MICHAEL BECKLEY 2024年8月20日

Felix Decombat

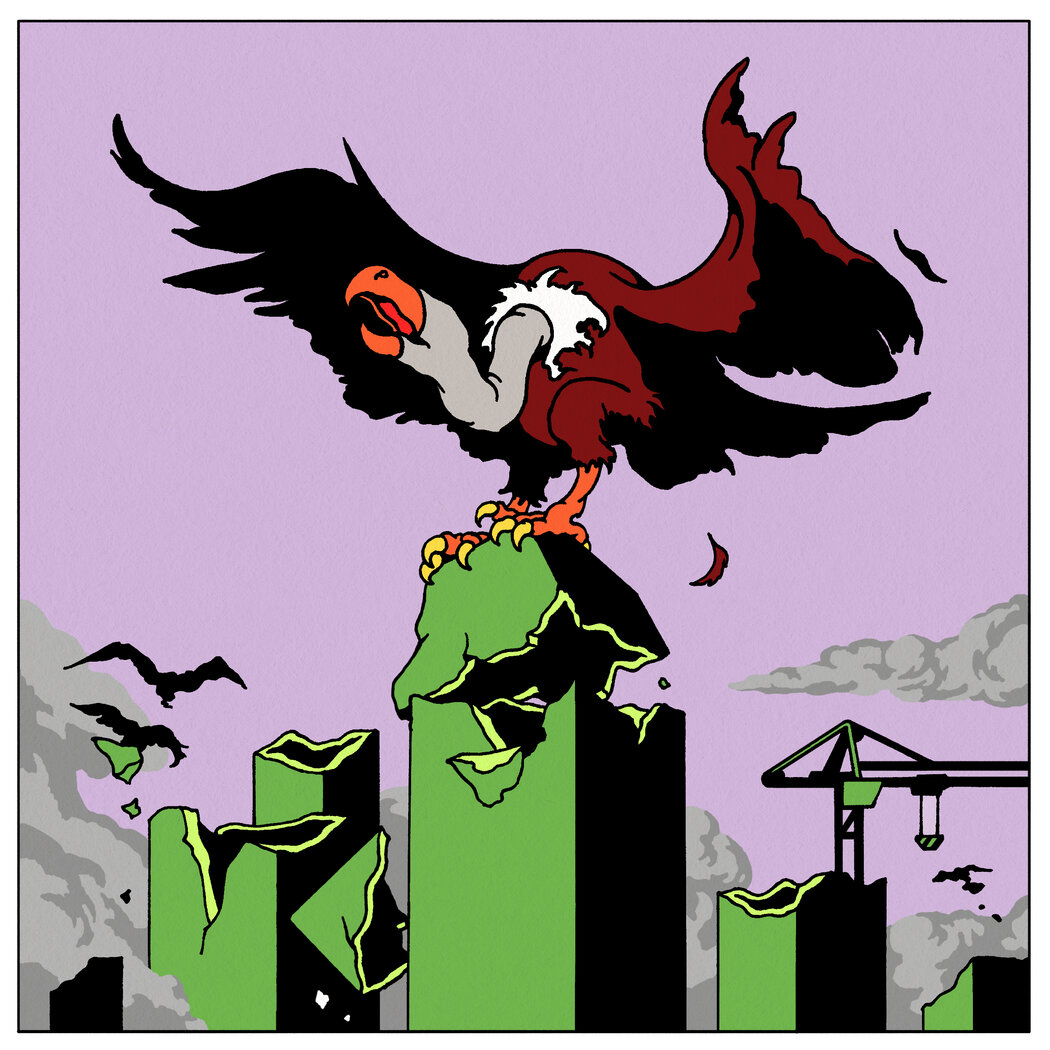

In the 2000s, former President Hugo Chávez of Venezuela bet his country’s economic future on a rising China, securing tens of billions of dollars in investments and loans-for-oil deals. It paid off at first. China voraciously consumed Venezuelan oil and financed infrastructure projects from a high-speed railway to power plants.

21世纪初,委内瑞拉当时的总统乌戈·查韦斯把国家的经济未来押在了崛起的中国身上,获得了数百亿美元的投资和石油换贷款的交易。这个做法起初曾给委内瑞拉带来回报。中国进口了大量的委内瑞拉石油,并为该国从高铁到发电厂等基础设施项目提供了资金。

The 2010s brought a reckoning. Oil prices fell, and growth in Chinese oil demand slowed along with its economy. Venezuela’s oil export revenues plummeted, from more than $73 billion in 2011 to $22 billion in 2016. Misrule by Mr. Chavez and his handpicked successor, Nicolás Maduro, and myriad other domestic problems already had Venezuela on the brink; the gamble on China helped push it over the edge. In 2014, Venezuela’s economy collapsed. People scavenged for food in garbage dumps, hospitals were short of essential medicines and crime surged. Since then, nearly eight million people have fled the country. China largely cut Venezuela off from new credit and loans, leaving behind a slew of unfinished projects.

