的强硬态度。 2023 年初,市场价格暗示利率将在上半年达到 5% 以下的峰值,然后美联储将开始降息。相比之下,央行官员认为今年年底利率将高于 5%,并且要到 2024 年才会降息。

The officials eventually prevailed. By continuing to raise rates even during a miniature banking crisis (see below), the Fed at last convinced investors it was serious about curbing inflation. The market now expects the Fed’s benchmark rate to finish the year at 5.4%, only marginally below the central bankers’ own median projection. That is a big win for a central bank whose earlier, flat-footed reaction to rising prices had damaged its credibility.

最终官员们取得了胜利。即使在小型银行危机期间(见下文),美联储也继续加息,最终让投资者相信,它是认真遏制通胀的。市场目前预计美联储今年的基准利率将达到 5.4%,仅略低于央行官员自己的预测中值。对于一家央行来说,这是一个巨大的胜利,该央行此前对物价上涨的措手不及的反应损害了其信誉。

…yet borrowers are mostly weathering the storm......

然而借款人大多都经受住了风暴

During the cheap-money years, the prospect of sharply higher borrowing costs sometimes seemed like the abominable snowman: terrifying but hard to believe in. The snowman’s arrival has thus been a double surprise. Higher interest rates have proved all-too-real but not-so-scary.

在廉价货币的年代,借贷成本急剧上升的前景有时就像可恶的雪人:令人恐惧,但又难以相信。因此,雪人的到来带来了双重惊喜。事实证明,更高的利率是真实存在的,但并不那么可怕。

Since the start of 2022, the average interest rate on an index of the riskiest (or “junk”) debt owed by American firms has risen from 4.4% to 8.1%. Few, though, have gone broke. The default rate for high-yield borrowers has risen over the past 12 months, but only to around 3%. That is much lower than in previous times of stress. After the global financial crisis of 2007-09, for instance, the default rate rose above 14%.

自 2022 年初以来,美国企业所欠风险最高(或“垃圾”)债务指数的平均利率已从 4.4% 上升至 8.1%。然而,很少有人破产。高收益借款人的违约率在过去 12 个月有所上升,但仅达到 3% 左右。这比以前的压力时期要低得多。例如,2007-09 年全球金融危机之后,违约率升至 14% 以上。

This might just mean that the worst is yet to come. Many firms are still running down cash buffers built up during the pandemic and relying on dirt-cheap debt fixed before rates started rising. Yet there is reason for hope. Interest-coverage ratios for junk borrowers, which compare profits to interest costs, are close to their healthiest level in 20 years. Rising rates might make life more difficult for borrowers, but they have not yet made it dangerous.

这可能只是意味着最糟糕的情况尚未到来。许多公司仍在耗尽疫情期间建立的现金缓冲,并依赖于利率开始上升之前固定的极其廉价的债务。但我们仍有理由抱有希望。垃圾借款人的利息覆盖率(将利润与利息成本进行比较)接近 20 年来的最健康水平。利率上升可能会让借款人的生活变得更加困难,但尚未使其变得危险。

Not every bank failure means a return to 2008

并非每一次银行倒闭都意味着回到 2008 年

In the panic-stricken weeks that followed the implosion of Silicon Valley Bank, a mid-tier American lender, on March 10th, events started to feel horribly familiar. The collapse was followed by runs on other regional banks (Signature Bank and First Republic Bank also buckled) and, seemingly, by global contagion. Credit Suisse, a 167-year-old Swiss investment bank, was forced into a shotgun marriage with its long-time rival, ubs. At one point it looked as if Deutsche Bank, a German lender, was also teetering.

3 月 10 日,美国中型银行硅谷银行 (Silicon Valley Bank) 破产后,在恐慌的几周内,发生的事情开始变得异常熟悉。崩溃之后,其他地区银行也出现了挤兑(Signature Bank 和 First Republic Bank 也崩溃了),而且似乎还蔓延到了全球。拥有167年历史的瑞士投资银行瑞士信贷被迫与其长期竞争对手瑞银联姻。德国银行德意志银行一度看起来也摇摇欲坠。

Mercifully a full-blown financial crisis was averted. Since First Republic’s failure on May 1st, no more banks have fallen. Stockmarkets shrugged off the damage within a matter of weeks, although the kbw index of American banking shares is still down by about 20% since the start of March. Fears of a long-lasting credit crunch have not come true.

