- Plan would let homeowners switch banks for cheaper loans

让房主更换银行以获得更便宜贷款的计划 - Property slump has dragged down consumption, household wealth

房地产不景气拖累了消费和家庭财富

By Bloomberg News 作者:布隆伯格新闻 2024 年 8 月 30 日格林尼治标准时间+8 11:50

China is considering allowing homeowners to refinance as much as $5.4 trillion in mortgages to lower borrowing costs for millions of families and boost consumption.

中国正在考虑允许房主对多达 5.4 万亿美元的抵押贷款进行再融资,以降低数百万家庭的借贷成本,促进消费。

Under the plan, homeowners would be able to renegotiate terms with their current lenders before January, when banks typically reprice mortgages, people familiar with the matter said, asking not to be identified discussing private information. They would also be allowed to refinance with a different bank for the first time since the global financial crisis, the people said.

熟悉内情的人士说,根据这项计划,房主将可以在 1 月银行通常重新定价抵押贷款之前,与目前的贷款机构重新谈判条款。他们还将被允许向不同的银行进行再融资,这在全球金融危机以来尚属首次。

Authorities are intensifying a push to reduce mortgage costs after the central bank encouraged such support last year and banks responded with a rare rate cut on outstanding mortgages of first homes. It wasn’t immediately clear if the latest considerations apply to all homes, said the people.

在央行去年鼓励Bloomberg提供此类支持、银行也罕见地下调了首套住房未偿抵押贷款利率之后,当局正在加紧推动降低抵押贷款成本。目前尚不清楚最新的考虑是否适用于所有住房,上述人士说。

While lower mortgage rates would hurt profitability at state-run Chinese banks, authorities are facing renewed pressure to stem a housing-led slowdown in Asia’s largest economy.

虽然降低房贷利率会损害中国国有银行的盈利能力,但中国政府正面临着新的压力,以阻止亚洲最大经济体因住房问题导致的经济放缓。

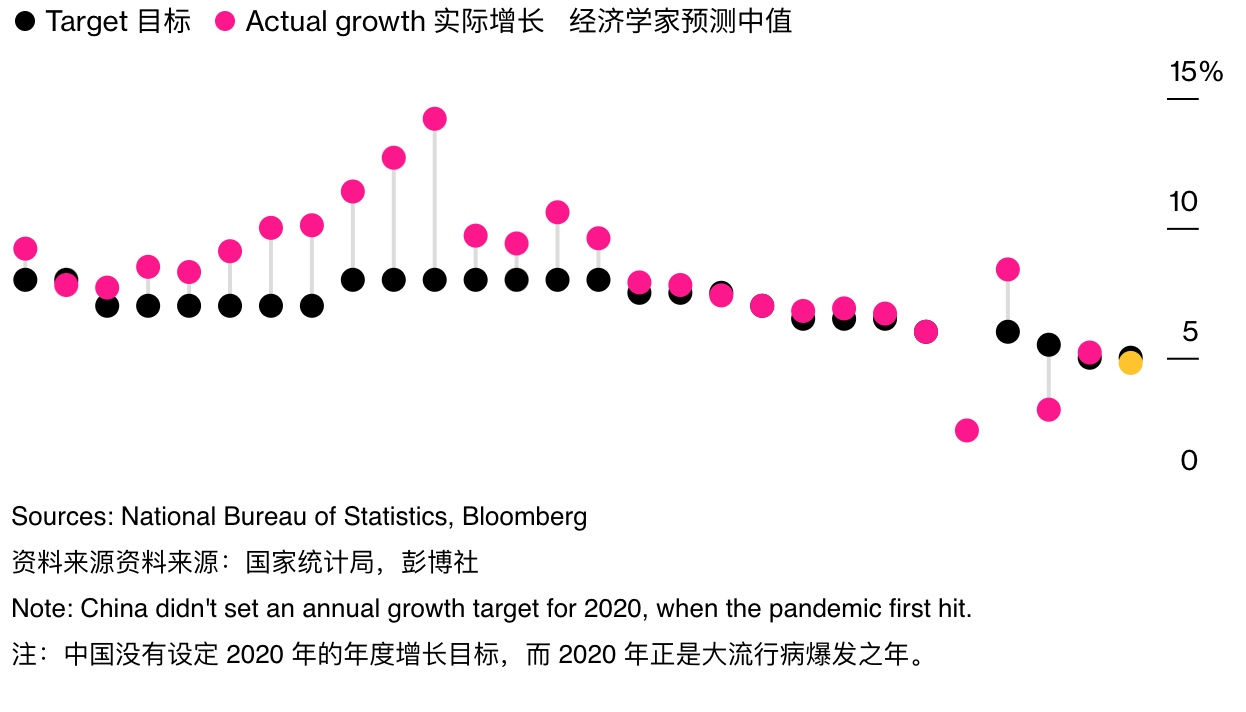

Concerns about a deteriorating outlook intensified this week after a string of disappointing earnings reports from consumer companies and a cut to China’s growth forecast by economists at UBS Group AG. The downgrade reflects an emerging consensus among global banks that the country might miss its growth target of around 5% in 2024. The nation last fell short in 2022, amid Covid lockdowns and abrupt policy changes.

