Authorities took series of steps to boost market sentiment

当局采取了一系列措施来提振市场情绪

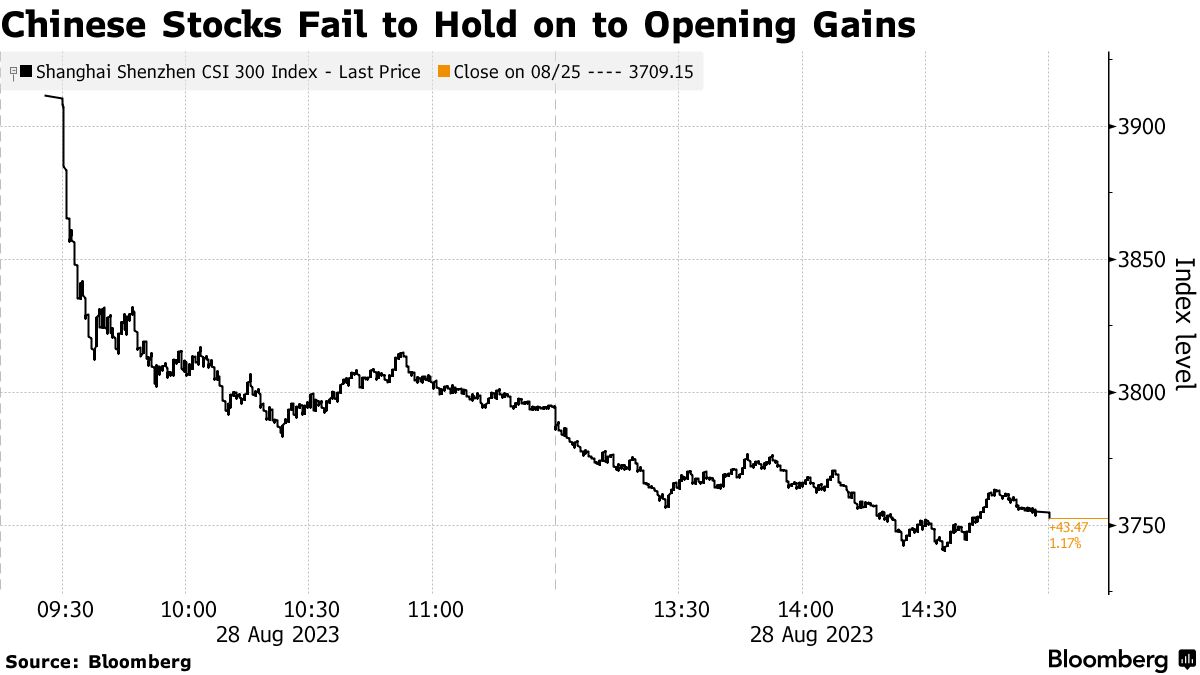

CSI 300 Index’s 5.5% rally fizzles in blow to Beijing’s effort**

沪深300指数5.5%的反弹在打击北京的努力中失败

Pedestrians ride escalators in Pudong's Lujiazui Financial District in Shanghai, China.Photographer: Qilai Shen/Bloomberg

中国上海浦东陆家嘴金融区,行人乘坐自动扶梯。摄影师:沈启来/彭博社

By Bloomberg News 彭博新闻社 2023年8月28日 at GMT+8 17:59

Chinese stocks started Monday by surging after authorities took a raft of steps to bring investors back to one of the world’s worst-performing equity markets. But most of the gains were gone by the end of the session, with foreign funds extending what’s set to be a record outflow this month.

中国股市周一开盘大涨,此前中国政府采取了一系列措施,将投资者带回全球表现最差的股市之一。但大部分涨幅在交易结束时消失,外国资金延续了本月创纪录的资金外流。

The price action illustrated once again how China’s efforts to boost its markets are struggling in the face of economic worries. Data Sunday showed industrial profits slid 6.7% in July from a year ago, adding to signs that the recovery lost further momentum. While calls for broad stimulus are mounting, authorities have held back given their determination to shift away from the debt-fueled growth model.

