The continent’s future will involve less Western influence 非洲大陆的未来将减少西方的影响

image: alberto miranda 图片:阿尔贝托-米兰达

image: alberto miranda 图片:阿尔贝托-米兰达

SINGAPORE 2023 年 9 月 19 日 | 新加坡

Listen to this story. Enjoy more audio and podcasts on iOS or Android.

收听本故事。在 iOS 或 Android 上欣赏更多音频和播客。

Seven hundred years ago, maritime trade routes that stretched from the coast of Japan to the Red Sea were peppered with Arab dhows, Chinese junks and Javanese djongs, ferrying ceramics, precious metals and textiles across the region. At its centre, a trading post known as Singapura flourished. The enormous intra-Asian commercial network was disrupted only by the arrival of sailors from rising European empires and the emergence of farther-flung markets for Asian goods.

七百年前,从日本海岸到红海的海上贸易航线上,阿拉伯单桅帆船、中国帆船和爪哇舢板络绎不绝,将陶瓷、贵金属和纺织品运往各地。在其中心,一个被称为 Singapura 的贸易站蓬勃发展。这个庞大的亚洲内部商业网络只在欧洲帝国崛起的水手到来和亚洲商品出现更远的市场时才被打乱。

image: the economist 图片:经济学家

image: the economist 图片:经济学家

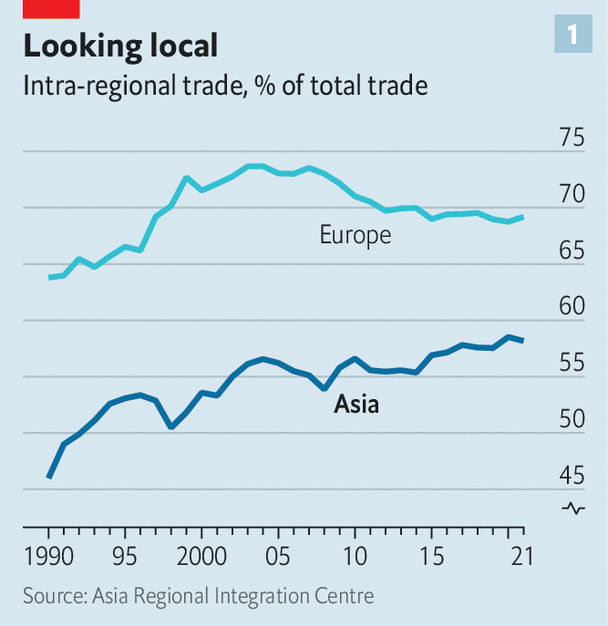

Today another reconfiguration is under way. The “Factory Asia” model of the late 20th century, in which the continent produced products for American and European consumers, provided an astonishing boost to the prosperity of China, Japan, South Korea and Taiwan. In 1990 just 46% of Asian trade took place within the continent, as vast quantities of goods flowed to the West. Yet by 2021 that figure had reached 58%, closer to European levels of 69% (see chart 1). More regional trade has led to an increase in capital flows, too, binding countries tighter still. A new era of Asian commerce has begun—one that will reshape the continent’s economic and political future.

如今,另一场重组正在进行。20 世纪末的 "亚洲工厂 "模式,即亚洲大陆为美国和欧洲消费者生产产品,为中国、日本、韩国和台湾的繁荣带来了惊人的推动力。1990 年,由于大量商品流向西方,亚洲仅有 46% 的贸易是在亚洲内部进行的。然而,到 2021 年,这一数字已达到 58%,接近欧洲 69% 的水平(见图 1)。更多的区域贸易也导致了资本流动的增加,使各国之间的联系更加紧密。亚洲商业的新时代已经开启--它将重塑亚洲大陆的经济和政治未来。

Its emergence began with the growth of sophisticated supply chains centred first on Japan in the 1990s, and later on China as well. Intermediate goods—components that will eventually become part of finished products—soon started to move across borders in greater numbers. They were followed by foreign direct investment (fdi). Asian investors now own 59% of the stock of fdi in their own region, excluding the financial hubs of Hong Kong and Singapore, up from 48% in 2010. In India, Indonesia, Japan, Malaysia and South Korea the share of direct investment from Asia rose by more than ten percentage points, to between 26% and 61%.