在21世纪的第二个十年,算总账的日子到了。石油价格下跌,而且中国经济增长的放缓导致它对委内瑞拉石油需求的增长也跟着放缓。结果,委内瑞拉的石油出口收入暴跌,从2011年的730多亿美元跌至2016年的220亿美元。查韦斯和他亲手挑选的继任者尼古拉斯·马杜罗的蠢政,加上国内无数的其他问题,让委内瑞拉濒临崩溃;而押注中国则加速了这一过程。2014年,委内瑞拉的经济崩溃。老百姓在垃圾堆中寻觅食物,医院缺少基本药物,犯罪率飙升。从那时起,已有近800万人逃离了委内瑞拉。中国基本上不再向委内瑞拉提供新的信贷和贷款,在该国留下了一大堆未完工的项目。

Venezuela’s over-dependence on China was an early warning that the world ignored. Dozens of other countries that rode China’s rise are now at serious risk of financial distress and debt default as the Chinese economy stagnates. Yet China refuses to offer meaningful foreign debt relief and is doubling down at home on its protectionist trade practices when it should be undertaking reforms to free up and restart its economy, the world’s second-largest and a crucial engine of global growth.

委内瑞拉对中国的过度依赖是被世界所忽视的一个早期预警。随着中国经济发展停滞不前,几十个曾借过中国经济增长东风的国家现在都面临着严重的财务困境和债务违约风险。但中国拒绝向它们提供重大的外债减免,并在国内加倍推行贸易保护主义,而不是进行所需的改革,释放并重启经济。中国是世界第二大经济体,也是全球增长的关键引擎。

This is the flip side of China’s “miracle.” After the 2008 global financial crisis, the world needed an economic savior, and China filled that role. Starting in 2008, it pumped $29 trillion into its economy over nine years — equivalent to about one-third of global G.D.P. — to keep it going. The positive ripple effects were felt worldwide: From 2008 to 2021 China accounted for more than 40 percent of global growth. Developing countries eagerly attached themselves to what seemed like an unstoppable economic juggernaut, and China became the top trading partner for most of the world’s nations. Like Venezuela, many discovered that the booming Chinese economy was a lucrative new market for their commodity exports, and they leaned heavily into that, allowing other sectors of their economies to languish.

这是中国“奇迹”的另一面。2008年全球金融危机后,世界经济需要一个救世主,中国曾充当这一角色。从2008年起,中国为维持经济运转在九年时间里向本国经济注入了29万亿美元,相当于全球GDP的三分之一。全世界都感受到了正面的涟漪效应:从2008至2021年,中国贡献了全球经济增长的40%以上。发展中国家急于将本国经济与这个似乎势不可挡的强大经济体挂钩,中国成了世界上大多数国家的最大贸易伙伴。与委内瑞拉一样,许多国家发现,蓬勃发展的中国经济是它们大宗商品出口利润丰厚的新市场,它们严重依赖这一市场,让经济的其他领域变得衰弱。

China also lent more than $1 trillion abroad, largely for infrastructure projects to be built by Chinese companies under its Belt and Road Initiative. Over the past two decades, one in three infrastructure projects in Africa was built by Chinese entities. The long-term debt risks for fragile developing economies were often ignored.

中国还向海外提供了逾一万亿美元的贷款,主要是为了让中国企业在“一带一路”倡议下在世界各地承建基础设施项目。在过去20年里,非洲基础设施项目中的三分之一是由中国企业修建的。这种债务给脆弱的发展中经济体带来的长期风险往往为人所忽视。

China’s boom, as we now know, was unsustainable. It was fueled in large part by years of inefficient stimulus spending at home, which has saddled China with a crushing debt hangover of it own. President Xi Jinping has stifled entrepreneurship, resisted reform and provoked a protectionist response from the United States. Since Mr. Xi took over a decade ago, Chinese economic growth has slowed dramatically; some experts believe it is barely growing at all.

正如我们现在所知,中国的经济繁荣是不可持续的。这种繁荣在很大程度上是由政府多年来的低效刺激性开支所推动,这让中国自身背上了沉重的债务负担。国家主席习近平抑杀创业精神,抵制改革,还激起了美国的保护主义反应。自从习近平十多年前上台以来,中国经济的增长速度已大幅放缓;一些专家认为,中国经济的增长几乎已经停滞。

This directly impacts countries that hitched their economic wagons to China. Studies find that every one percent decline in Chinese G.D.P. growth can slow its trading partners’ economies by nearly comparable amounts. A number of countries have seen their exports to China plunge. At the same time, China is addressing its economic slowdown by extending huge loans and subsidies to Chinese manufacturers, which are flooding world markets with inexpensive products, dragging down global goods prices and posing unfair competition for manufacturers in other countries.

