- Central bank chief reveals policy rate, RRR cuts at briefing

央行行长在发布会上透露政策利率和存款准备金率下调情况 - Measures to boost property sector, stock market announced

宣布促进房地产行业和股票市场发展的措施

By Bloomberg News 作者:布隆伯格新闻 2024年9月24日

China’s central bank unveiled a broad package of monetary stimulus measures to revive the world’s second-largest economy, underscoring mounting alarm within Xi Jinping’s government over slowing growth and depressed investor confidence.

中国央行公布了振兴世界第二大经济体的一揽子货币刺激措施,凸显了习近平政府内部对经济增长放缓和投资者信心低迷的日益担忧。

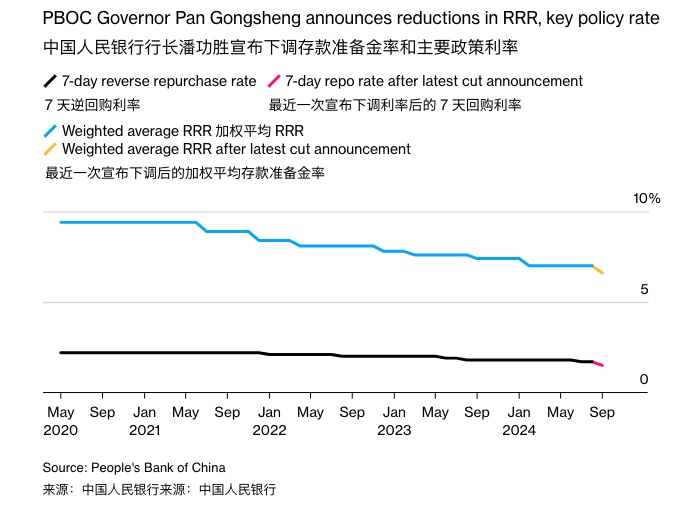

People’s Bank of China governor Pan Gongsheng cut a key short-term interest rate and announced plans to reduce the amount of money banks must hold in reserve to the lowest level since at least 2018, appearing at a rare briefing alongside two of the country’s other top financial regulators in Beijing. That marked the first time reductions to both measures were revealed on the same day since at least 2015.

中国人民银行行长潘功胜下调了关键的短期利率,并宣布计划将银行必须持有的货币储备量降至至少自2018年以来的最低水平。这标志着至少自2015年以来,首次在同一天公布两项措施的削减。

Those moves were followed by a slew of other announcements that fueled gains in China’s beleaguered equity market. The central bank chief also unveiled a package to shore up the nation’s troubled property sector, including lowering borrowing costs on as much as $5.3 trillion in mortgages and easing rules for second-home purchases.

在这些举措之后,央行又宣布了一系列其他措施,推动了中国受困股市的上涨。央行行长还公布了一揽子措施,以支持中国陷入困境的房地产行业,包括降低多达 5.3 万亿美元抵押贷款的借贷成本,以及放宽购买第二套住房的规定。

For the nation’s stocks, Pan said the central bank will provide at least 800 billion yuan ($113 billion) of liquidity support, adding that officials were studying setting up a market stabilization fund.

潘功胜表示,对于全国股市,央行将提供至少 8000 亿元人民币(合 1,130 亿美元)的流动性支持,并补充说官员们正在研究布隆伯格设立市场稳定基金。

While several of the measures had been anticipated by investors, the highly publicized rollout showed authorities are taking seriously warnings that China risks missing its growth target of around 5% this year. The policy barrage likely puts that goal back within reach, but doubts remain whether it was enough to break China’s longer-term deflationary pressure and entrenched real estate crisis.

虽然其中几项措施早在投资者的预料之中,但这次大张旗鼓的推出表明,政府正在认真对待有关中国今年可能无法实现 5% 左右增长目标的警告。政策大棒很可能使这一目标重新变得触手可及,但人们仍然怀疑这是否足以打破中国长期的通货紧缩压力和根深蒂固的房地产危机。

Authorities have yet to unveil more forceful measures to boost demand among consumers, which some analysts view as a key missing ingredient for the economy.

当局尚未推出更有力的措施来刺激消费者需求,而一些分析师认为消费者需求是经济缺失的关键因素。

“It’s hard to say what silver bullet can help resolve everything,” said Ken Wong, Asian equity portfolio specialist at Eastspring Investments Hong Kong Ltd. “While it’s good to have monetary easing measures that are accommodative, more needs to be done in order to help solidify fourth quarter growth.”

"瀚亚投资香港有限公司(Eastspring Investments Hong Kong Ltd.)亚洲股票投资组合专家Ken Wong表示:"很难说有什么灵丹妙药可以帮助解决一切问题。"虽然采取宽松的货币政策措施是件好事,但要帮助巩固第四季度的经济增长,还需要做更多的工作。

China’s benchmark CSI 300 Index of shares rose as much as 4%, close to erasing losses for the year, though the gauge is still down more than 40% from its recent peak in 2021. Commodities markets gained and the yuan was little changed against the dollar. China’s 10-year bond yields rose 3 basis points to 2.06%, erasing an earlier decline to a record low.

