- Outflow from capital account was the largest since 2015

资本账户流出量为 2015 年以来最大 - Reversal of flows depends on monetary policy, economic outlook

流动逆转取决于货币政策和经济前景

By Bloomberg News 2023年9月19日

China is witnessing the biggest flight of capital in years, creating concern for authorities as it worsens pressure on the beleaguered yuan.

中国正在经历多年来最大规模的资本外逃,这加剧了受困人民币的压力,引起了当局的担忧。

The currency has been hammered from all fronts as money leaves its financial markets, global companies look for China alternatives and a revival in overseas travel hits services trade. All of this is captured in the latest official data, which shows an outflow of $49 billion in the capital account last month, the largest since December 2015.

随着资金离开中国金融市场、全球企业寻找中国替代品以及海外旅游复苏对服务贸易的冲击,中国货币受到了来自各方面的冲击。所有这一切都反映在最新的官方数据中,该数据显示上个月资本账户流出了490亿美元,是自2015年12月以来最大的一次。

The exodus, spurred by sputtering growth in the world’s second-largest economy and a widening interest-rate gap with the US, helped push the yuan to a 16-year low. The risk is that the currency weakness further saps the market’s appeal and results in an acceleration of outflows that can destabilize financial markets.

受世界第二大经济体增长乏力以及与美国利率差距不断扩大的刺激,外流助推人民币汇率跌至 16 年低点。风险在于,货币疲软会进一步削弱市场吸引力,导致资金加速外流,从而破坏金融市场稳定。

That was the case in the aftermath of a shock currency devaluation in 2015 and during China’s trade war with the US under the Trump administration, when Beijing needed to tighten capital curbs and boost the yuan’s funding cost in Hong Kong. While authorities have also taken various steps to stem the currency’s weakness this time around, the outflow trend looks hard to reverse.

在2015年人民币震荡贬值之后,以及在特朗普政府领导下的中国与美国贸易战期间,北京需要收紧资本管制并提高人民币在香港的融资成本,情况就是如此。虽然当局这次也采取了各种措施来遏制人民币的疲软,但外流趋势似乎难以逆转。

“Due to the divergence in monetary policies and the current macro environment, it is unlikely that China has reached the turning point with enough incentives to attract capital back,” said Gary Ng, a senior economist at Natixis SA.

"Natixis SA 的高级经济学家 Gary Ng 说:"由于货币政策的分歧和当前的宏观环境,中国不太可能已经到了有足够激励措施吸引资本回流的转折点。

Of the $49 billion outflow from the capital and financial account last month, $29 billion came from securities investments, according to data from the State Administration of Foreign Exchange. While inflows have picked up, an even larger amount fled to push the balance deeper into the red.

国家外汇管理局的数据显示,在上个月资本和金融账户流出的 490 亿美元中,290 亿美元来自证券投资。虽然资金流入有所回升,但更大数额的外逃使余额进一步亏损。

The flight comes as Beijing runs the risk of missing its economic growth target of around 5% for the year amid an ailing property market and slumping exports. Foreign investors’ ownership of Chinese sovereign bonds fell to a four-year low in August, while they ditched a record $12 billion of mainland shares in the month.

由于房地产市场不景气和出口下滑,中国政府有可能无法实现今年 5% 左右的经济增长目标。8 月份,外国投资者持有的中国主权债券跌至四年来的最低点,而当月他们抛售的内地股票达到创纪录的 120 亿美元。

Direct investment slipped to a deficit of $16.8 billion in August, the worst since early 2016. The balance has been negative since mid-2022 as the country’s Covid restrictions and a crackdown on the private sector kept investors away. China’s fragile recovery since Covid restrictions were lifted and a slide in consumer confidence means investment has been slow to return.