这直接影响到那些让本国经济与中国经济挂钩的国家。研究发现,中国国内生产总值增长率每下降一个百分点,其贸易伙伴的经济会放缓近乎相当的幅度。一些国家已看到它们对中国的出口大幅下降。与此同时,中国应对国内经济增长放缓的做法是向国内的制造商提供巨额贷款和补贴,导致它们向全球市场抛售大量廉价产品,拉低了全球商品的价格,对其他国家的制造商造成了不公平竞争。

China is, of course, not solely responsible for weakness in the global economy, which has been buffeted by a pandemic, wars and trade tensions. But the country is making things worse at a delicate moment. It has drastically cut overseas lending and is squeezing strapped developing nations to repay their existing loans. Rather than offer real debt relief, China typically extends short-term credit swaps and loan rollovers.

中国当然不是对全球经济疲软负有唯一责任的国家,全球经济受到了新冠疫情、战争,以及贸易紧张关系的冲击。但中国在这个微妙的时刻让情况变得更糟。它大幅削减了海外放贷,并迫使陷入困境的发展中国家偿还现有贷款。中国通常用延长短期信贷互换和贷款展期的做法,而不是向负债国家提供真正的债务减免。

Zambia and Sri Lanka defaulted on billions in debt owed to international creditors in 2020 and 2022, respectively. In both cases, an explosion of Chinese loans and credit was a significant factor in pushing those countries into deep financial trouble. This led to debt restructuring negotiations that were difficult and protracted partly because of the opaque nature of Chinese lending practices, exacerbating both countries’ crises. Eventually, Zambia and Sri Lanka were forced to extend repayment periods, meaning that resources that could have been spent on economic recovery went to servicing debt obligations. The extended uncertainty has made it difficult for these countries to access new financing.

赞比亚和斯里兰卡分别在2020年和2022年对国际债权人违约,欠下数十亿美元的贷款。中国向这两个国家提供的贷款和信贷激增是将它们推入严重财务困境的重要因素。中国在放贷上的不透明是导致债务重组谈判困难重重且旷日持久的部分原因,加剧了这两个国家的危机。最终是赞比亚和斯里兰卡被迫延长还款期限,这意味着本可用于恢复经济的资源将被用于偿还债务。不确定性的延长已让这两个国家难以获得新资金。

The International Monetary Fund and the World Bank have warned that dozens of countries across the developing world — many of which have close trade relationships with China — now face some form of debt distress. Pakistan is mired in a deep economic crisis that it can’t climb out of, partly because of the need to pay back billions of dollars in loans to China for infrastructure and other projects. Some factories in the country have been idled because they have been unable to buy necessary materials and because the government can’t afford to maintain a stable power supply. In Laos, around half of the nation’s foreign debt is owed to China, which extended billions of dollars in loans for projects including a China-Laos high-speed rail line that has been widely panned as a white elephant. The heavy debt has hammered Laos’s currency, making it more difficult for the country to service its debt and forcing it to cede some of its economic sovereignty as repayment, including allowing China to take ownership stakes in its power grid.

国际货币基金组织和世界银行警告,发展中世界的几十个国家(其中许多与中国有密切贸易关系)现在都面临某种形式的债务困境。巴基斯坦已陷入本国无法摆脱的严重经济危机,部分原因是需要偿还中国为基础设施和其他项目提供的数十亿美元贷款。巴基斯坦的一些工厂已经停工,因为它们无法购买所需的材料,而政府也无力维持稳定的电力供应。老挝的约一半外债是欠中国的,中国曾向老挝提供数十亿美元的贷款,修建了包括中老高铁在内的项目,这条高铁已被普遍批评为“白象”(喻指大而无用之物——编注)。沉重的债务已导致老挝汇率贬值,使其更难偿还外债,并迫使该国用放弃自己部分经济主权的方式来偿还债务,包括让中国接管老挝电网的部分所有权。

广告

Even some wealthy nations such as Germany, the economic powerhouse of Europe, face deep challenges because of their over-dependence on doing business with China. German exports to China fell nine percent last year — the steepest decline since China joined the World Trade Organization in 2001 — and Germany’s economy shrank that year, too. Major commodity exporters such as Australia, Brazil and Saudi Arabia are vulnerable since exports of energy, metals or agricultural products to China make up significant portions of their economies.