中国基准沪深 300 指数上涨了 4%,接近抹平今年的跌幅,但与 2021 年的近期峰值相比,该指数仍下跌了 40%以上。大宗商品市场上涨,人民币兑美元汇率变化不大。中国 10 年期国债收益率上升 3 个基点,至 2.06%,抹去了早些时候跌至纪录低点的跌幅。

China Unveils Stimulus Blitz 中国推出刺激经济闪电战

Policymakers in Beijing have been trying to revive the economy without resorting to the bazooka stimulus China used in previous downturns, but such piecemeal efforts have been ineffective. Growth recently slowed to its worst pace in five quarters — a deterioration that’s testing the leadership’s tolerance for missing its high-profile annual target for the second time in three years.

北京的政策制定者们一直在努力重振经济,而没有采用中国在以往经济衰退时使用的火箭筒式刺激政策,但这种零敲碎打的努力效果不佳。最近,经济增长速度放缓至五个季度以来的最差水平--这种恶化正在考验中国领导层对三年来第二次未能实现其备受瞩目的年度目标的容忍度。

“The purpose of today’s briefing is to inject confidence into the market, judging by the fact that the authorities revealed measures in one go,” said Larry Hu, head of China economics at Macquarie Group Ltd. “The stimulus push will still need coordination from other policies — particularly follow-up policies from the fiscal side.”

"麦格理集团(Macquarie Group Ltd)中国经济部主管 Larry Hu 表示:"从当局一次性披露措施的事实来看,今天的吹风会旨在为市场注入信心。"刺激政策的推进仍需要其他政策的配合--尤其是财政方面的后续政策。"

The Federal Reserve’s bigger-than-expected half-percentage point slash has given central banks across Asia more room to move. But making money cheaper won’t lift the economy if Chinese consumers don’t want to spend because layoffs are looming amid sliding corporate profits and property prices are still falling. New home prices clocked their biggest decline last month from the previous period since 2014.

美联储超出预期地削减了半个百分点,这为亚洲各国央行提供了更大的行动空间。但是,如果中国消费者不想消费,因为企业利润下滑,裁员迫在眉睫,而房地产价格仍在下跌,那么让货币变得更便宜也不会提振经济。上个月的新房价格创下了自2014年以来的最大降幅。

Pan’s decisive display of ramped up monetary policy now sets the stage for the Finance Ministry to unveil its own bid to defend the growth target. A plunge in revenue from land sales has held back fiscal spending this year, crippling indebted local governments’ ability to invest in growth-boosting projects.

潘功胜果断地加大了货币政策的力度,这为财政部公布其捍卫增长目标的努力奠定了基础。土地出让收入的骤降抑制了今年的财政支出,削弱了负债累累的地方政府投资促进增长项目的能力。

“It is too far from being a bazooka,” ANZ chief greater China economist Raymond Yeung said of the package. “We are not sure how much the mortgage rate cut will induce a property recovery.”

"澳新银行(ANZ)大中华区首席经济学家杨伟民(Raymond Yeung)在谈到该方案时说:"它离火箭筒还太远。"我们不确定房贷利率下调能在多大程度上促进房地产复苏。

China's Government Spending Drops 中国政府支出下降

The central bank governor unveiled his big policy shift at his first high-profile press conference since March, appearing alongside securities regulator Wu Qing, and Li Yunze, head of the National Financial Regulatory Administration. The trio used their collective public debut to roll out steps to salvage investor sentiment and stem a selloff in the stock market.

这位央行行长与证券监管机构负责人吴庆和国家金融监管局局长李云泽一起,在自 3 月份以来的首次高调新闻发布会上公布了他的重大政策转变。这三位央行行长利用他们的首次公开亮相,推出了挽救投资者情绪和阻止股市下挫的措施。

That included new financial tools to expand liquidity for equities, which would help listed companies and major shareholders buy back shares and raise holdings.

其中包括扩大股票流动性的新金融工具,这将有助于上市公司和大股东回购股票和增持股份。

The PBOC chief has displayed a more transparent approach to policy, with Pan on Tuesday effectively mapping out rate cuts and policy moves for the rest of the year. He used a similar briefing in January to announce a RRR cut two weeks before it was effective, as authorities tried to halt a stock-market rout.

潘功胜周二有效地规划了今年下半年的降息和政策措施,中国人民银行行长在政策方面表现出了更高的透明度。今年 1 月,在当局试图阻止股市暴跌之际,他利用类似的简报会在存款准备金率下调生效前两周宣布了下调存款准备金率。

“Monetary policy easing came in bolder than expected,” said Becky Liu, head of China macro strategy at Standard Chartered Plc. “We see room for bolder easing ahead in the coming quarters, following the Fed’s outsized rate cuts.”

"渣打银行(Standard Chartered Plc)中国宏观策略主管贝基-刘(Becky Liu)表示:"货币政策放松的力度超出预期。"在美联储大幅降息之后,我们认为未来几个季度还有更大胆的宽松空间。"