8 月份,直接投资下滑至 168 亿美元的赤字,这是自 2016 年初以来最严重的一次。自2022年年中以来,由于中国的Covid限制和对私营部门的打压,投资者望而却步,直接投资余额一直为负。自 Covid 限制取消以来,中国经济复苏脆弱,消费者信心下滑,这意味着投资恢复缓慢。

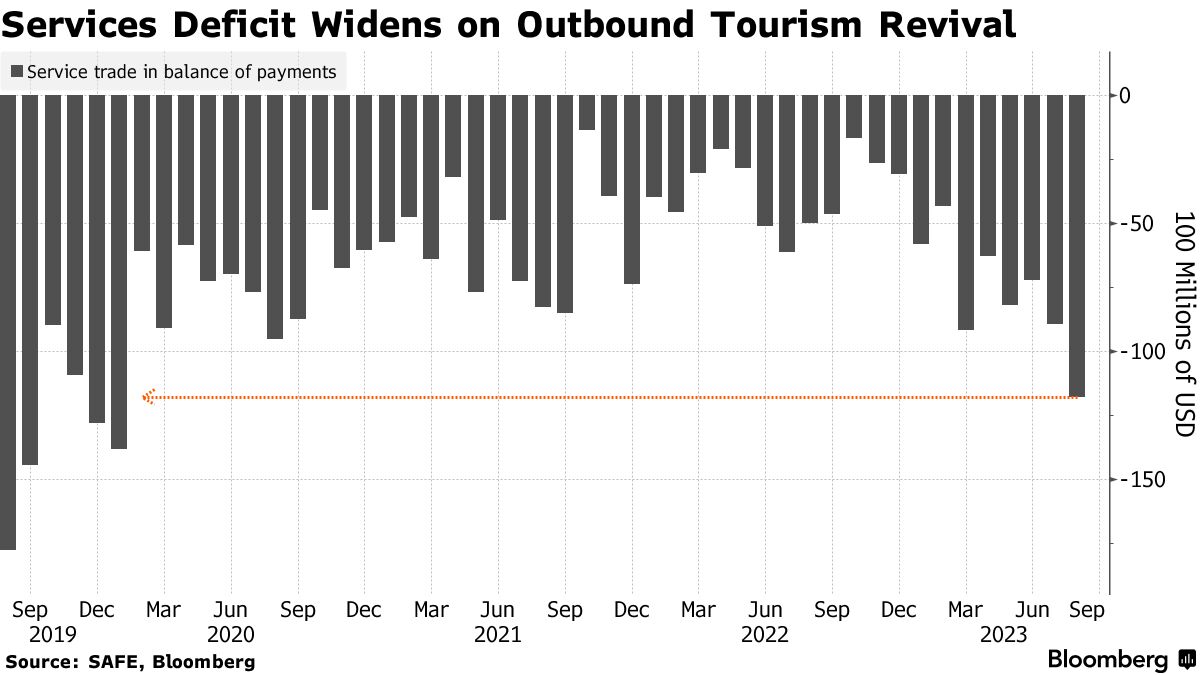

China has been running a perennial deficit in services trade since the number of mainlanders traveling overseas has outpaced the amount of visitors to the country. That trend has been aggravated as foreign tourists are yet to return in droves, even as the country has fully discarded its Covid restrictions. The deficit worsened last month amid a jump in outbound tourism during the summer holiday season.

由于出国旅游的大陆人超过了来华游客的数量,中国的服务贸易长期处于逆差状态。由于外国游客尚未大批回国,即使中国已经完全取消了 Covid 限制,这一趋势仍在加剧。上个月,由于暑假期间出境旅游人数激增,赤字进一步加剧。

The Chinese currency has slumped more than 5% this year both onshore and offshore, marking the worst performance in emerging Asia after Malaysia’s ringgit.

今年以来,中国货币在岸和离岸汇率均下跌超过 5%,是继马来西亚林吉特之后表现最差的新兴亚洲货币。

Still, capital outflows may slow to some extent as China’s economy shows some signs of stabilization, although much depends on the rates trajectory in the US and China, said Edmund Goh, investment director of Asia fixed income at abrdn Plc.

abrdn Plc 亚洲固定收益投资总监 Edmund Goh 表示,随着中国经济出现一些企稳迹象,资本外流可能会在一定程度上放缓,但这在很大程度上取决于美国和中国的利率走势。

“A lot of the money that was bearish on China’s growth and the yuan has left China in the past 12 months and we should start to see some stabilization in capital outflows,” he said.

"他说:"在过去 12 个月里,很多看跌中国经济增长和人民币的资金已经离开中国,我们应该开始看到资本外流趋于稳定。