它的出现始于 20 世纪 90 年代以日本为中心的复杂供应链的发展,后来也出现在中国。中间产品--最终将成为制成品一部分的零部件--很快开始大量跨境流动。紧随其后的是外国直接投资(fdi)。除香港和新加坡等金融中心外,亚洲投资者目前拥有本地区 59% 的外国直接投资存量,高于 2010 年的 48%。在印度、印度尼西亚、日本、马来西亚和韩国,来自亚洲的直接投资份额上升了十多个百分点,达到 26% 至 61%。

After the global financial crisis of 2007-09, cross-border banking also became more Asian. Before the crisis hit, local banks accounted for around a third of the region’s overseas lending. They now account for more than half, having taken advantage of the retreat of Western financiers. China’s huge state banks led the way. Overseas loans by the Industrial and Commercial Bank of China more than doubled from 2012 to last year, rising to $203bn. Japan’s megabanks have also spread, in order to escape narrow margins at home, as have Singapore’s United Overseas Bank and Oversea-Chinese Banking Corporation.

2007-09 年全球金融危机爆发后,跨境银行业务也变得更加亚洲化。危机爆发前,本地银行的海外贷款约占该地区的三分之一。现在,它们利用西方金融家的撤退,占据了一半以上的份额。中国的大型国有银行引领了这一趋势。从 2012 年到去年,中国工商银行的海外贷款增加了一倍多,达到 2,030 亿美元。日本的大型银行也纷纷扩张,以摆脱国内狭窄的利润空间,新加坡的大华银行和华侨银行也是如此。

The presence of Western governments has also diminished. In a recent survey of South-East Asian researchers, businessfolk and policymakers by the iseas-Yusof Ishak Institute in Singapore, some 32% of respondents said they thought America was the most influential political power in the region. Yet just 11% of respondents called it the most influential economic power. State-led investment from China to the rest of the continent under the Belt and Road Initiative has captured attention, but official assistance and government-facilitated investment from Japan and South Korea are also growing.

西方政府的影响力也在减弱。在新加坡的 iseas-Yusof Ishak 研究所最近对东南亚研究人员、商界人士和政策制定者进行的一项调查中,约 32% 的受访者表示,他们认为美国是该地区最具影响力的政治大国。然而,仅有 11% 的受访者认为美国是最具影响力的经济大国。中国在 "一带一路 "倡议下对非洲大陆其他国家的国家主导型投资备受关注,但日本和韩国的官方援助和政府推动型投资也在增长。

These trends are likely to accelerate. In the face of deteriorating relations between America and China, companies in the region that rely on Chinese factories are considering alternatives in India and South-East Asia. At the same time, few bosses expect to desert China entirely, meaning two Asian supply chains will be required, along with some doubling-up of investment. Trade deals will speed this along. A study published last year suggested that the Regional Comprehensive Economic Partnership, a broad but shallow pact signed in 2020, will increase investment in the region. By contrast, as a result of America’s abandonment of the Trans-Pacific Partnership trade deal in 2017, there is little chance of Asian exporters gaining greater access to the American market.

这些趋势很可能会加速。面对日益恶化的中美关系,该地区依赖中国工厂的企业正在考虑在印度和东南亚寻找替代工厂。与此同时,很少有老板希望完全抛弃中国,这意味着需要两条亚洲供应链,同时需要加倍投资。贸易协议将加速这一进程。去年发表的一份研究报告指出,2020 年签署的《区域全面经济伙伴关系》将增加该地区的投资。相比之下,由于美国在 2017 年放弃了跨太平洋伙伴关系贸易协定,亚洲出口商几乎没有机会获得更多进入美国市场的机会。

image: the economist 图片:经济学家

image: the economist 图片:经济学家

The need to establish new supply chains means that transport and logistics are another area where intra-Asian investment will probably increase, notes Sabita Prakash of adm Capital, a private-credit firm. Matching investors searching for reliable income with projects looking for finance—the mission of such private-credit companies—has been a lucrative pastime in Asia, and is likely to become a more popular one. The size of the private-credit market in South-East Asia and India rose by around 50% between 2020 and mid-2022, to almost $80bn. Other big investors are turning to infrastructure, too. gic, Singapore’s sovereign wealth fund, which manages a portion of the country’s foreign reserves, is spending big on the building required for new supply chains.

