傅才德, KATRINA NORTHROP, ELIOT CHEN

2024年7月22日

MARK HARRIS FOR THE NEW YORK TIMES

Four years ago, Jack Ma was the embodiment of China’s spectacular economic rise. Already the country’s wealthiest and most famous businessman, he was poised to become one of the richest in the world.

四年前,马云曾是中国经济壮观崛起的化身。他那时已是中国最富有、最著名的商人,而且已经准备好成为世界上最富有的人之一。

The expected initial public offering of Mr. Ma’s fintech company, Ant Group, was projected to surpass the record-shattering launch of his e-commerce giant, Alibaba. Soon, it was thought, he would be lionized like Bill Gates and Steve Jobs — a paragon of Western-style business in China.

马云的金融科技公司蚂蚁集团当时即将首次公开发行股票,预计上市将打破他的电商巨头阿里巴巴首次公开募股时创下的纪录。人们曾认为,他很快就会在中国像比尔·盖茨和史蒂夫·乔布斯那样,被推崇为西方商业模式在中国的典范。

At the same time, another wealthy Chinese businessman was awaiting a very different fate. Xiao Jianhua was languishing in detention on bribery and corruption charges — a larger-than-life target of a government crackdown on graft. Mr. Xiao had amassed a fortune manipulating markets and cultivating close ties to relatives of top Chinese officials, and he was about to be made an example.

与此同时,另一名富裕的中国商人正面临截然不同的命运。肖建华因受贿和腐败的指控已被拘禁,他是政府反腐败行动惹人注目的目标。他曾通过操纵股市、与中国高官的亲属建立密切关系积累了大量财富。政府要用惩罚他来儆戒他人。

And yet behind the scenes, these bookends of China’s catch-as-catch-can capitalism — its most celebrated and its most notorious billionaires — were linked through investments worth at least $1 billion, an investigation by The New York Times and The Wire China found.

这两名亿万富翁一个最为著名,另一个最臭名昭著,但都是不择手段的中国式资本主义的代表人物。而《纽约时报》和《连线中国》(The Wire China)的调查发现,背后至少有10亿美元的投资将他们联系在一起。

A review of more than 2,000 confidential documents shows that Mr. Xiao’s now dismantled company Tomorrow Group secretly secured lucrative shares in an array of Mr. Ma’s companies over a period of five years. These business associations were never disclosed, and a former senior executive at Tomorrow Group said, “As far as we know, Jack Ma was unaware” of them.

记者通过查阅2000多份保密文件发现,肖建华的(现已解体的)明天控股集团曾在五年内获得了马云旗下多家公司的丰厚股份。这些商业联系从未披露过,“明天系”的一名前高管说,“据我们所知,马云对此不知情。”

The deals offer a close-up view of China’s signature brand of capitalism, where well-connected entrepreneurs and those who raise money for them are better off, at least in some cases, not interacting with one another. In almost any other robust economy, the proprietor of a major business would want to develop a relationship with an investor who raised $1 billion, and the investor would want to influence how the money was used.

这些交易让人得以从近距离了解中国特色的资本主义。在中国,人脉广泛的企业家和为他们筹集资金的人最好不要互动,至少在某些情况下是如此。在几乎所有其他强健经济体中,大型企业的所有者都会想与为其企业筹集了10亿美元资金的投资者发展关系,而投资者也会想影响所投资金的使用方式。

Not in the China of Mr. Xiao and Mr. Ma.

在肖建华和马云所在的中国不是这样。

The documents do not show that Mr. Ma knew about the Xiao investments, and speaking through a lawyer for Alibaba, Mr. Ma said he “never had any business relationship with Mr. Xiao.” The lawyer for Alibaba, in a statement, also said, “As far as Alibaba and its affiliates know, the connections you claim to exist do not have any basis in fact.”

这些文件并未显示马云知道肖建华的投资,马云通过阿里巴巴的一名律师表示,他“从未与肖建华有任何商业关系”。阿里巴巴的律师在一份声明中还说,“就阿里巴巴及其附属机构所知,你们声称存在的联系没有任何事实依据。”

But in one instance involving an Alibaba affiliate, the investigation found, Mr. Ma’s friend and business partner, Huang Youlong, entered into the investment on behalf of Mr. Xiao’s companies. In another deal involving a Hong Kong brokerage firm named in part after Mr. Ma, Mr. Huang and other Xiao associates were the biggest shareholders.

但调查发现,在一笔涉及一家阿里巴巴附属机构的投资中,马云的朋友和商业伙伴黄有龙是代表肖建华公司的参股人。在另一笔涉及一家香港券商(该公司部分以马云的名字命名)的交易中,黄有龙和其他与肖建华有关系的人是公司的最大股东。

As late as 2020, even as Mr. Xiao sat in detention and Ant was preparing its I.P.O., companies and people in Mr. Xiao’s network held Ant shares with an estimated value of more than $300 million, the investigation found. In a surprise last-minute move, Chinese regulators halted the offering and launched investigations into both Alibaba and Ant, which to this day remains privately held.

调查发现,直到2020年,也就是肖建华被拘留、蚂蚁集团准备上市前,肖建华网络中的公司和人曾持有估值超过3亿美元的蚂蚁集团股份。中国监管机构在最后一刻出人意料地叫停了蚂蚁集团的首次公开募股,并对阿里巴巴和蚂蚁集团展开调查,蚂蚁集团至今仍为私人控股。

The documents reveal the inner workings of the Xiao network, which he controlled through proxy shareholders that granted him anonymity and made the transactions difficult to decipher. They were concealed behind offshore entities and tracked on spreadsheets by Mr. Xiao’s staff. The Times and The Wire China were able to confirm transaction details through an examination of corporate filings and interviews, and two former employees of Tomorrow Group confirmed the authenticity of the documents.