幸运的是,一场全面的金融危机得以避免。自 5 月 1 日第一共和国倒闭以来,没有更多银行倒闭。尽管美国银行股 kbw 指数自 3 月初以来仍下跌约 20%,但股市在几周内就摆脱了损失。对长期信贷紧缩的担忧并未成为现实。

Yet this happy outcome was far from costless. America’s bank failures were stemmed by a vast, improvised bail-out package from the Fed. One implication is that even mid-sized lenders are now deemed “too big to fail”. This could encourage such banks to indulge in reckless risk-taking, under the assumption that the central bank will patch them up if it goes wrong. The forced takeover of Credit Suisse (on which ubs shareholders were not given a vote) bypassed a painstakingly drawn-up “resolution” plan detailing how regulators are supposed to deal with a failing bank. Officials swear by such rules in peacetime, then forswear them in a crisis. One of the oldest problems in finance still lacks a widely accepted solution.

然而,这一幸福的结果并非没有代价。美国银行倒闭的根源在于美联储庞大的临时救助计划。其中一个含义是,即使是中型贷款机构现在也被认为“太大而不能倒”。这可能会鼓励这些银行不计后果地冒险,因为他们假设央行会在出现问题时对其进行修补。对瑞士信贷的强制收购(瑞银股东没有投票权)绕过了精心制定的“决议”计划,该计划详细说明了监管机构应如何处理一家破产银行。官员们在和平时期宣誓遵守这些规则,但在危机时期就放弃它们。金融领域最古老的问题之一仍然缺乏广泛接受的解决方案。

Stock investors are betting big on big tech—again

股票投资者再次大举押注大型科技公司

Last year was a humbling time for investors in America’s tech giants. These firms began 2022 looking positively unassailable: just five firms (Alphabet, Amazon, Apple, Microsoft and Tesla) made up nearly a quarter of the value of the s&p 500 index. But rising interest rates hobbled them. Over the course of the year the same five firms fell in value by 38%, while the rest of the index dropped by just 15%.

去年对于美国科技巨头的投资者来说是一段令人羞愧的时期。 2022 年伊始,这些公司看起来是无懈可击的:仅五家公司(Alphabet、亚马逊、苹果、微软和特斯拉)就占了标准普尔 500 指数价值的近四分之一。但不断上升的利率阻碍了他们。在这一年里,这五家公司的价值下跌了 38%,而该指数的其余公司仅下跌了 15%。

Now the behemoths are back. Joined by two others, Meta and Nvidia, the “magnificent seven” dominated America’s stockmarket returns in the first half of this year. Their share prices soared so much that, by July, they accounted for more than 60% of the value of the nasdaq 100 index, prompting Nasdaq to scale back their weights to prevent the index from becoming top-heavy. This big tech boom reflects investors’ enormous enthusiasm for artificial intelligence, and their more recent conviction that the biggest firms are best placed to capitalise on it.

现在,庞然大物又回来了。与另外两家公司 Meta 和 Nvidia 一起,“七巨头”主导了今年上半年美国股市的回报。他们的股价飙升至7月份,占纳斯达克100指数价值的60%以上,促使纳斯达克缩减其权重,以防止该指数变得头重脚轻。科技的蓬勃发展反映了投资者对人工智能的巨大热情,以及他们最近的信念,即最大的公司最有能力利用人工智能。