这一价格走势再次表明,面对经济担忧,中国提振股市的努力是多么艰难。周日公布的数据显示,7月份工业利润同比下滑6.7%,进一步显示复苏失去了进一步的动力。尽管广泛刺激的呼声越来越高,但鉴于当局决心摆脱债务推动的增长模式,他们一直犹豫不决。

Opening with a 5.5% pop in response to weekend measures that included the first cut in stamp duty since 2008 as well as curbs on share sales by major stakeholders, the CSI 300 Index of onshore Chinese stocks finished just 1.2% higher.

上周末出台的措施包括自2008年以来首次下调印花税,以及主要利益相关者限制股票销售,中国内地股市沪深300指数开盘上涨5.5%,仅上涨1.2%。

“The measures over the past weekend are not enough to stem the downward spiral” and their impact will be short lived if not followed by measures for supporting the real economy, Ting Lu, chief China economist at Nomura Holdings Inc., wrote in a note. “Without additional and more aggressive policy stimulus, these stock-markets-focused policies alone have little sustainable positive impact.”

野村控股(Nomura Holdings Inc.)首席中国经济学家陆挺表示,“上周末采取的措施不足以阻止螺旋式下降”,如果不采取支持真实的经济的措施,其影响将是短暂的。写在一张纸条上。“如果没有额外的、更积极的政策刺激,单靠这些以股市为重点的政策几乎没有可持续的积极影响。”

Echoing similar views, Neo Wang, Evercore ISI’s New York-based managing director for China Research, said that a turnaround in the A-share market would not happen unless Beijing adopts more “bazooka” measures, such as the 4-trillion yuan ($548 billion) stimulus package it rolled out in 2008.

Evercore ISI驻纽约的中国研究部董事总经理Neo Wang表示,除非北京采取更多的“火箭筒”措施,例如2008年推出的4万亿元人民币(5480亿美元)刺激计划,否则A股市场不会出现转机。

READ: Run It Cold: Why Xi Jinping Is Letting China’s Economy Flail

英文名:Run It Cold习近平为何让中国经济陷入困境

Beijing’s efforts to revive investor confidence suggest the slump in Chinese equities has reached a level that policymakers can no longer turn a blind eye to. As households suffer from a shrinking wealth effect from China’s property crisis, invigorating capital markets has become even more crucial.

北京方面重振投资者信心的努力似乎表明,中国股市的暴跌已达到政策制定者不能再视而不见的程度。随着中国家庭受到房地产危机带来的财富缩水效应的影响,振兴资本市场变得更加重要。

Other measures announced Sunday included a cut in deposit ratios for margin financing as well as a pledge by the China Securities Regulatory Commission to slow the pace of initial public offerings. The raft of changes this time are expected to bring the equivalent of 750 billion yuan of new funds into the market per year, according to estimates from Huatai Securities.

周日宣布的其他措施包括下调保证金融资的存款比率,以及中国证监会(CSRC)承诺放缓首次公开发行(IPO)的步伐。根据华泰证券的估计,这一次的大量变化预计每年将带来相当于7500亿元人民币的新资金进入市场。

Equity traders had been expecting more forceful steps after recent efforts by authorities failed to arrest the market’s slide. Stock exchanges asked some mutual funds to avoid selling equities on a net basis, Bloomberg News reported late on Monday, citing people who asked not to be identified discussing private information.

股市交易员此前一直预计,在当局最近的努力未能阻止股市下滑后,他们将采取更多有力措施。彭博新闻社(Bloomberg News)周一晚间报道称,证券交易所要求一些共同基金避免净卖出股票,并援引不愿透露姓名的人士的话讨论私人信息。

“The open today was a bit too strong, and that level of hype understandably leads to some people walking away from the table,” said Lin Menghan, a fund manager at Shanghai Xiejie Asset Management Co. “The measures overall addressed the issues of outflow and dilution of funds in the market, rather than where the fresh liquidity will come from.”

上海协杰资产管理有限公司的基金经理林梦涵说:“今天开盘有点太猛了,这种程度的炒作导致一些人离场是可以理解的。”“这些措施总体上解决了市场资金外流和稀释的问题,而不是新的流动性将来自哪里。”