这些文件揭示了肖建华网络的内部运作方式,肖建华通过代理股东控制这个网络,让他能匿名行事,让人难以了解交易的各方。交易方隐藏在海外实体背后,肖建华的员工用电子表格将它们联系起来。时报和《连线中国》通过查阅公司提交的文件和采访有关人员证实了这些交易的细节,“明天系”的两名前雇员证实了这些文件的真实性。

Mr. Xiao’s specialty was helping influential officials and their relatives transfer wealth abroad and buy and sell assets; in at least one case, he did so for one of President Xi Jinping’s sisters. At his trial, the Chinese authorities suggested his holdings, which stretched from banking and insurance to rare metals, coal and real estate, were so vast that they threatened the country’s financial stability.

肖建华的专长是帮助有支配权的官员及其亲属将财产转移到海外和进行资产交易;他的这些交易中至少有一笔是为国家主席习近平的一个姐姐做的。肖建华的资产涉及银行、保险、稀有金属、煤炭和房地产等行业,中国当局在审判他的案件时暗示,他的资产规模已庞大到威胁中国金融稳定的程度。

The documents also tell a story at times sharply at odds with the public narrative about Mr. Ma, who publicly derided the cronyism that pervades Chinese companies. That Mr. Xiao was able to benefit from Mr. Ma’s world, even as some of New York’s most prestigious law firms conducted due diligence on the deals, was shocking — and telling — to scholars of China’s economy.

这些文件讲述的故事与关于马云的公开叙事有很大的不同。马云曾多次在公开场合嘲笑中国公司中普遍存在的裙带关系。尽管纽约的一些最负盛名的律师事务所对这些交易进行了尽职调查,但肖建华仍能从马云的世界获益,这一事实对研究中国经济的学者来说既令人震惊,也很说明问题。

“Finding them connected this way,” said Meg Rithmire, a Harvard Business School professor who has studied Mr. Xiao’s financial network, “shows that the Chinese system is so murky that everyone gets caught in the same web.”

“发现他们以这种方式联系在一起,”哈佛商学院教授、一直关注肖建华金融网络的任美格(Meg Rithmire)说。“表明中国的体系非常阴暗,以至于每个人都陷入了同一张网中。”

Mr. Xiao is now serving a 13-year sentence, and Mr. Ma has all but retreated from public life, having no formal role in the companies he founded. Both men — one defrocked, the other locked away — are among the highest-profile targets in Mr. Xi’s dramatic consolidation of power since he became China’s top leader over a decade ago.

肖建华已被判处13年有期徒刑,目前正在服刑。马云也已几乎完全退出公众视野,不再在他创立的公司中有任何正式职务。两人一个不再是红人,另一个失去了自由,他们都是习近平打击目标中最引人注目的对象。习近平十多年前出任中国最高领导人以来,已为巩固权力采取了惊人做法。

Mr. Ma’s clashes with the government have been well documented, including his running afoul of Mr. Xi for criticizing the push for stronger financial oversight of his companies. But until now, nothing has been publicly known about the investments linked to Mr. Xiao.

马云与政府失和的事情已广为人知,比如他曾批评政府加强对他的公司的金融监管,触犯了习近平。但此前与肖建华有关的投资尚未公开披露过。

The Times obtained the documents in 2018, more than a year after Mr. Xiao was abducted in Hong Kong and spirited into mainland China, and they have been used in various reporting efforts. In parts English and Chinese, they include brokerage and bank statements, contracts, corporate registration filings and spreadsheets mostly from the company’s Hong Kong operations.

时报在2018年获得了这些文件,那是在肖建华从香港被秘密绑架到中国内地一年多后。以前的报道用过这些文件。它们有英文有中文,包括经纪公司和银行的对账单、合同,公司注册提交的文件和电子表格,主要与“明天系”在香港的业务有关。

The source of the material, who once worked for Tomorrow Group, wanted to expose how Mr. Xiao secretly controlled and manipulated companies and how financial regulators in Hong Kong and China failed to stop him, the source said. Because Tomorrow Group was also under government investigation, it is possible that Chinese authorities have access to the same information, the source said. Mr. Xiao was praised for his cooperation at his sentencing.

提供这些材料的人曾在“明天系”工作。对方表示,提供材料是因为想揭露肖建华如何秘密控制和操纵这些公司的,以及香港和中国的金融监管部门在阻止他的做法上是如何失败的。对方称,中国当局手中可能有相同的文件,因为“明天系“也在接受政府调查。法院在宣判时对肖建华的立功表现进行了肯定。

The Times revisited the documents last year and shared them with The Wire China. Their joint investigation found that the investment connection between Mr. Ma, 59, and Mr. Xiao, 52, had begun several years before the 2017 abduction.

去年,时报重新查阅了这些文件,并与《连线中国》进行了分享。双方的联合调查发现,现年59岁的马云与现年52岁的肖建华之间的投资关系始于后者2017年被绑架的几年前。

Mr. Xiao, who is in prison in Shanghai, could not be reached for comment. The former senior executive at Tomorrow Group confirmed that the company was behind the investments. “At the time, Alibaba and Jack Ma were so successful,” the former executive said. “Everyone wanted to invest with them. They had the magic touch.”

肖建华目前在上海的监狱服刑,记者无法联系到他置评。“明天系”的前高管证实这些投资的背后正是该公司。“当时,阿里巴巴和马云都非常成功,”这名前高管说。“所有的人都想投资他们。他们有魔力。”

‘Clandestine and Dispersed’

“秘密而分散”

As China’s economy boomed in recent decades, many well-connected families earned billions of dollars by leveraging their clout over highly regulated industries.