私人信贷公司 adm Capital 的萨比塔-普拉卡什(Sabita Prakash)指出,建立新供应链的需求意味着运输和物流是亚洲内部投资可能增加的另一个领域。为寻找可靠收入的投资者和寻找资金的项目牵线搭桥--是这类私人信贷公司的使命--在亚洲一直是一种有利可图的消遣,而且很可能会变得更加流行。从 2020 年到 2022 年中期,东南亚和印度的私人信贷市场规模增长了约 50%,达到近 800 亿美元。管理着新加坡部分外汇储备的新加坡主权财富基金GIC,正在斥巨资建设新供应链所需的建筑。

Changes to Asian savings and demography will also speed up economic integration. China, Hong Kong, Japan, Singapore, South Korea and Taiwan have climbed the ranks of overseas investors, becoming some of the world’s largest. These richer and older parts of the continent have exported striking volumes of capital into the rest of the region, with cash following recently established trade links. In 2011 richer and older countries in Asia had about $329bn, in today’s money, invested in the younger and poorer economies of Bangladesh, Cambodia, India, Indonesia, Malaysia, the Philippines and Thailand. A decade later that figure had climbed to $698bn.

亚洲储蓄和人口结构的变化也将加速经济一体化。中国、香港、日本、新加坡、韩国和台湾已跻身海外投资者行列,成为世界上最大的海外投资者之一。亚洲大陆的这些较富裕和较古老的国家向该地区其他国家输出了大量资本,并在最近建立的贸易联系中获得了现金。2011 年,亚洲较富裕和较老的国家在孟加拉国、柬埔寨、印度、印度尼西亚、马来西亚、菲律宾和泰国等较年轻和较贫穷的经济体投资了约 3290 亿美元(按今天的货币计算)。十年后,这一数字已攀升至 6980 亿美元。

Silk flows 丝绸流动

In India and South-East Asia, “you’ve still got urbanisation happening, and capital follows those trends,” says Raghu Narain of Natixis, an investment bank. Bigger cities require not only more infrastructure investment, but also new companies better suited to urban life. Asian cross-border merger-and-acquisitions (m&a) activity is changing, according to Mr Narain, becoming more like that found in Europe and North America. Even as deals into and out of China have slowed considerably, m&a activity has become more common elsewhere. Japanese banks, facing low interest rates and a slow-growing economy at home, are ravenous for deals. Over the past year Sumitomo Mitsui Financial Group and Mitsubishi ufj Financial Group have snapped up Indonesian, Philippine and Vietnamese financial firms.

投资银行 Natixis 的 Raghu Narain 说:"在印度和东南亚,城市化进程仍在继续,资本也会追随这些趋势。大城市不仅需要更多的基础设施投资,还需要更适合城市生活的新公司。Narain先生认为,亚洲的跨国并购活动正在发生变化,变得更像欧洲和北美。即使进出中国的交易大幅放缓,并购活动在其他地区也变得更加普遍。日本的银行面临着低利率和国内经济增长缓慢的问题,对并购交易如饥似渴。过去一年,三井住友金融集团和三菱 UFJ 金融集团收购了印尼、菲律宾和越南的金融公司。

image: the economist 图片:经济学家

image: the economist 图片:经济学家

Meanwhile, rising Asian consumption makes local economies more attractive as markets. Whereas in Europe 70% or so of consumption goods are imported from the local region, just 44% are in Asia. This is likely to change. Of the 113m people expected next year to enter the global consumer class (spending over $12 a day in 2017 dollars, adjusted for purchasing power), some 91m will be in Asia, according to World Data Lab, a research firm. Even as Chinese income growth slows after decades of expansion, other countries will pick up the pace. The five largest economies in asean, a regional bloc—namely, Indonesia, Malaysia, the Philippines, Singapore and Thailand—are expected to see imports grow by 5.7% a year between 2023 and 2028, the most rapid pace of any region (see chart 3).