本周,在一连串令人失望的消费企业财报以及瑞银集团经济学家下调中国经济增长预期之后,市场对中国经济前景恶化的担忧加剧。下调评级反映出全球银行正在形成一种共识,即中国可能无法实现2024年约5%的增长目标。中国上一次未能实现 增长目标 是在2022年,当时正值Covid封锁和政策突变。

The People’s Bank of China and the National Financial Regulatory Administration didn’t respond to requests for comment.

中国人民银行和国家金融监管局没有回应置评请求。

China Seen Missing Growth Target in 2024

2024 年中国经济增长目标将落空

Economic momentum has waned amid persisting property slump, tight fiscal stance

房地产持续低迷,财政紧缩,经济势头减弱

The new plan targets existing homeowners, who have been left out as new homebuyers have enjoyed sizable cuts to key interest rates this year.

新计划针对的是现有房主,由于新购房者今年享受到了关键利率的大幅下调,他们被排除在外。

If approved, it may serve to ease mortgage burdens faster than expected. While China has pushed average mortgage costs to a record low this year, most households haven’t benefited since banks won’t reprice existing loans until next year.

如果获得批准,减轻房贷负担的速度可能比预期的要快。虽然中国已将今年的平均房贷成本降至历史最低点,但由于银行要到明年才会对现有贷款重新定价,因此大多数家庭并未从中受益。

China’s forceful steps to lower mortgage costs in recent years have mostly helped new property buyers. The five-year prime rate, a benchmark for long-duration mortgages, was cut to 3.85% in July. In May, the central bank scrapped a nationwide mortgage rate floor for first and second home purchases. Earlier, some mega cities allowed buyers who previously had a mortgage — even if fully repaid — to qualify for lower rates.

近年来,中国降低房贷成本的有力措施主要帮助了新购房者。7 月,作为长期抵押贷款基准的五年期最优惠利率下调至 3.85%。5 月,央行取消了全国范围内的首套房和二套房贷款利率下限。早些时候,一些特大城市允许以前有过抵押贷款的购房者(即使已全额偿还)有资格享受较低的利率。

The disparity has driven a wave of early mortgage repayments, which has strained lenders in recent years. Homeowners have taken advantage of cheap consumer loans to prepay mortgages, a practice that is banned by regulators.

这种差距推动了提前偿还抵押贷款的浪潮,近年来已使贷款机构捉襟见肘。房主们利用廉价的消费贷款提前偿还抵押贷款,而这种做法是被监管机构禁止的。

While China has been easing its policies since the end of 2022 to revive the property market, the implementation of the measures has been slow, with limited impact, according to UBS. The weak property market will have a bigger drag on the overall economy than expected, including through household consumption, the Swiss bank said.

瑞银集团(UBS)认为,尽管中国自2022年底以来一直在放松政策以重振房地产市场,但这些措施的实施进展缓慢,影响有限。瑞士银行表示,房地产市场疲软对整体经济的拖累将大于预期,包括通过家庭消费造成的拖累。

The real estate crisis, now in its fourth year, has dragged down everything from the job market to consumption and household wealth. While retail sales beat expectations in July, it was largely due to a seasonal uptick and was still well below the pre-pandemic trend.

房地产危机已进入第四个年头,拖累了从就业市场到消费和家庭财富的方方面面。虽然 7 月份的零售额超出预期,但这主要是由于季节性上升所致,仍远低于疫情前的趋势。

The mortgage plan would add further pressure on the nation’s banks, which Beijing has relied on to help revive the flagging economy. The banking sector is struggling with falling earnings amid record low margins.

抵押贷款计划将进一步增加中国银行的压力,而中国政府一直依赖银行来帮助重振疲软的经济。在利润率创历史新低的情况下,银行业正面临盈利下降的困境。

China’s outstanding amount of individual mortgages stood at 38.2 trillion yuan ($5.4 trillion) at the end of March, and count as prime assets at Chinese lenders. More than 90% of China’s outstanding mortgages were for first homes as of late 2021, according to the latest public data available from the banking regulator.

截至 3 月底,中国未偿还的个人住房抵押贷款总额为 38.2 万亿元(5.4 万亿美元),是中国贷款机构的主要资产。根据银行监管机构提供的最新公开数据,截至 2021 年底,中国 90% 以上的未偿抵押贷款都用于首套住房。

Banks’ net interest margin tumbled to a record low of 1.54% as of end-June, well below the 1.8% threshold regarded as necessary to maintain reasonable profitability.

截至 6 月底,银行净息差跌至 1.54% 的历史最低点,远低于 1.8% 的门槛,而 1.8% 被认为是维持合理盈利能力的必要条件。