就连一些富裕国家也因过度依赖与中国的贸易而面临严峻挑战,比如欧洲经济强国德国。去年,德国对华出口下降了9%,这是自2001年中国加入世界贸易组织以来的最大降幅,德国经济也在去年出现了萎缩。澳大利亚、巴西、沙特阿拉伯等主要大宗商品出口国很容易受影响,因为它们对中国的能源、金属或农产品出口占其经济的很大一部分。

The United States is less directly exposed; manufactured exports to China make up less than one percent of America’s G.D.P. But the glut of Chinese products such as electrical vehicles and solar panels threatens American manufacturers, and some of the largest U.S. companies, including Apple, General Motors, Nike, Starbucks, and Tesla are losing sales revenue in China because of weak Chinese consumer demand, disrupted supply chains or increased competition from subsidized Chinese companies.

美国受到的直接影响较小;美国制成品对中国的出口在其国内生产总值中不到1%。但电动汽车和太阳能电池板等中国产品过剩的问题威胁着美国的制造商。由于中国消费者需求疲软,供应链中断,或来自拿政府补贴的中国公司的竞争加剧,苹果、通用汽车、耐克、星巴克和特斯拉等一些美国最大的公司在中国的销售收入正在下降。

There are worrying parallels between today’s situation and the debt crisis that swept through developing countries in the 1980s. Many nations, particularly in Latin America and Africa, were burdened with massive debts primarily owed to Western commercial banks and international institutions such as the I.M.F. and the World Bank. Facing soaring interest rates and plummeting commodity prices, nations including Mexico, Brazil and Argentina defaulted. Some endured years of subsequent low economic growth, severe austerity measures, plummeting living standards and political upheaval.

目前的形势与20世纪80年代席卷了发展中国家的债务危机有令人担忧的相似之处。那时,许多国家,尤其是拉丁美洲和非洲国家背负着主要是欠西方商业银行以及国际货币基金组织、世界银行等国际机构的巨额债务。由于利率飙升和大宗商品价格暴跌,一些国家出现了债务违约,包括墨西哥、巴西和阿根廷。一些国家后来经历了多年的经济低增长、苛刻的紧缩政策、生活水平急剧下降,以及政治动荡等问题。

China, now by far the world’s largest sovereign lender, has played a leading role in saddling many countries with levels of debt, often through nontransparent arrangements, that are comparable to those seen in the 1980s. The situation is becoming perilous. Over the past decade, during which China doled out more lending than the Paris Club — a grouping of 22 of the world’s largest creditor nations — the total value of interest payments of the 75 poorest countries in the world have quadrupled and will outstrip their total annual spending on health, education and infrastructure combined, according to the World Bank. An estimated 3.3 billion people live in countries where interest payments exceed investments in either education or health, the United Nations said.

中国现在是世界上最大的主权债权国,在许多国家背负巨额债务方面起到了主要作用,它往往用不透明的方式放贷,与20世纪80年代债务危机中看到的类似。情况正在走向危险的程度。据世界银行的数据,中国在过去十年发放的贷款超过了由22个世界上最大的债权国组成的巴黎俱乐部发放的贷款总额,而世界上75个最贫穷国家为中国贷款支付的利息总额在这十年中已增长至以前的四倍,并将超过这些国家在医疗、教育和基础设施方面的年度总支出。据联合国估计,有33亿人生活在利息支出超过教育或医疗投入的国家。

The example of Venezuela — which remains mired in an economic crisis — has shown where these conditions can lead: Economic collapse, repression and humanitarian disaster. In a world already shaken by war, the risks posed by sovereign defaults, political instability and resulting mass migrations is acute. In recent months, people in France, Poland, Kenya, Bolivia, Sri Lanka and a host of other countries across the world have staged protests about deteriorating economic conditions.

委内瑞拉深陷经济危机的例子表明,这种情况能导致经济崩溃、镇压和人道主义灾难。在一个已经因战争而动荡不安的世界,主权债务违约、政治不稳定以及由此导致的大规模移民的风险愈发突出。近几个月来,法国、波兰、肯尼亚、玻利维亚、斯里兰卡,以及世界其他国家的人民都已针对不断恶化的经济状况举行了抗议活动。

Calls are rising for wealthy economies and creditor nations to collaborate to provide debt relief, market access and other ways to help fragile economies.

要求富裕经济体和债权国在提供债务减免、市场准入,以及其他帮助脆弱经济体的办法上合作的呼声越来越高。

Such steps will have only a limited impact unless China is confronted over its role in exacerbating these problems and failing to address them. Finding the collective international resolve needed to get China to change its self-serving ways will be difficult. The crucial first step is to recognize the scale of the problem.

然而,除非中国正视自己在加剧这些问题和未能解决问题方面所起的作用,否则这些措施只会带来有限的效果。找到让中国改变其自私自利行为所需的共同的国际决心将是困难的。第一个关键步骤是认识到问题的严重性。