随着中国经济近几十年来蓬勃发展,许多人脉广泛的家庭利用他们在高度监管行业的影响力赚了数十亿美元的财富。

Leading the charge were the so-called princelings — the relatives of top Communist Party officials — who controlled the intersection of state influence and private wealth. Their behind-the-scenes efforts could save or wreck deals, and they did so without worrying about being unmasked by the Chinese media or facing consequences on Election Day.

带头这样做的是所谓的太子党,也就是中共高级官员的亲属,他们控制着国家影响和私人财富的交汇处。他们的幕后努力可以挽救或破坏交易,而且不必担心遭中国媒体曝光或在选举时面临后果。

Mr. Xiao was their longtime concierge.

肖建华曾是他们长期的看门人。

From the time he was a 17-year-old student leader at Peking University, Mr. Xiao began to develop ties to the country’s power structure. With a coterie of female bodyguards, at least two foreign passports and more than 100 offshore companies, he amassed riches through state-dominated industries rife with cronyism: banking, insurance and brokerages.

自从17岁在北京大学当学生领袖时起,肖建华就开始与国家权力结构建立联系。他通过充斥着裙带关系的国家主导行业——银行、保险和经纪公司——积累了大量财富,拥有一群女保镖、至少两本外国护照,以及100多家离岸公司。

Mr. Ma was not part of this system. In the late 1980s, he took a job as an English teacher making $14 a month, and when he founded Alibaba a decade later, he followed the Silicon Valley playbook, acquiring funds from savvy global investors like Goldman Sachs and Japan’s SoftBank.

马云不是这个体系内的人。他曾在20世纪80年代末当英语教师,每月工资不到100元。十年后创立阿里巴巴时,他以硅谷为指南,从高盛和日本软银等精明的全球投资者那里获得了资金。

For Mr. Ma, Chinese officials were to be respected and obeyed but otherwise avoided. “I do everything they tell me,” he told an audience at Stanford University in September 2011. “But do business? Sorry.”

在马云看来,对中国官员应该敬而远之。“他们叫我怎么做,我就怎么做,”他曾在2011年9月对一群斯坦福大学的听众说。“但在做生意上?对不起。”

上海街上的小贩收钱用的蚂蚁集团移动支付系统支付宝的二维码。 QILAI SHEN FOR THE NEW YORK TIMES

The Chinese authorities began paying more attention to Alibaba as its success took off. Mr. Ma has said he was pressured to transfer Alipay, a mobile payment system now controlled by Ant Group, to a Chinese company. Mr. Ma also moved to increase Chinese ownership in Alibaba, which at the time had more than 70 percent of its shares held by foreign investors.

随着阿里巴巴在生意上取得成功,中国当局开始更关注这家公司。马云表示曾面临将支付宝转让给一家中国公司的压力,支付宝是个移动支付系统,现由蚂蚁集团控制。马云还采取行动增加了阿里巴巴股份中由中国人持有的比例,当时阿里巴巴70%以上的股份由外国投资者持有。

It was around this time that Mr. Ma and Mr. Xiao’s parallel universes first converged.

差不多是在那个时候,马云和肖建华的平行宇宙首次出现了交汇。

The same month that Mr. Ma spoke at Stanford, Chinese investors began increasing their foothold in Alibaba. The select group included Mr. Ma’s friends as well as an obscure British Virgin Islands shell company called Financial Giant, which invested $25 million, the documents show.

马云在斯坦福大学发表演讲的同一个月,中国投资者开始增加他们对阿里巴巴的持股。这些投资者中有马云的朋友,还有一家鲜为人知的英属维尔京群岛空壳公司,据文件显示,这家公司叫Financial Giant,对阿里巴巴投了2500万美元。

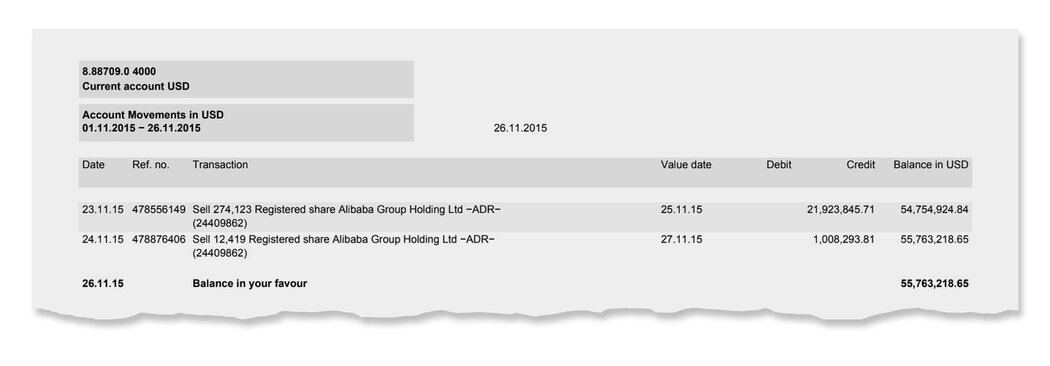

On paper, Financial Giant’s owner was an unknown 24-year-old woman whose family hailed from a small city near the Russian border. Two Swiss banks — UBS and J. Safra Sarasin — lent her legitimacy by opening brokerage accounts for her company.

从公司文件看,Financial Giant的所有者是一名没人听说过的24岁女子,她家位于中国和俄罗斯边境附近的一个小城市。两家瑞士银行——瑞银和J. Safra Sarasin——为她的公司开设了经纪账户,从而为其合法性提供了支持。

瑞士嘉盛银行的记录显示,肖建华的一名代理人出售了阿里巴巴股份。

The woman, Zhao Binbin, could not be reached for comment. She had something else going for her, the Tomorrow Group documents show: She belonged to a family that acted as proxies for Mr. Xiao, and she was holding the Alibaba shares on his behalf.

