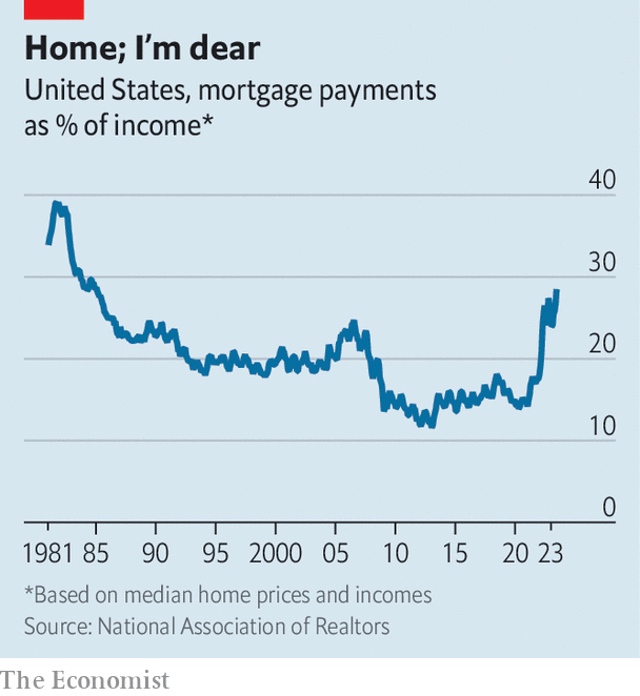

Mortgage payments are at their highest since the mid-1980s.

抵押贷款支付额达到 20 世纪 80 年代中期以来的最高水平。

2023 年 8 月 30 日 |华盛顿特区 经济学人

Homeownership regularly nears the top of surveys about what Americans most want in life. Alas, this part of the American dream has rarely been harder to attain. Those looking to enter the property market face a triple whammy of high prices, costly mortgages and limited choice. Together these factors have conspired to make housing deeply unaffordable, with little sign of relief on the horizon.

在有关美国人最想要的生活的调查中,拥有住房经常位居榜首。可惜的是,美国梦的这一部分却很难实现。那些想要进入房地产市场的人面临着高房价、昂贵的抵押贷款和有限的选择的三重打击。这些因素共同导致住房严重难以负担,而且这种情况几乎没有任何缓解的迹象。

Yet in a roundabout way, the property crunch also helps explain one of the most pressing economic conundrums of the day: why American growth has remained robust, defying predictions of a recession.

然而,以一种迂回的方式,房地产紧缩也有助于解释当今最紧迫的经济难题之一:为什么美国经济增长依然强劲,无视经济衰退的预测。

Housing is usually one of the sectors most sensitive to interest rates, but things have not been quite so straightforward in America. As the Federal Reserve turned hawkish over the past two years, mortgage rates soared, ascending from less than 3% to more than 7%. For the median family buying the median home, mortgage payments doubled from roughly 14% of monthly household income in 2020 to nearly 29% in June, the highest since 1985, according to the National Association of Realtors (see chart).

房地产通常是对利率最敏感的行业之一,但美国的情况却并非如此简单。随着美联储在过去两年变得强硬,抵押贷款利率飙升,从不到3%升至7%以上。根据全国房地产经纪人协会的数据,对于购买中位住房的中位家庭来说,抵押贷款支付额从 2020 年占家庭月收入的约 14% 翻了一番,达到 6 月份的近 29%,为 1985 年以来的最高水平(见图表)。

Surprisingly, this jump in mortgage rates has not led to a decline in house prices. They fell briefly as rates began to rise but have since rebounded to the record highs hit early last year after covid-era stimulus boosted the economy. Figures on August 29th showed that this rebound may be gaining strength: house prices in the second quarter of this year rose at an annualised pace of 15%, according to the s&p Case-Shiller index, a benchmark for American property prices.

令人惊讶的是,抵押贷款利率的上涨并没有导致房价下跌。随着利率开始上升,它们短暂下跌,但在新冠时代的刺激措施提振经济后,它们又反弹至去年初创下的历史新高。 8月29日的数据显示,这种反弹可能正在增强:根据美国房价基准标准普尔凯斯希勒指数,今年第二季度房价年化增长率为15%。

What explains this impressive resilience? For something the size of America’s property market—where annual sales are worth about $2trn, scattered across a continent-sized economy, in which some regions are flourishing and others contracting—there is inevitably a nuanced answer. However, a good summary came in late August from Douglas Yearley, chief executive of Toll Brothers, one of America’s biggest homebuilders, during an earnings call. “There are still buyers out there. They have very few options,” he explained.

