- Equity benchmarks post rare rally as authorities mull measures

当局考虑采取措施,股市基准罕见反弹 - Traders say economic recovery needed for sustained rally

交易员称持续上涨需要经济复苏

By Bloomberg News 作者:彭博新闻 2024年1月23日 at GMT+8 18:09

China’s boldest plan yet to stem the current stock market rout is facing a wall of skepticism as disillusioned investors say any rebound will prove fleeting without a fundamental fix for its ailing economy.

中国迄今为止最大胆的阻止当前股市暴跌的计划正面临质疑,因为失望的投资者表示,如果不能从根本上解决其陷入困境的经济,任何反弹都将是短暂的。

A rare mix of positive news including a stabilization fund in the works and Premier Li Qiang’s order to calm markets sent equity benchmarks rallying on Tuesday. However, China’s history of botched market rescue efforts, the grim state of its economy, and uncertainties over Beijing’s long-term policy roadmap are keeping investors skeptical about the sustainability of these gains.

一系列罕见的利好消息,包括正在建设的平准基金以及李强总理安抚市场的命令,推动股市基准周二上涨。然而,中国糟糕的市场救援努力的历史、严峻的经济状况以及北京长期政策路线图的不确定性,让投资者对这些收益的可持续性持怀疑态度。

Should the rally fail to hold, it raises the risk of a further downward spiral in sentiment, something authorities can ill-afford given that investors are already reeling from a record three-year losing run in onshore equities and the market’s heft in global portfolios is shrinking rapidly.

如果涨势未能持续,就会增加情绪进一步下滑的风险,鉴于投资者已经因境内股市创纪录的三年连跌而感到震惊,而且市场在全球投资组合中的比重正在下降,当局无法承受这种风险。迅速缩小。

“Xi Jinping’s people are almost certainly telling him that the rout in the equity market is a stability risk,” said George Magnus, a research associate at Oxford University’s China Centre. “Investors aren’t just abandoning Chinese stocks for normal reasons of valuation, but because the whole economic policy and political environment has atrophied. Getting confidence back probably requires major changes in both.”

牛津大学中国中心研究员乔治·马格努斯表示:“几乎可以肯定,习近平的手下告诉他,股市暴跌是一种稳定风险。” “投资者放弃中国股票不仅仅是出于正常的估值原因,而且是因为整个经济政策和政治环境已经恶化。恢复信心可能需要在这两方面做出重大改变。”

The latest package including about 2 trillion yuan ($278 billion) to buy mainland shares via offshore trading links shows a sense of urgency from authorities. It comes after a rout that’s seen Chinese and Hong Kong stocks erase more than $6 trillion in market value since a peak reached in 2021. The value of China’s equity market has never been this far behind that of the US.

最新一揽子计划包括斥资约2万亿元人民币(合2780亿美元)通过离岸交易平台购买内地股票,显示出当局的紧迫感。 此前,中国股市和香港股市自 2021 年达到峰值以来,市值蒸发了超过 6 万亿美元。中国股市的市值从未如此落后于美国。

The Hang Seng China Enterprises Index rose 2.8% Tuesday to cap its best day this year while a benchmark for mainland Chinese stocks ended up 0.4% after sliding to a five-year low.

恒生中国企业指数周二上涨 2.8%,创下今年以来最好单日涨幅,而中国内地股市基准指数在跌至五年低点后收涨 0.4%。

“Considering how cheap Chinese stocks have gotten and how under-owned they now appear, we would not be surprised by a short-term boost in sentiment and prices,” said Aninda Mitra, head of Asia macro and investment strategy at BNY Mellon Investment Management. “But we doubt its sustainability unless these are complemented by a broader package of far-reaching reforms.”

纽约梅隆银行投资管理公司亚洲宏观和投资策略主管阿宁达·米特拉(Aninda Mitra)表示:“考虑到中国股票的价格已经变得多么便宜,而且它们现在的持有量又显得多么不足,我们对情绪和价格的短期提振不会感到惊讶。” 。 “但我们怀疑其可持续性,除非这些措施得到更广泛、影响深远的改革方案的补充。”

