By Masaki Kondo

2024年7月19日 at GMT+8 08:08

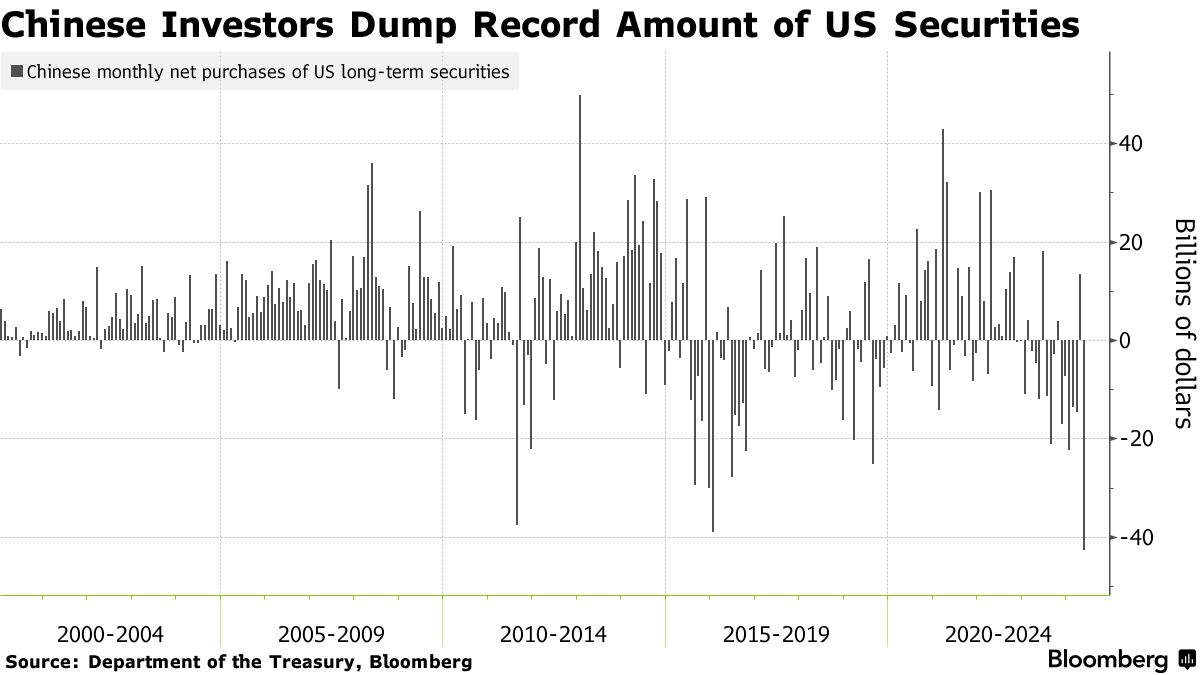

Chinese investors dumped a record amount of US securities, both stocks and bonds, in May as diplomatic tensions remained elevated between the world’s largest economies.

由于全球最大经济体之间的外交紧张局势持续加剧,中国投资者 5 月份抛售的美国证券(包括股票和债券)数量创历史新高。

Funds in the Asian nation offloaded a net $42.6 billion worth of long-term securities consisting of Treasury, agency and corporate bonds as well as equities, according to the latest data from the US Department of the Treasury released Thursday. Sales in the first five months of this year totaled $79.7 billion, an all-time high for the January-May period.

根据美国财政部周四发布的最新数据,这个亚洲国家的基金净抛售了价值 426 亿美元的长期证券,包括国债、机构债券、公司债券以及股票。今年前五个月的销售额总计797亿美元,创1-5月历史新高。

More than half of the sales were of Treasuries, followed by agency debt and stocks. The yield on the benchmark Treasury 10-year note climbed to the highest since November on April 25.

一半以上的销售是国债,其次是机构债务和股票。 4月25日,基准10年期国债收益率攀升至11月以来的最高水平。

China is one of the largest foreign holders of Treasuries and their flows are closely watched by bond investors and geopolitical strategists alike. A rise in Sino-American tensions has often fueled speculation that Beijing may shift its foreign reserves out of US assets — a move that would likely add upward pressure to yields.

中国是美国国债最大的外国持有者之一,其流动受到债券投资者和地缘政治策略师的密切关注。中美紧张关系的加剧往往会引发人们的猜测,即北京可能将其外汇储备从美国资产中转移出来,此举可能会增加收益率的上行压力。