记者无法联系到这个名叫赵彬彬(音)的女子置评。“明天系”的文件显示,还有其他与她有关系的事情:她来自一个为肖建华担任代理人的家族,她的阿里巴巴股份是为肖建华代持的。

One of her relatives, a piano teacher, was listed as the top official of a Xiao company that in 2013 bought assets from one of Mr. Xi’s sisters. The same relative was married to a Xiao employee who in 2014 bought a $62 million Van Gogh painting at a Sotheby’s auction.

她的一个亲戚是钢琴教师,被列为肖建华一家公司的高管,该公司于2013年从习近平的一个姐姐那里收购了资产。这位亲戚的妻子是肖建华公司的一名员工,于2014年在苏富比拍卖会上以6200万美元的价格购买了一幅梵高的画作。

“When Boss Xiao was building Tomorrow Group, there was a saying: ‘clandestine and dispersed,’” said the former Xiao employee who provided the documents, speaking on the condition of anonymity because the former employee still works in the industry.

“肖老板打造明天集团的时候,有一句话是‘秘密而分散’,”提供文件的肖建华前员工说。由于这位前员工仍在业内工作,所以要求不透露姓名。

“Xiao’s name and Tomorrow’s name will not appear,” the former employee said.

“肖建华的名字和明天的名字不会出现,”这位前雇员说。

Playing the Princelings Game

太子党游戏

It is unclear how or why Mr. Ma and Mr. Xiao first became acquainted. They met in Beijing in 2013, at a club affiliated with a major Chinese bank, one person close to Mr. Xiao said. An undated photo surfaced on a Chinese social media site in 2018 showing them toasting each other at a restaurant with kimono-clad servers.

目前尚不清楚马云和肖建华最初结识的方式和原因。一位与肖建华关系密切的人士说,他们是2013年在北京一家属于中国某大银行的会所认识的。2018年,中国一家社交媒体网站上出现了一张未注明日期的照片,显示两人在一家餐厅里互相敬酒,身边的服务员穿着和服。

The “why” behind the Xiao investments may have more to do with China’s inescapable world of princelings than any pressing business imperative. As relatives of China’s political elite looked to benefit from the country’s growing economy, Mr. Xiao made a career of connecting them with promising ventures — and often concealing those connections behind shell companies, proxy investors and other smoke screens.

肖建华投资背后的“原因”可能更多与中国不可避免的太子党世界有关,而不是任何紧迫的商业需求。中国政治精英的亲属希望从国家不断增长的经济中获益时,肖建华帮他们和前景看好的企业牵线搭桥,并且经常将这些联系隐藏在空壳公司、代理投资者和其他烟幕之后。

In 2010, Mr. Ma co-founded an investment firm, Yunfeng Capital, and investors got early access to his companies. One of Mr. Xiao’s proxies, the young woman from near the Russian border, was among them, acquiring her Alibaba shares through Yunfeng around 2011, the investigation found.

2010年,马云与他人联合创立了一家投资公司云锋基金,投资者可以提前得到投资他的公司的机会。调查发现,肖建华的代理人之一、来自俄罗斯边境附近的那名年轻女子就是其中一名投资者,她在2011年左右通过云锋基金获得了阿里巴巴的股份。

By the following year, in anticipation of Alibaba’s I.P.O., Mr. Ma was looking to pare down foreign ownership in the company — particularly Yahoo’s huge stake — and brought in a new corps of Chinese investors. A $7.6 billion deal to buy back about half of Yahoo’s holdings was financed in large part by Chinese banks and investment firms led by princelings, including Boyu Capital, which was founded by the Harvard-educated grandson of a former Chinese president, Jiang Zemin.

马云预计阿里巴巴会在接下来的一年里进行首次公开募股,他希望减少外资对公司的所有权——尤其是雅虎的巨额股份——并引入一批新的中国投资者。中国银行和太子党领导的投资公司为回购雅虎持有的约一半股份提供了76亿美元的资金,其中包括博裕资本,其创始人是前中国国家主席江泽民的孙子,曾在哈佛大学读书。

By 2014, Mr. Ma had become a money-making machine for the country’s political elite. Chinese firms owned or overseen by relatives of six current or former Politburo members had invested in Alibaba and its affiliates, according to company records.

到2014年,马云已经成为这个国家政治精英的赚钱机器。根据公司记录,六名现任或前任政治局委员的亲属拥有或监管的中国公司投资了阿里巴巴及其关联公司。

In a statement on behalf of the companies, Alibaba described the investors as “reputable state-owned firms or well-regarded private investment firms,” adding that it had “never solicited investments from any investor on account of their ‘political connections.’”

在代表这些公司发表的一份声明中,阿里巴巴称这些投资者是“声誉良好的国有企业或备受推崇的私人投资公司”,并称,阿里巴巴“从未因为任何投资者的‘政治关系’而向他们征求投资”。

The most lucrative event was Alibaba’s I.P.O. on Sept. 19, 2014, when the e-commerce giant’s market value shot past that of its biggest rival, Amazon. Mr. Xiao’s $25 million investment, made through his proxy, soared to $160 million that day.

2014年9月19日阿里巴巴的IPO是有史以来最赚钱的一次募股,当时这家电子商务巨头的市值超过了其最大竞争对手亚马逊。肖建华通过代理人投资的2500万美元当天飙升至1.6亿美元。

2014年9月,阿里巴巴在纽交所进行IPO期间,马云的两位商业伙伴虞锋和黄有龙在纽约证券交易所外合影。 VIA YOUTUBE

It was a heady day for Mr. Ma at the New York Stock Exchange, which was decked out in Alibaba orange. Beaming before the cameras, he posed with friends and colleagues, including a stocky man who appeared fleetingly in a video produced by Alibaba documenting the I.P.O.

