Stagflation risks mount in Europe, China in deflation

欧洲滞胀风险加剧,中国陷入通货紧缩

US stocks set to beat Europe for eighth time in last decade

美国股市将在过去十年中第八次击败欧洲股市

By Sagarika Jaisinghani, Elena Popina, and April Ma 2023年9月2日

Europe’s stagflation crisis and a property downturn in China are flashing a familiar message: for equity investors, there is no real alternative to the US stock market.

欧洲的滞胀危机和中国的房地产低迷正在传递出一个熟悉的信息:对于股票投资者来说,除了美国股市之外,没有真正的替代选择。

With four months left of 2023, returns on the S&P 500 boast about an eight percentage-point lead over the Stoxx Europe 600. The index is on course for its eighth year of outperformance in the past decade, as the artificial intelligence buzz overshadows economic recession fears and pricey valuations.

距离 2023 年还有四个月,标准普尔 500 指数的回报率比斯托克欧洲 600 指数领先约 8 个百分点。随着人工智能的热潮掩盖了经济衰退,该指数有望在过去十年中连续第八年表现优异恐惧和昂贵的估值。

What’s more, the Federal Reserve’s policy-tightening has cooled inflation while managing to keep the economy growing at just over 2%. Data Friday reinforced that soft-landing picture, showing a pick up in labor hiring and a slight slowdown in wage growth.

更重要的是,美联储的政策紧缩冷却了通胀,同时成功地将经济增长保持在2%以上。周五的数据强化了这种软着陆的前景,显示劳动力招聘有所增加,而工资增长略有放缓。

“US stocks are the place to be,” said Max Kettner, chief multi-asset strategist at HSBC Holdings Plc, who recommends using any S&P 500 pullback to buy.

汇丰控股有限公司首席多元资产策略师马克斯·凯特纳表示,“美国股市是最佳选择”,他建议利用标准普尔 500 指数回调的机会买入。

“It’s the economic resilience, the tailwinds from the weaker dollar, still fairly downbeat expectations on earnings. All of that plays in favor of the US,” Kettner added, in a reference to the view that dollar strength has finally topped out.

“这是经济的韧性、美元疲软的推动力,以及对盈利的预期仍然相当悲观。所有这些都对美国有利,”凯特纳补充道,他指的是美元强势终于见顶的观点。

In contrast, higher interest rates threaten to tip Europe into 1970s-style stagflation, with the economy sinking into a downturn and inflation running above 5%. In China, it remains unclear whether drip-feed stimulus can revive an economy in deflation. That’s accelerated an investor exodus from both regions.

相比之下,较高的利率有可能使欧洲陷入 20 世纪 70 年代式的滞胀,经济陷入低迷,通胀率超过 5%。在中国,目前尚不清楚点滴刺激能否重振通货紧缩的经济。这加速了投资者从这两个地区的撤离。

Investors have fled European equity funds for 25 weeks straight, Bank of America Corp. says, citing EPFR Global data, while Germany’s DAX, home to the region’s manufacturing stalwarts, has just posted its worst monthly performance since December.

美国银行援引 EPFR Global 的数据称,投资者已连续 25 周逃离欧洲股票基金,而该地区制造业巨头所在的德国 DAX 指数刚刚公布了自 12 月以来最差的月度表现。

Europe does have an edge on share valuations — on a price-to-earnings measure, the Stoxx 600 trades near a record low to the S&P 500. For some strategists such as David Groman at Citigroup Inc., that shows Europe is already pricing the bad news. Citi turned overweight on Europe in July and cut the US to neutral.

欧洲在股票估值方面确实具有优势——按照市盈率衡量,斯托克 600 指数相对于标准普尔 500 指数的交易价格接近历史低点。 对于花旗集团 (Citigroup Inc.) 的大卫·格罗曼 (David Groman) 等一些策略师来说,这表明欧洲已经在定价坏消息。花旗集团于 7 月份转而增持欧洲股票,并将美国股票评级降至中性。

Yet, in markets gripped by stagflation fears, the cheapness argument is finding fewer takers.