如何解释这种令人印象深刻的恢复力?对于美国房地产市场的规模——年销售额约为 2 万亿美元,分散在整个大陆规模的经济体中,其中一些地区正在蓬勃发展,而另一些地区则在萎缩——不可避免地会有一个微妙的答案。然而,美国最大的住宅建筑商之一托尔兄弟公司 (Toll Brothers) 的首席执行官道格拉斯·耶尔利 (Douglas Yearley) 在 8 月下旬的财报电话会议上给出了一份很好的总结。 “仍然有买家。他们的选择很少,”他解释道。

Although demand for homes has fallen as rates have risen, the supply of properties has fallen almost in lockstep. Homebuyers typically obtain fixed-rate mortgages for 30 years—unheard of in most countries but viewed almost as a constitutional right in America, owing to the role of Fannie Mae and Freddie Mac, two giant government-backed firms, which buy up mortgages from lenders and securitise them. In enabling lenders to offer long-term fixed rates, their objective is to make it easier for people to buy homes. But at the moment long-term rates are serving as an impediment, since homeowners who got low-interest mortgages before the Fed ratcheted up rates have no desire to give them up, and so are unwilling to sell their homes. Redfin, a property platform, calculates that about 82% of homeowners have mortgage rates below 5%. Charlie Dougherty of Wells Fargo, a bank, calls it “a state of suspended animation” for the housing market.

尽管随着利率上升,房屋需求下降,但房产供应几乎同步下降。购房者通常获得 30 年的固定利率抵押贷款——这在大多数国家闻所未闻,但在美国几乎被视为一项宪法权利,因为房利美和房地美这两家政府支持的大型公司从贷方购买抵押贷款。并将它们证券化。在使贷款人能够提供长期固定利率的过程中,他们的目标是让人们更容易购房。但目前长期利率是一个障碍,因为在美联储加息之前获得低息抵押贷款的房主不想放弃它们,因此不愿意出售房屋。房地产平台 Redfin 计算得出,约 82% 的房主抵押贷款利率低于 5%。富国银行的查理·多尔蒂(Charlie Dougherty)称房地产市场处于“假死状态”。

The decline in transactions, all else being equal, ought to hurt the economy, dampening housing-related activity, with less money spent on remodelling, new construction, furniture and so on. This is not how things have played out. Unable to trade up to nicer digs, locked-in homeowners have invested more fixing up their current homes. The rise of remote working has reinforced that trend, with people adding extra office space to their houses. Remodelling expenditures in 2022 reached nearly $570bn, or about 2% of gdp, up by 40% in nominal terms from 2019, according to the Joint Centre for Housing Studies at Harvard University.

在其他条件相同的情况下,交易量的下降应该会损害经济,抑制与住房相关的活动,导致用于改建、新建、家具等的资金减少。事情的发展并非如此。由于无法换到更好的住所,锁定的房主不得不投入更多资金来修缮他们现有的房屋。远程工作的兴起强化了这一趋势,人们在家里增加了额外的办公空间。根据哈佛大学住房研究联合中心的数据,2022 年的改建支出将达到近 5700 亿美元,约占 GDP 的 2%,较 2019 年名义增长 40%。

Many of those braving the market in order to buy homes have opted for new-builds, not existing stock. One advantage of newly built homes is that they are actually available. Thus they account for about one-third of active listings this year, up from an average of 13% over the two decades before the covid-19 pandemic, according to the National Association of Home Builders. As Daryl Fairweather of Redfin puts it: “Builders are benefiting because they don’t have competition from existing homeowners.”

