- Tax authorities summoned wealthy individuals in rare request

税务机关罕见地传唤富人 - Government faces dwindling fiscal revenue as land sales slow

由于土地销售放缓,政府面临财政收入减少

By Trista Xinyi Luo and Lulu Yilun Chen

作者: Trista Xinyi Luo和Lulu Yilu Chen

2024年10月15日 GMT+8 08:08

China has begun enforcing a long-overlooked tax on overseas investment gains by the country’s ultra-rich, according to people familiar with the matter.

据知情人士透露,中国已开始对该国超级富豪的海外投资收益征收长期被忽视的税收。

Some wealthy individuals in major Chinese cities were told in recent months to conduct self-assessments or summoned by tax authorities for meetings to evaluate potential payments, including those in arrears from past years, said the people, asking not to be identified discussing a private matter.

知情人士称,近几个月来,中国主要城市的一些富人被要求进行自我评估,或被税务机关传唤参加会议,评估潜在的付款,包括过去几年拖欠的付款。 。

The move underscores growing urgency within the government to expand its sources of revenue as land sales tumble and growth slows. It also aligns with President Xi Jinping’s “common prosperity” campaign to create a more equal distribution of wealth in the world’s second-largest economy.

此举突显出,随着土地销售下滑和经济增长放缓,政府内部扩大收入来源的紧迫性越来越大。它还符合习近平主席旨在在世界第二大经济体创造更加平等的财富分配的“共同繁荣”运动。

The individuals contacted are facing up to 20% levies on investment gains, and some are also subject to penalties on overdue payments, said the people, adding that the final amount is negotiable.

知情人士称,所接触的个人将面临高达 20% 的投资收益税,有些人还可能因逾期付款而受到处罚,并补充说最终金额可以协商。

China’s tax push also follows its 2018 implementation the Common Reporting Standard, a global information-sharing system aimed at preventing tax evasion. While local regulations always stipulated that residents be taxed on worldwide income, including investment gains, it has rarely been enforced until recently, said the people.

中国在2018年实施了共同报告标准之后也推出了税收推动措施,该标准是一个旨在防止逃税的全球信息共享系统。知情人士表示,虽然地方法规一直规定居民对全球收入(包括投资收益)征税,但直到最近才得到执行。

It’s unclear how widespread the efforts are and how long they’ll last, the people said. Some of the targeted Chinese had at least $10 million in offshore assets, while others were shareholders of companies listed in Hong Kong and the US, according to the people.

知情人士称,目前尚不清楚这些努力的范围有多大以及将持续多久。知情人士称,其中一些目标中国人拥有至少 1000 万美元的离岸资产,而其他人则是在香港和美国上市公司的股东。

China’s tax bureau didn’t respond to a request for comment.