然而,在陷入滞胀担忧的市场中,廉价论点的接受者越来越少。

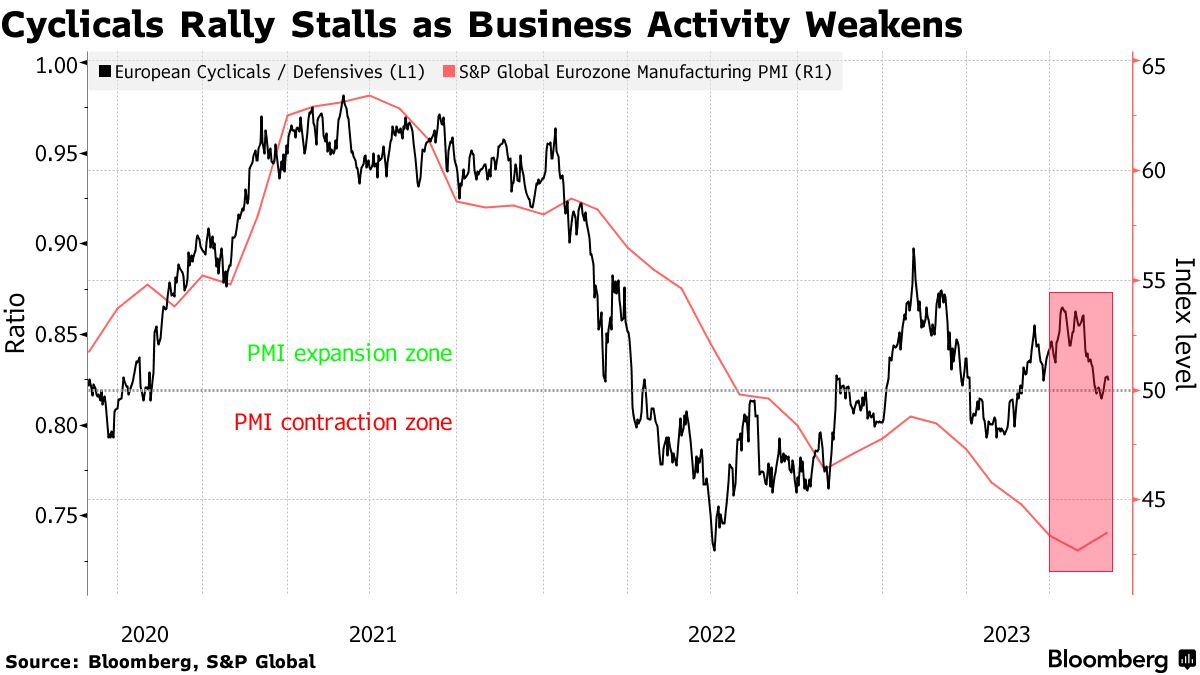

In such an environment, shares in autos, capital goods, retail, chemicals, banks, semiconductors and leisure — essentially cyclical sectors — are most at risk, the JPMorgan Chase & Co. team led by Mislav Matejka wrote.

由米斯拉夫·马特伊卡 (Mislav Matejka) 领导的摩根大通团队写道,在这种环境下,汽车、资本货物、零售、化工、银行、半导体和休闲行业(本质上是周期性行业)的股票面临的风险最大。

Europe loses out on another front. Dominated by so-called old economy stocks, it’s also missed out on 2023’s favorite trade: artificial intelligence. The impact of this is underscored by a single statistic — the market value of the entire 600-member Stoxx benchmark has grown this year by about $810 billion, less than what the poster child of AI, Nvidia Corp., has added.

欧洲在另一条战线上失败了。它以所谓的旧经济股票为主,也错过了 2023 年最受欢迎的行业:人工智能。一项统计数据凸显了这一影响——整个 600 家成员公司 Stoxx 基准的市值今年增长了约 8100 亿美元,低于人工智能的典型代表英伟达公司 (Nvidia Corp.) 所增加的数字。

Tech should benefit even more next year as Treasury yields slide, reckons Nicolas Domont, a fund manager at Optigestion in Paris, and his quest for mega-cap stocks has yielded little outside of Wall Street.

巴黎 Optigestion 基金经理尼古拉斯·多蒙特 (Nicolas Domont) 认为,随着美国国债收益率下滑,明年科技股应该会受益更多,而他对大型股的追求在华尔街之外几乎没有产生什么成果。

“I was talking with my team about what to buy in Europe as we are predominantly looking for growth and our conclusion was that there really wasn’t much indeed,” Domont added.

“我正在与我的团队讨论在欧洲购买什么,因为我们主要寻求增长,我们的结论是,确实没有太多,”多蒙特补充道。

Luxury has been Europe’s answer to America’s high-growth, highly valued technology stocks — companies such as LVMH and Hermes International have accounted for a substantial chunk of equity returns this year. But for such names, China’s slowdown poses a hurdle, given it is estimated to contribute up to a fifth of their annual sales.

奢侈品是欧洲对美国高增长、高估值科技股的回应——路威酩轩集团(LVMH)和爱马仕国际(Hermes International)等公司在今年的股票回报中占据了很大一部分。但对于这些品牌来说,中国经济放缓构成了障碍,因为据估计中国贡献了其年销售额的五分之一。

China Confidence中国信心

Within China, problems run deep — even after an interest-rate cut and steps to ease mortgage curbs, the Hang Sang Index was the worst performer last month out of 92 gauges tracked by Bloomberg. Foreign investors offloaded around 90 billion yuan ($12.3 billion) worth of mainland Chinese shares in August, according to data compiled by Bloomberg.

在中国国内,问题依然存在——即使在降息并采取措施放松抵押贷款限制之后,恒生指数仍是上个月彭博追踪的 92 个指数中表现最差的指数。根据彭博社汇编的数据,外国投资者 8 月份抛售了价值约 900 亿元人民币(123 亿美元)的中国大陆股票。

Overseas Investors Sell Record Amount of Onshore Stocks海外投资者抛售境内股票数量创历史新高

Bloomberg 彭博社

Investors will watch closely how the real estate malaise shapes Chinese consumer spending, with a consumption-related MSCI stocks index trading at around a third of its 2021 peak.

投资者将密切关注房地产低迷如何影响中国消费者支出,与消费相关的 MSCI 股票指数目前约为 2021 年峰值的三分之一。

More broadly, the lackluster consumer outlook in China and Europe gives Wall Street bulls another reason to stay close to the US market, where a resilient labor market lifted inflation-adjusted consumer spending by a solid 0.6% last month.

更广泛地说,中国和欧洲低迷的消费者前景为华尔街多头提供了另一个密切关注美国市场的理由,美国劳动力市场的弹性使上个月经过通胀调整的消费者支出增长了0.6%。

Oppenheimer Asset Management’s chief investment strategist John Stoltzfus recently upped his forecast for the S&P 500, citing the soft-landing view. He now sees the gauge ending the year at 4,900 points, representing an upside of about 9% from current levels.

奥本海默资产管理公司首席投资策略师 John Stoltzfus 最近以软着陆观点为由,上调了对标准普尔 500 指数的预测。他现在预计该指数今年年底将达到 4,900 点,较当前水平上涨约 9%。

“We wouldn’t bet against the American consumer and we wouldn’t bet against American business and the American economy,” Stoltzfus told Bloomberg Television this week.

斯托尔茨福斯本周对彭博电视台表示:“我们不会做空美国消费者,也不会做空美国企业和美国经济。”