马云在纽约证券交易所度过了激动人心的一天。在镜头前,他笑容满面地与朋友和同事合影,其中一名矮胖男子在阿里巴巴制作的一段记录这次IPO的视频中短暂出现。

The man was Huang Youlong, a businessman married to one of China’s most famous actresses. He was also Mr. Xiao’s ticket to even bigger stakes in Mr. Ma’s companies, The Times and The Wire China found.

这名男子名叫黄有龙,是一位商人,他的妻子是中国最著名的女演员之一。时报和《连线中国》发现,他也是肖建华获得马云公司更多利益的敲门砖。

The Movie Star’s Husband

电影明星的丈夫

Mr. Huang, 47, stands out from the rest of Mr. Ma’s high-achieving friends: He didn’t look the part, and he lived a bit of a charmed life.

47岁的黄有龙在马云其他成就不凡的朋友当中显得与众不同:他看起来并不适合他的角色,而且他过着一种神秘的生活。

He became a citizen of Singapore and went into business there with an American who was later jailed in the United States for illegally exporting aviation equipment to Iran. He became a business partner of a Chinese casino magnate who is now reportedly a fugitive. And in 2008, he married Zhao Wei, a famous Chinese actress who would eventually fall from favor and be mysteriously erased, film credits and all, from the Chinese internet.

他入了新加坡籍,在那里与一名美国人一起做生意,后者后来因非法向伊朗出口航空设备而在美国入狱。他成了一名中国赌场大亨的商业伙伴,据报道,这名大亨目前在逃。2008年,他与中国著名女演员赵薇结婚,赵薇最终名声扫地,她的名字神秘地从电影演职人员名单上消失,甚至一度在中国互联网上彻底消失。

黄有龙与妻子、电影明星赵薇。这对夫妇用肖建华一家公司的资金投资了马云的电影业务。

By 2014, Mr. Ma and Mr. Huang had become close. In a sign of friendship, Mr. Ma joined Mr. Huang that year at his father’s 80th birthday party and even sang at the celebration, Chinese media reported.

到2014年,马云和黄有龙已经走得很近。据中国媒体报道,当年马云和黄有龙一起参加了黄父的80岁寿宴,甚至还在庆祝活动上唱歌,可见两人关系的不一般。

When it came to his own businesses, Mr. Ma was joined by Mr. Huang in blockbuster deals, the Tomorrow Group documents show, in which Mr. Huang both acted as a proxy for Mr. Xiao and sought to profit for himself.

明天集团的文件显示,在马云自己的企业中,黄有龙和马云一起参与了一些重大交易,在这些交易中,黄有龙既是肖建华的代理人,也为自己谋取利益。

In 2014, Alibaba bought ChinaVision, a film and television production company, and renamed it Alibaba Pictures. But the purchase immediately ran into problems when accounting irregularities were discovered in the former company’s books.

2014年,阿里巴巴收购了影视制作公司文化中国,将其更名为阿里影业。但是,前公司的账目被发现存在会计违规,这笔收购立刻遇到了问题。

Trading in Alibaba Pictures stock was temporarily suspended, and two days before it resumed, Mr. Huang and his wife paid about $400 million to acquire a 9 percent stake from ChinaVision’s former chairman. The widely publicized investment boosted confidence in the new company, in part because Ms. Zhao was a bankable movie star at the time.

阿里巴巴影业的股票被暂时停牌,在复牌两天前,黄有龙和妻子花了大约4亿美元,从文化中国前董事长手中收购了9%的股份。这一被广泛宣传的投资增强了人们对新公司的信心,部分原因是,赵薇当时是一位有票房号召力的电影明星。

But the couple paid for it with money from one of Mr. Xiao’s companies, the documents show, a fact not publicly known and not included in disclosures to the Hong Kong Stock Exchange.

但文件显示,这对夫妇用肖建华一家公司的钱支付了这笔费用,这一事实没有公开,也没有包括在向港交所披露的信息中。

The documents reveal that the Xiao company financed 60 percent of the purchase and privately lent Mr. Huang $125 million at 8 percent interest to pay for the majority of the couple’s 40 percent stake. Mr. Huang also received a $75 million loan from Credit Suisse to help pay for the shares. While the loan was in Mr. Huang’s name, Mr. Xiao’s team handled payments and correspondence with the bank, the documents show.

文件显示,肖建华的公司为收购提供了60%的资金,并以8%的利息私下借给黄有龙1.25亿美元,以买下这对夫妇持有的40%股份的大部分。黄有龙还从瑞士信贷获得了7500万美元贷款,帮助支付这些股份。文件显示,虽然贷款是以黄有龙的名义,但肖建华的团队负责处理付款和与银行的往来。

Mr. Huang did not respond to emails or questions sent to his Hong Kong office. In a statement, Alibaba said it was “not involved in the transaction, and had no knowledge about Mr. Huang and Ms. Zhao’s investment activities,” though it acknowledged it had consented to the transaction.

黄有龙没有回复发往他香港办公室的电子邮件或问题。阿里巴巴在声明中表示公司“没有参与这笔交易,对黄先生和赵女士的投资活动也不知情”,但承认公司同意了这笔交易。

The investment quickly paid off. In April 2015, shares in Alibaba Pictures soared as Alibaba said it was considering injecting some of its own entertainment assets into the company. Days later, Mr. Huang sold some of his holdings, netting a $75 million profit, or a return of 144 percent in four months. A near-identical amount was paid to Mr. Xiao’s company, the documents show.

这笔投资很快就得到了回报。2015年4月,阿里影业的股价飙升,因为阿里巴巴表示正在考虑将自己的一些娱乐资产注入该公司。几天后,黄有龙卖掉了他持有的部分股票,获得了7500万美元的利润,四个月的回报率达到144%。文件显示,肖建华的公司也获得了几乎相同的金额。

‘Jack’s Eyes and Ears’

马云的耳目

By the time Mr. Huang cashed out those holdings in Alibaba Pictures, Mr. Ma’s investment firm had already set its sights on a new business: Reorient Group, a Hong Kong brokerage run by a business partner of Erik Prince, the American security contractor.