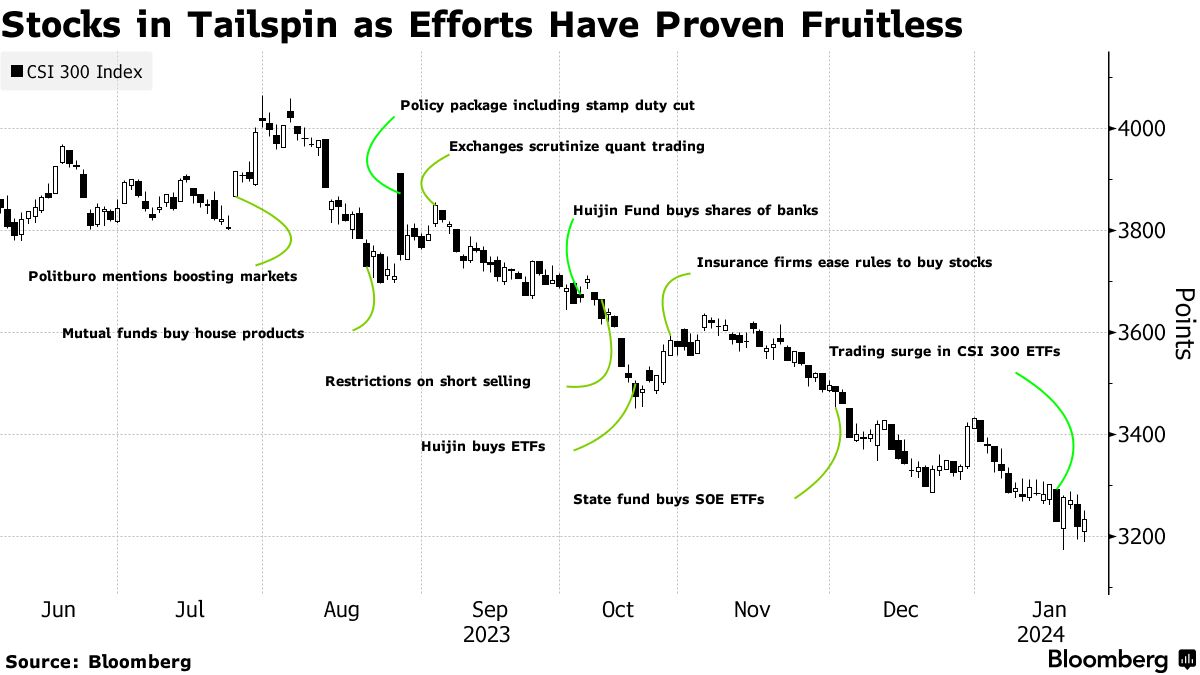

It’s hard to blame investors for their cynicism. China has a history of marshaling policy resources to stanch market bleeding, but few succeeded. During the 2015 rout, state funds reportedly spent the equivalent of $240 billion over the summer — but that didn’t keep prices from falling again after the buying wound down.

很难责怪投资者的愤世嫉俗。中国历来都曾调动政策资源来止住市场失血,但很少成功。据报道,在 2015 年股市大跌期间,国家基金在整个夏季花费了相当于 2400 亿美元的资金,但这并没有阻止购买减少后价格再次下跌。

In a high-profile misstep back then, the securities watchdog introduced a circuit breaker which instead of reducing volatility, led to a frenzied rush to the exit by panicky investors.

当时,证券监管机构采取了一个引人注目的失误,引入了熔断机制,但这不但没有降低波动性,反而导致惊慌失措的投资者疯狂退出。

Multiple rounds of efforts to reverse the selloff last year, including a reduction in stock trading stamp duty and ETF purchases by state-backed funds, fell flat. Selling gathered pace into the new year as technical factors including loss triggers at some structured products added to the pressure.

去年为扭转抛售局面而采取的多轮努力,包括降低股票交易印花税和国家支持的基金购买ETF,均以失败告终。 由于一些结构性产品的损失触发等技术因素增加了压力,进入新的一年,抛售步伐加快。

All of this suggests that throwing money at the market as Beijing appears willing to do, while economic woes lie unresolved, will only embolden traders to sell into what may at best be a bear-market rally.

所有这些都表明,在经济困境尚未解决的情况下,北京方面似乎愿意向市场投入资金,只会鼓励交易者在熊市反弹时卖出。

“The 2015 experience shows that even when the government steps up buying, the rally is not necessarily sustainable unless we have a bigger stimulus package to address the economic issues,” said Michelle Lam, Greater China economist at Societe Generale SA.

法国兴业银行大中华区经济学家林嘉欣表示:“2015年的经验表明,即使政府加大购买力度,除非我们出台更大规模的刺激计划来解决经济问题,否则涨势也不一定可持续。”

Authorities are feeling the heat to end this rout ahead of next month’s Spring Festival, one of the nation’s biggest festivities.

当局正迫不及待地想在下个月中国最大的节日之一——春节之前结束这场溃败。

Retail investors, at 220 million, account for around 60% of China’s stock market turnover, and the idea of disgruntlement at gatherings probably won’t sit well with the nation’s leadership.

散户投资者数量达 2.2 亿,约占中国股市成交量的 60%,而在聚会上表达不满的想法可能不会被国家领导层接受。

Without conviction over the economy’s recovery, investors will remain on the sidelines. Some of the world’s biggest money managers have already opted out of the market as they deem risks as too high.

如果对经济复苏缺乏信心,投资者将继续观望。全球一些最大的基金管理公司已经选择退出市场,因为他们认为风险太高。

The list of economic troubles facing China is long, and requires structural fixes. A shrinking population bodes ill for consumption, geopolitical tensions are capping Beijing’s tech ambitions and property market is stuck in a rut — all of this is exacerbating deflationary pressure in the economy.

中国面临的经济问题清单很长,需要进行结构性修复。人口减少对消费来说是不利的,地缘政治紧张局势正在限制北京的科技雄心,房地产市场陷入困境——所有这些都加剧了经济的通缩压力。

“Ultimately, even if the money is enough to support the market, it doesn’t resolve any other issue that China is facing such as restrictions from the US, weak economy, unemployment,” said Vey-Sern Ling, managing director at Union Bancaire Privee.

Union Bancaire董事总经理Vey-Sern Ling表示:“最终,即使这些资金足以支撑市场,也无法解决中国面临的任何其他问题,例如美国的限制、经济疲软、失业等。”私人。