许多冒着市场购买房屋的人都选择了新建房屋,而不是现有的房屋。新建房屋的优点之一是它们实际上是可用的。因此,根据全国住宅建筑商协会的数据,它们约占今年活跃挂牌房屋的三分之一,高于 covid-19 大流行前二十年的平均 13%。正如 Redfin 的达里尔·费尔韦瑟 (Daryl Fairweather) 所说:“建筑商正在受益,因为他们没有来自现有房主的竞争。”

Homebuilders have also been bold in offering incentives to buyers. Most strikingly, they have been “buying down” as much as 1.5 percentage points on mortgage rates, by paying a one-time fee upfront that reduces future interest payments. That has allowed their in-house mortgage companies to offer rates of roughly 5%. For homebuilders, these buy-downs are equivalent to knocking off about 6% from their selling price, which they can easily afford given the strength of their balance-sheets. For buyers, the lower mortgage rates are welcome relief in the current environment, which has translated into a pick-up in both purchases and construction. New starts on single-family homes bottomed out late last year. In July starts were up by nearly 10% compared with a year earlier.

房屋建筑商也大胆地向买家提供激励措施。最引人注目的是,他们通过预先支付一次性费用来“降低”抵押贷款利率高达 1.5 个百分点,从而减少未来的利息支付。这使得他们的内部抵押贷款公司能够提供大约 5% 的利率。对于房屋建筑商来说,这些收购相当于将售价降低约 6%,鉴于其资产负债表的实力,他们可以轻松负担得起。对于买家来说,较低的抵押贷款利率在当前环境下是受欢迎的缓解措施,这已转化为购买和建设的回升。单户住宅的新开工量在去年年底触底。 7 月开工率较去年同期增长近 10%。

Property types now wonder whether the price resilience will continue. The market faces a test as mortgage rates climb even higher. For much of the past year rates had seemed to stabilise at around 6.5%, but since the start of August investors have concluded that the Fed will keep policy tight for longer, which has pushed up mortgages towards 7.5%. “The higher rates go, the more demand falls. This is going to catch up with the homebuilders pretty quickly,” reckons John Burns, a property consultant. To counteract a slowdown, some lenders may offer riskier deals. Zillow, a property platform, is now promoting downpayments of just 1% on homes in Arizona, a once-hot market. If prices fall, owners with little equity in their homes may be among the first to default.

房地产类型现在想知道价格弹性是否会持续。随着抵押贷款利率进一步攀升,市场面临考验。在过去一年的大部分时间里,利率似乎稳定在 6.5% 左右,但自 8 月初以来,投资者得出结论,美联储将在更长时间内保持紧缩政策,这将抵押贷款利率推高至 7.5%。 “利率越高,需求下降就越多。这将很快赶上房屋建筑商的步伐,”房地产顾问约翰·伯恩斯 (John Burns) 认为。为了应对经济放缓,一些贷方可能会提供风险更高的交易。房地产平台 Zillow 目前正在推动亚利桑那州这个曾经炙手可热的市场的房屋首付仅需 1%。如果价格下跌,房屋净值很少的业主可能会首先违约。

If, though, the property market does remain resilient, it is the Fed’s policymakers who will face a test. Strong housing-market activity contributes to an overheating economy. A sustained rebound in prices would also complicate the inflation outlook. The relationship is not entirely straightforward. since property shows up in inflation indices in terms of rental prices, rather than purchase ones. Moreover, the main inflation gauges tend to lag high-frequency measures of rents by at least six months. These high-frequency measures have fallen for much of the past year, and that decline is just now filtering into official inflation indices—a process that will probably continue into early 2024.

不过,如果房地产市场确实保持弹性,那么美联储的政策制定者将面临考验。强劲的房地产市场活动导致经济过热。价格持续反弹也将使通胀前景变得复杂。这种关系并不完全简单。因为房地产在通货膨胀指数中是以租金价格而非购买价格的形式体现的。此外,主要通胀指标往往滞后高频租金指标至少六个月。这些高频指标在过去一年的大部分时间里都在下降,而且这种下降目前刚刚渗透到官方通胀指数中——这一过程可能会持续到 2024 年初。

What happens after that is much less certain. On the one hand, a record number of apartment units are under construction, and this supply ought to keep a lid on rents. On the other hand, the unaffordability of housing is forcing more would-be buyers into the rental market, which could push up rents and add to inflation. One big thing is clear: until interest rates come back down, millions of Americans will have little choice but to defer their dream of homeownership. ■

此后会发生什么就不太确定了。一方面,正在建设的公寓单元数量创历史新高,这种供应应该会抑制租金。另一方面,住房负担不起正迫使更多潜在买家进入租赁市场,这可能会推高租金并加剧通货膨胀。一件大事是明确的:在利率回落之前,数百万美国人别无选择,只能推迟他们的住房梦想。 ■