在黄有龙套现所持阿里影业股份时,马云的投资公司已经把目光投向了一项新业务:瑞东集团,这是一家香港经纪公司,由美国安保承包商埃里克·普林斯的业务伙伴经营。

Taking over Reorient would give Mr. Ma and David Yu, a friend and Shanghai financier who was his partner on the deal, a foothold in Hong Kong’s financial sector. They would rename the company Yunfeng Financial after the firm they founded earlier, Yunfeng Capital.

收购瑞东将使马云和他的朋友、上海金融家、交易合作伙伴虞锋在香港金融业站稳脚跟。他们将公司更名为云锋金融,取自两人早些时候创立的公司云锋基金。

“This is a strategic investment for us,” Mr. Yu said at the time.

“这对我们来说是一项战略投资,”虞锋当时说。

2021年,马云与虞锋。肖建华的公司网络是他们的香港证券公司的最大股东。 JAIME REINA/AGENCE FRANCE-PRESSE — GETTY IMAGES

Mr. Ma owns 40 percent of Yunfeng Capital and remains closely associated with it. (The “Yun” in Yunfeng is Mr. Ma’s given name in Chinese.) He took the stage in Beijing when they debuted the company in 2010 and Yunfeng Capital later joined Alibaba on at least a half-dozen deals.

马云拥有云锋基金40%的股份,并与该公司保持密切联系。(云锋中的“云”是指马云)。2010年在北京,云锋基金首次亮相时,马云登台致辞,随后云锋基金与阿里巴巴一起参与了至少六七宗交易。

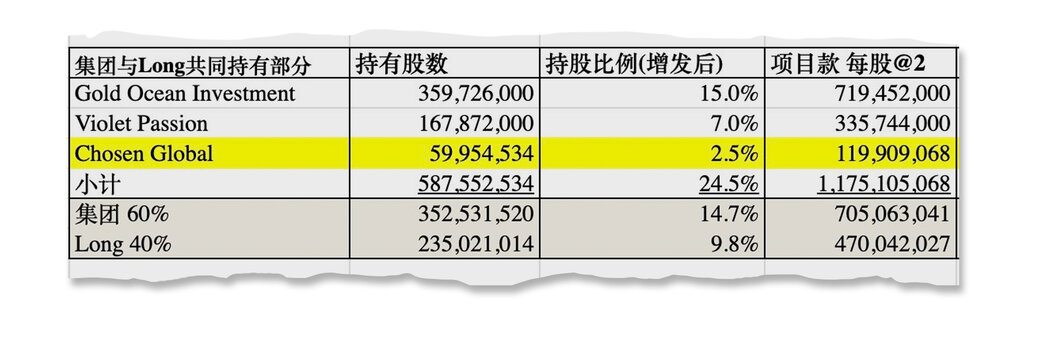

The Reorient purchase is the clearest evidence that Mr. Xiao was a crucial shareholder in one of Mr. Ma’s companies. Through four offshore companies and a fifth firm owned by Mr. Huang, Mr. Xiao controlled roughly one-third of the company’s shares by the end of 2015, making his network the largest shareholder — even larger than Mr. Ma.

对瑞东的收购格外清楚地证明,肖建华是马云旗下一家公司的重要股东。到2015年底,通过四家离岸公司和黄有龙拥有的第五家公司,肖建华控制了瑞东大约三分之一的股份,使他的网络成为最大股东,甚至比马云还大。

The deal took weeks to negotiate, and both Mr. Huang and his wife were a regular presence in the talks, recalled one former senior Reorient executive who was not authorized to speak publicly about the deal. Mr. Huang acted as “Jack’s eyes and ears,” the executive said.

一名无权公开谈论这笔交易的前瑞东高管回忆说,这笔交易的谈判花了数周时间,黄有龙和他的妻子都经常出现在谈判中。这位高管说,黄有龙充当了“马云的耳目”。

数据显示肖建华通过黄有龙秘密持有的瑞东集团的股份。

The purchase followed a familiar playbook from Alibaba Pictures and other deals. Reorient’s top executives sold a controlling stake to Mr. Ma and his fellow investors, issuing them new shares at a steep discount, according to a regulatory filing. When news broke that a firm co-founded by Mr. Ma had made the investment, Reorient’s shares soared more than 150 percent.

此次收购延续了阿里巴巴影业和其他交易的熟悉套路。一份监管文件显示,瑞东的高管向马云和其他投资者出售了控股权,并以极低的折扣向他们发行了新股。当马云参与创办的公司进行了投资的消息传出后,瑞东的股价飙升了150%以上。

In a statement, Yunfeng played down Mr. Ma’s role in the firm, saying he “is not involved in the decision-making or operation.” But the former senior executive at Tomorrow Group said Mr. Ma was the main attraction. “When we had a chance to invest in his companies,” the executive said, “we often did this through Huang Youlong or Yunfeng Capital.”

在一份声明中,云锋淡化了马云在公司中的作用,称他“不参与决策或运营”。但那位明天集团的前高管说,马云是公司最大的吸引力。“当我们有机会投资他的公司时,”这位高管说,“我们经常通过黄有龙或云锋基金进行投资。”

Mr. Xiao’s network paid a premium to become the biggest shareholder, the documents show, offering a glimpse into the shadow world of Hong Kong finance, where side agreements often spell out ownership of shell companies.

文件显示,肖建华的网络为成为最大股东还额外支付了一笔费用,这让人们得以一窥香港金融业的隐秘世界,那里经常通过补充协议来说明空壳公司的持有者身份。

A contract between Mr. Huang and a company controlled by Mr. Xiao showed that they had to pay a $190 million premium to an unspecified beneficiary, effectively doubling the price of their investment.