An inverted yield curve does not spell immediate doom

收益率曲线倒挂并不意味着立即厄运

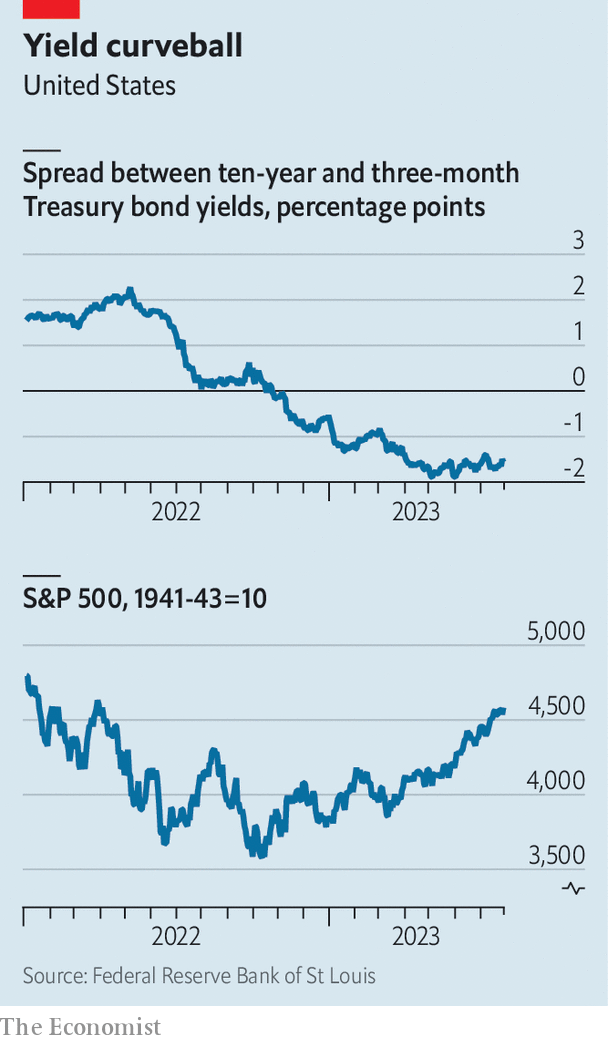

The stockmarket rally means that it is now bond investors who find themselves predicting a recession that has yet to arrive. Yields on long-dated bonds typically exceed those on short-dated ones, compensating longer-term lenders for the greater risks they face. But since last October, the yield curve has been “inverted”: short-term rates have been above long-term ones (see chart). This is financial markets’ surest signal of impending recession. The thinking is roughly as follows. If short-term rates are high, it is presumably because the Fed has tightened monetary policy to slow the economy and curb inflation. And if long-term rates are low, it suggests the Fed will eventually succeed, inducing a recession that will require it to cut interest rates in the more distant future.

股市上涨意味着债券投资者现在发现自己预测经济衰退尚未到来。长期债券的收益率通常超过短期债券,从而补偿长期贷款人面临的更大风险。但自去年10月以来,收益率曲线出现“倒挂”:短期利率一直高于长期利率(见图表)。这是金融市场即将发生衰退的最可靠信号。思路大致如下。如果短期利率很高,可能是因为美联储收紧货币政策以减缓经济增长并抑制通胀。如果长期利率较低,则表明美联储最终将取得成功,引发经济衰退,从而需要美联储在更遥远的将来降息。

This inversion (measured by the difference between ten-year and three-month Treasury yields) had only happened eight times previously in the past 50 years. Each occasion was followed by recession. Sure enough, when the latest inversion started in October, the s&p 500 reached a new low for the year.

这种倒挂(以十年期和三个月期国债收益率之差衡量)在过去 50 年中只发生过八次。每次事件之后都会出现经济衰退。果然,当 10 月份最近一次反转开始时,标准普尔 500 指数创下了年内新低。

Since then, however, both the economy and the stockmarket have seemingly defied gravity. That hardly makes it time to relax: something else may yet break before inflation has fallen enough for the Fed to start cutting rates. But there is also a growing possibility that a seemingly foolproof indicator has misfired. In a year of surprises, that would be the best one of all. ■

然而,从那时起,经济和股市似乎都在反抗重力。现在还没有到放松的时候:在通胀下降到足以让美联储开始降息之前,其他事情可能还会破裂。但一个看似万无一失的指标也有可能失灵。在充满惊喜的一年中,这将是最好的一年。 ■