与此同时,亚洲不断增长的消费使当地经济成为更具吸引力的市场。在欧洲,70%左右的消费品从当地进口,而亚洲仅为 44%。这种情况很可能会改变。根据研究公司世界数据实验室(World Data Lab)的数据,预计明年将有1.13亿人进入全球消费阶层(按2017年美元购买力调整后,每天消费超过12美元),其中约9100万人将在亚洲。即使中国的收入增长在经过几十年的扩张后有所放缓,其他国家也将加快步伐。东盟是一个地区集团,其中最大的五个经济体--即印度尼西亚、马来西亚、菲律宾、新加坡和泰国--预计在2023年至2028年期间进口将每年增长5.7%,是所有地区中增长速度最快的(见图3)。

These regional trading patterns would represent a return to a more normal state of affairs. The globe-spanning export model that delivered first-world living standards to large parts of Asia, and encouraged investment from far afield, was a product of unique historical circumstances. The amount of goods that travel from the continent’s industrial cities to America is far higher than would be predicted by the relative size of their respective export and import markets, and the distance between them. Indeed, a paper by the Economic Research Institute for asean and East Asia suggests that machinery exports from North-East and South-East Asia to North America in 2019 were more than twice as high as such factors would suggest.

这些地区贸易模式代表着一种更正常状态的回归。跨越全球的出口模式为亚洲大部分地区带来了第一世界的生活水平,并鼓励了来自远方的投资,这是独特历史条件下的产物。从亚洲大陆的工业城市运往美国的商品数量,远远高于根据各自进出口市场的相对规模和它们之间的距离所预测的数量。事实上,东盟和东亚经济研究所(Economic Research Institute for asean and East Asia)的一份文件表明,2019 年东北亚和东南亚对北美的机械出口量是上述因素所预测的两倍多。

Closer commercial links will bind the business cycles of Asian economies even more tightly together. Despite the enduring use of the dollar in cross-border transactions and Asian investors’ continuing penchant for Western-listed markets, a study by the Asian Development Bank in 2021 concluded that Asian economies are now more exposed to spillovers from economic shocks in China than in America. This has been on display in recent months, as China’s faltering trade has hit exporters in South Korea and Taiwan. More trade, not just in intermediate parts but in finished goods for consumption, means the continent’s currencies and monetary-policy decisions will increasingly move together.

更紧密的商业联系将把亚洲经济体的商业周期更紧密地联系在一起。尽管在跨境交易中一直使用美元,而且亚洲投资者仍然对西方上市市场情有独钟,但亚洲开发银行 2021 年的一项研究得出结论认为,与美国相比,亚洲经济体现在更容易受到中国经济冲击的溢出效应的影响。最近几个月,中国贸易的不景气打击了韩国和台湾的出口商,这一点已经显现出来。更多的贸易,不仅是中间产品的贸易,而且是消费成品的贸易,意味着亚洲大陆的货币和货币政策决定将越来越多地相互影响。

This will have political ramifications. America will retain influence over Asian security, but its economic importance will decline. Local businessfolk and policymakers will be more interested in and receptive to their neighbours, rather than customers and countries farther afield. With local factories still being built, consumption growing and a deep pool of savings from Asia’s increasingly elderly savers desperate for projects to finance, the high point for regional integration has yet to be reached. The new era of Asian commerce will be more locally focused and less Western-facing. So will the continent itself. ■

这将产生政治影响。美国将保持对亚洲安全的影响力,但其经济重要性将下降。当地的商界人士和政策制定者将更加关注和接受邻国,而不是更远的客户和国家。由于本地工厂仍在兴建,消费不断增长,而且亚洲日益年长的储蓄者拥有大量储蓄,急需为项目提供资金,因此地区一体化的高潮尚未到来。亚洲商业的新时代将更加注重本地化,而不是面向西方。亚洲大陆本身也将如此。■

For more expert analysis of the biggest stories in economics, finance and markets, sign up to Money Talks, our weekly subscriber-only newsletter.

欲了解更多有关经济、金融和市场领域重大事件的专家分析,请注册订阅我们的每周订户专享时事通讯 Money Talks。

This article appeared in the Finance & economics section of the print edition under the headline "A new era of Asian commerce"

本文以 "亚洲商业的新时代 "为题刊登在印刷版的财经版上。