黄有龙与肖建华控制的一家公司签订的一份合同显示,他们必须向一名未指明的受益人支付1.9亿美元的额外费用,这实际上使他们的投资价格翻了一番。

On paper, Mr. Huang retained a 10 percent stake himself, but a spreadsheet shows that even that holding was obtained with loans from Mr. Xiao’s company.

纸面上,黄有龙自己保留了10%的股份,但一份电子表格显示,就连这10%的股份也是从肖建华的公司贷款获得的。

At the time, the filing with regulators said nothing about Mr. Xiao, who, the documents show, actually invested alongside Mr. Ma in Reorient through three separate companies. Two of them were owned by stand-ins for Mr. Xiao, including a 27-year-old woman from the Inner Mongolian city where Tomorrow Group once operated.

当时,向监管机构提交的文件没有提到肖建华,文件显示,他实际上通过三家不同的公司与马云一起投资了瑞东。其中两家公司由肖建华的代持人拥有,其中包括一位27岁的女性,此人来自内蒙古的一座城市,明天集团曾经在那里有运营项目。

In separate statements, Mr. Ma, Yunfeng and Johnson Ko, the chairman of Reorient at the time, said they had no knowledge of the Xiao connection. “Reorient conducted thorough know-your-clients due diligence,” Mr. Ko said.

在各自的声明中,马云、云锋金融和时任瑞东董事会主席的高振顺表示,他们对于肖建华参与其中毫不知情。“瑞东对客户进行了彻底的尽职调查,”高振顺说。

Weeks after the deal was finalized, the ex-wife of Mr. Ma’s business partner, Mr. Yu, benefited enormously from Mr. Xiao’s continued interest in Yunfeng Financial. Two offshore entities controlled by Mr. Xiao paid $235 million to buy an additional stake in the company from the ex-wife.

交易敲定数周后,马云的商业伙伴虞锋的前妻从肖建华对云锋金融的持续兴趣中获得了可观的利益,肖建华控制的两家离岸实体支付了2.35亿美元,从虞锋前妻手中购买了该公司的更多股份。

She netted a windfall of more than $190 million, public records show. In its statement, Yunfeng Capital described her as “an independent investor.”

公开记录显示,她从中获利超过1.9亿美元。在声明中,云锋资本称她为“独立投资者”。

A Campaign Against Graft

反腐运动

In 2017, the dragnet of Mr. Xi’s corruption crackdown finally closed in on Mr. Xiao.

2017年,习近平的反腐之网终于将肖建华锁定。

Years earlier, in his first speech to the Politburo as Communist Party chief, Mr. Xi made clear that the party was facing an existential crisis after six decades of rule.

数年前,习近平在担任中共中央总书记后首次向政治局发表的讲话中明确表示,在执政60年后,中共正面临生存危机。

“A mass of facts tells us that if corruption becomes increasingly serious, it will inevitably doom the party and the state,” Mr. Xi said in November 2012.

“大量事实告诉我们,腐败问题越演越烈,最终必然会亡党亡国!”习近平在2012年11月说表示。

Before the year was out, government officials were being rounded up in an ever-widening campaign against graft, which also took down some of Mr. Xi’s most powerful political rivals.

在这一年结束之前,许多政府官员在不断扩大的反腐运动中被捕,这场运动也拿下了习近平一些最强大的政治对手。

In March 2013, Mr. Xi became president, and that same year his relatives shed hundreds of millions of dollars in insider investments. In a statement to The Times in 2014, a spokeswoman for Mr. Xiao confirmed that the president’s sister and brother-in-law had finalized the sale of their 50 percent stake in a Beijing investment company they had set up in partnership with a state-owned bank. Their stake was sold to a company founded by Mr. Xiao.

2013年3月,习近平成为国家主席,同年他的亲属抛售了数亿美元的内部投资。2014年,肖建华的一位发言人在给《纽约时报》中的声明中证实,习近平的姐姐和姐夫已确定出售他们在一家北京投资公司中持有的50%的股份,这家公司是他们与一家国有银行合作成立的。他们的股份卖给肖建华创办的一家公司。

The crackdown initially focused mainly on government and party officials and their relatives, not business leaders, but soon virtually no one was off limits. Mr. Xiao’s turn came under cover of night in January 2017, when he disappeared from his apartment at the Hong Kong Four Seasons Hotel.

这场反腐运动最初主要针对党政官员及其亲属,而非商业领袖,但很快几乎无人能够幸免。2017年1月的一个夜晚,肖建华在其香港四季酒店的住所失踪。

Video footage captured by security cameras showed he was taken away in a wheelchair, his head covered, accompanied by about a half-dozen unidentified men pushing a large suitcase. It is believed he was then transported by boat from Hong Kong, eluding border controls, to police custody in mainland China.

监控画面显示,他蒙着头、坐在轮椅上被带走,同行的还有大约六七名身份不明的男子,推着一个大行李箱。据信,他随后坐船离开香港,绕过了边境管制,后来被内地警方关押。

In the days that followed, Mr. Xiao’s relatives and associates scrambled to unload some of their holdings, including more than $60 million held in a Yunfeng Capital fund, the Tomorrow Group documents show. The company that bought the stake was run by a business associate of Mr. Huang’s, Chinese corporate records show.

明天集团的文件显示,在接下来的几天里,肖建华的亲戚和同事争先恐后地抛售了他们持有的一些股份,包括云峰金融的逾6000万美元资产。中国的公司记录显示,购买这些股份的公司由黄有龙的一个商业伙伴经营。

Mr. Xiao’s role as concierge to the Communist Party elite had come to an end. But his financial ties to Mr. Ma had not — just as Ant Group, the e-payments and personal lending company, had become Mr. Ma’s latest darling.