中国税务局没有回应置评请求。

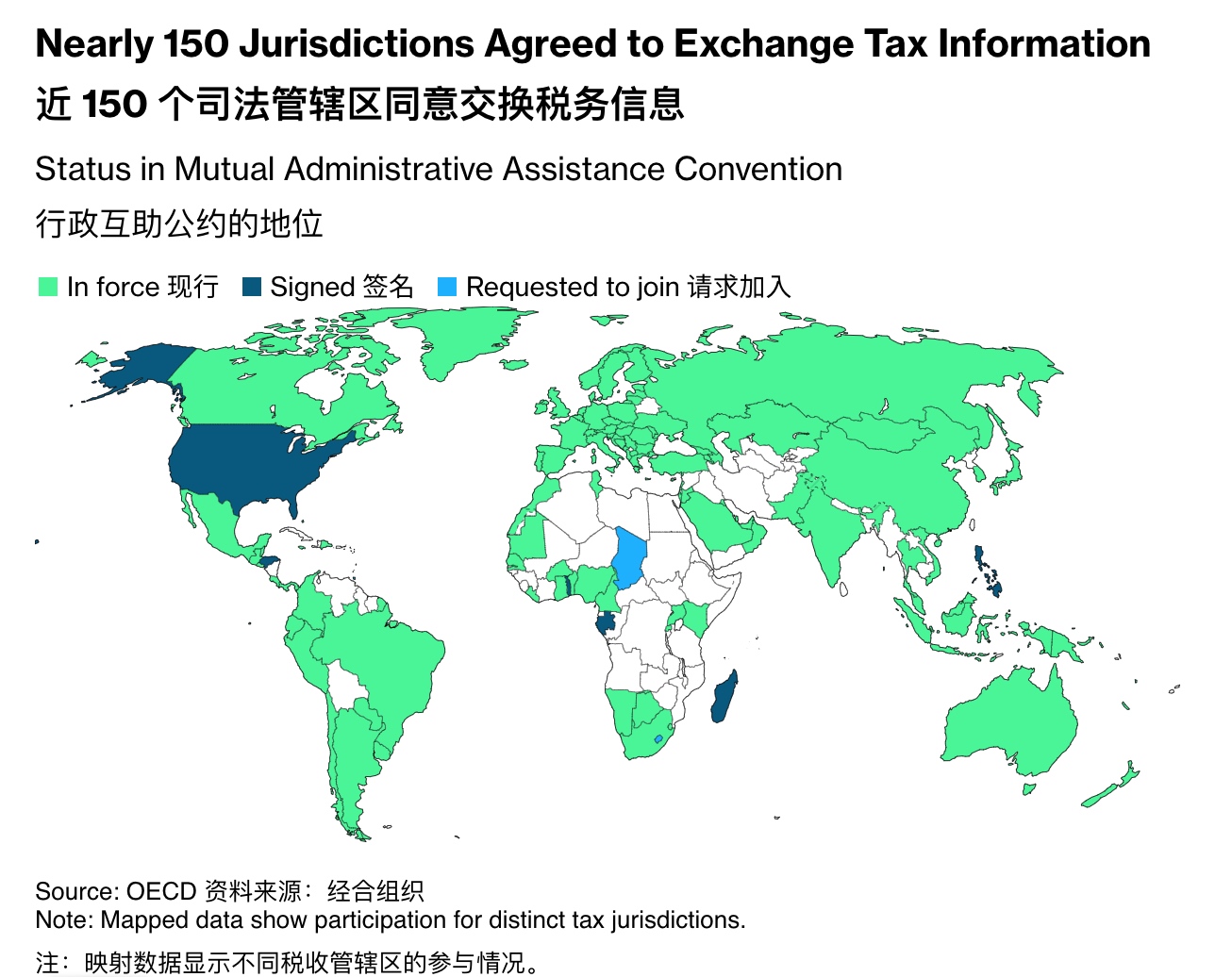

Under the CRS, China has been automatically exchanging information with nearly 150 jurisdictions about accounts belonging to people subject to taxes in each member country for the past six years.

根据CRS ,过去六年来,中国一直在与近150个司法管辖区自动交换每个成员国纳税人账户的信息。

“China already has a treasure trove of CRS data which the tax authorities could readily mine to uncover collection opportunities,” said Patrick Yip, Deloitte China’s vice chair. “The potential for individual tax audits, relative to enterprise tax audits, would be on the rise.”

“中国已经拥有了CRS数据宝库,税务机关可以很容易地挖掘这些数据以发现征收机会,”德勤中国副主席Patrick Yip表示。 “相对于企业税务审计,个人税务审计的潜力将会上升。”

China’s wealthy have been under the spotlight since President Xi unleashed a multiyear crackdown that ensnared the consumer internet, finance and property sectors.

自从习近平主席发起多年的打压行动,令消费者互联网、金融和房地产行业陷入困境以来,中国的富人一直受到关注。

The campaign dented the confidence of the richest individuals in a country where a billionaire was being minted every few days in 2018. Boston Consulting Group estimated around the time that of the nation’s $24 trillion personal wealth, about $1 trillion was held abroad. China has also seen a spike in emigration by affluent citizens, with more than 1.2 million people leaving the country since 2021, according to United Nations data.

这场运动削弱了这个国家最富有的人的信心,2018 年每隔几天就会诞生一位亿万富翁。波士顿咨询集团估计,当时该国 24 万亿美元的个人财富中,约有 1 万亿美元存放在国外。联合国数据显示,中国富裕公民的移民人数也激增,自 2021 年以来已有超过 120 万人离开中国。

China’s fiscal revenue from January through August fell 2.6% from last year to about 14.8 trillion yuan. Government land sales income dropped 25% to 2 trillion yuan, while tax revenue also dipped 5.3%. Policymakers announced a swath of stimulus measures since late September to revive the economy, including pledges to make the largest effort in years to swap local governments’ off-balance sheet debt to ease their financial burden.

1-8月中国财政收入下降比去年增长2.6%至约14.8万亿元。政府土地出让收入下降25%至2万亿元,税收收入也下降5.3%。自9月下旬以来,政策制定者宣布了一系列刺激措施以重振经济,包括承诺采取多年来最大的努力来置换地方政府的表外债务,以减轻地方政府的财政负担。

Local officials have become more aggressive in chasing companies for taxes dating back decades as they try to plug a hole in municipal finances caused by the housing downturn.

地方官员在几十年前就更加积极地向企业追缴税收,试图填补房地产市场低迷造成的市政财政漏洞。

“Going forward, there will be stricter enforcement of the individual income tax law,” said Peter Ni, a Shanghai-based partner and tax specialist at Zhong Lun Law Firm. “Eventually offshore income of those high-income individuals will become a specific target for the tax authority.”

“今后,个人所得税法的执行将会更加严格,”中伦律师事务所驻上海合伙人兼税务专家倪彼得表示。 “最终这些高收入个人的离岸收入将成为税务机关的具体目标。”