肖建华作为中共权贵看门人的角色结束了。但他与马云的财务关系却没有——此时电子支付和个人贷款公司蚂蚁集团正成为马云的新宠。

The Final Undoing

最终的崩溃

By 2018, Ant had more than 700 million active users, and the company was barreling its way toward an I.P.O.

到2018年,蚂蚁金服的活跃用户已超过7亿,公司正朝着上市的方向快速迈进。

Mr. Ma followed the old playbook in preparing for the offering, corralling a group of powerful political elites as investors, The Wall Street Journal reported in 2021.

《华尔街日报》在2021年曾报道,马云在筹备IPO时遵循了老套路,找来了一群背景强大的政治精英作为投资者。

Mr. Xiao was secreted away in detention. But members of his network controlled about a tenth of a percentage point of Ant’s shares, according to data from WireScreen, a sister company of The Wire China that compiles Chinese corporate ownership data. Even that small fraction would be worth about $307 million if the I.P.O., as had been expected, valued the company at more than $313 billion.

肖建华遭秘密关押,但根据《连线中国》的姊妹公司WireScreen掌握的数据,他名下公司控制了蚂蚁金服大约0.1%的股份,蚂蚁金服的估值超过3130亿美元,如果IPO如外界预期的那样进行,即使这一小部分股份的价值也将达到3.07亿美元。

One Xiao employee, the corporate records show, was the single largest investor in a fund full of Mr. Ma’s friends and their relatives, including the mother of Ms. Zhao, the movie star. The fund was managed by Yunfeng Capital and was one of the largest holders of Ant shares.

公司记录显示,肖建华的一名员工是某基金的最大单一投资者,该基金由马云的朋友及其亲属组成,其中包括电影明星赵薇的母亲。该基金由云锋金融管理,是蚂蚁金服的最大股东之一。

Yunfeng and Ant said in statements that they were not aware of any connection between their investors and Mr. Xiao.

云峰金融和蚂蚁集团在声明中表示,他们并不知道投资者与肖建华之间存在任何关联。

By the end of 2019, as the Chinese authorities were unwinding Mr. Xiao’s network of companies, they saw concerning parallels in Ant’s ownership structure, according to Angela Huyue Zhang, a law professor at the University of Hong Kong who recently wrote a book about China’s regulation of technology companies.

香港大学法学教授张湖月最近写了一本关于中国的科技公司监管的书,她表示,到2019年底,随着中国的有关部门对肖建华的公司网络进行清理,他们看到了蚂蚁金服的所有权结构存在一些相似之处。

Like Mr. Xiao’s Tomorrow Group, Ant was dominated by a single person. And there were troublesome ripple effects of Mr. Xiao’s downfall. A bank he had controlled, Baoshang, filed for bankruptcy in 2020.

与肖建华的明天集团一样,蚂蚁金服也是由一个人主导。肖建华的垮台也带来了麻烦的连锁反应。他控制的包商银行于2020年申请破产。

一名男子走过包商银行的街头广告, 肖建华控制的该银行于2020年申请破产。 REUTERS

China’s central bank would need to intervene, Professor Zhang said, “if something bad happens to Ant like what happened to Baoshang.”

张湖月说,“如果蚂蚁金服发生像包商银行那样的灾难”,中国央行就需要干预了。

The authorities had drafted new rules that would rein in private financial systems, and Mr. Ma made their decision to intervene in Ant easier to justify during a speech in Shanghai.

政府有关部门已经起草了控制私人金融体系的新规则,马云在上海的一次演讲,进一步证明了他们干预蚂蚁金服的必要性。

Mr. Ma took aim at China’s state-dominated banking system, arguing that it constrained innovation and growth through a “pawnshop mentality” by lending only to those who posted collateral. He roasted financial regulators for being obsessed with minimizing risk.

马云将矛头对准了由国家主导的银行体系,认为该体系通过“当铺思维”限制了创新和增长,因为它只向提供抵押品的人贷款。他抨击金融监管机构一味追求风险最小化。

That was in October 2020. By early November, the Chinese government called off Ant’s I.P.O., the opening salvo in its assault on big tech. On social media, one post derided Mr. Ma’s remarks as “the most expensive speech in history.”

那是在2020年10月。到11月初,中国政府叫停了蚂蚁金服的首次公开募股,这是对大型科技企业发起攻击的开端。在社交媒体上,有一条帖子嘲笑马云的言论是“历史上最昂贵的演讲”。

Since then, Mr. Ma and his companies have been routed. Alibaba’s stock is down about 75 percent from its peak. Mr. Ma’s voting power in Ant has been mostly stripped away. A turnaround strategy announced by Alibaba last year has languished. Plans to publicly list some of its assets have been put on ice.

从那以后,马云和他的公司遭遇了重大打击。阿里巴巴的股价从最高点下跌了约75%。马云在蚂蚁金服的投票权已几乎被剥夺。阿里巴巴去年宣布的一项转型战略未能取得进展。部分资产上市的计划已被搁置。

Some of Mr. Ma’s friends haven’t fared any better. Mr. Huang was sued in Hong Kong for millions in unpaid debts. His wife, Ms. Zhao, has not appeared in a movie since 2019, though some references to her on the Chinese internet have been restored. Mr. Ma, in his statement, said he had not been in contact with either of them “for many years.”

马云一些朋友的情况也好不到哪里去。黄有龙因拖欠数千万美元债务在香港遭到起诉。他的妻子赵薇自2019年以来就没有在大银幕上露过面,尽管她的名字已经可以在中国的互联网上出现。马云在声明中说,他已经“多年”没有与他们中的任何一人有过联系。

Muyi Xiao对本文有报道贡献。