Contrarians might have passed over China, but the point of being a contrarian is to venture to places others shun. 逆向思维者可能会忽略中国,但逆向思维者的意义就在于敢于去别人避之不及的地方冒险。

By James Mackintosh 詹姆斯-麦金托什 美国东部时间 2023 年 9 月 5 日

China, as an emerging market, stands to benefit if the dollar begins to weaken. PHOTO: TODD LEE/ZUMA PRESS如果美元开始走软,作为新兴市场的中国将从中受益。照片:Todd Lee/ZUMA Press

Given the endless bad news about China’s economy, the contrarian in me wants to be bullish.

鉴于有关中国经济的坏消息层出不穷,我这个逆向思维者希望看涨中国经济。

It’s true that debt, housing, local government and consumer demand are all a mess, and dire demographics raise the prospect of a Japanese-style economic disaster. But there are three things working in China’s favor as an investment destination: Stocks rarely have been this cheap compared with the U.S.; its entire weight in a global benchmark is smaller than Apple’s; and a weaker dollar might help.

诚然,债务、住房、地方政府和消费需求都是一团糟,严峻的人口结构也使日本式的经济灾难前景堪忧。但作为投资目的地,有三件事对中国有利:与美国相比,中国的股票很少这么便宜;在全球基准中,中国的全部权重比苹果公司还小;美元走弱可能会有所帮助。

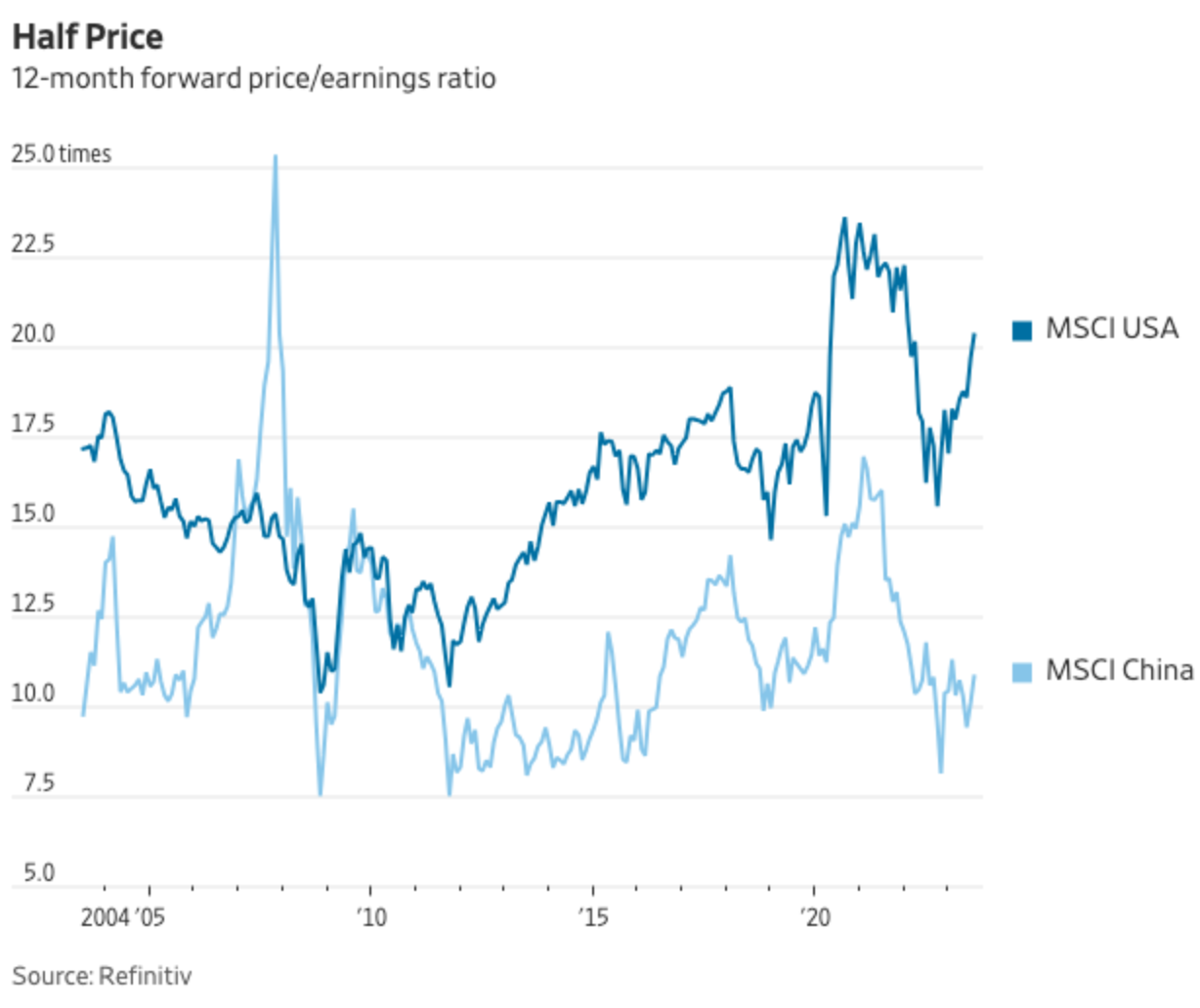

The basic case is that China is cheap. MSCI China, which includes Hong Kong stocks, trades at just 10.8 times the next 12 months’ earnings, about half the 20 times earnings of both the S&P 500 and MSCI USA. Even that hides the cheapness of much of the market, as Tencent Holdings makes up more than 12% of the index, and trades at 17.5 times forward earnings.

基本情况是,中国的股价便宜。摩根士丹利资本国际中国指数(MSCI China)包括香港股票,其未来 12 个月的市盈率仅为 10.8 倍,约为标准普尔 500 指数和摩根士丹利资本国际美国指数 20 倍市盈率的一半。即便如此,也掩盖了大部分市场的便宜,因为腾讯控股占该指数的 12% 以上,远期市盈率为 17.5 倍。

Of course, China is cheap for a reason. The property-market implosion has exposed the underlying weakness of the economy, while frigid relations with the U.S. have scared off Western investors. The risk of being in a Communist dictatorship has become all too clear, with the arbitrary decision to shut the private education industry, the crackdown on China’s big tech companies and the capricious response to Covid-19.

当然,中国股市便宜是有原因的。房地产市场的内爆暴露了中国经济的潜在弱点,而与美国的冷淡关系则吓跑了西方投资者。关闭民办教育产业、打击中国大型科技公司以及对 Covid-19 的反复无常的反应,让身处共产党独裁统治下的风险昭然若揭。

The question is: How cheap should China be? Past evidence suggests it can get much cheaper in a crisis. In the 2008-09 financial crisis, China traded at 6.6 times forward earnings, and was below 10 for most of the time from 2011 to 2015. It is also one of the few countries whose history includes a thriving stock market that went to zero, after the Communist revolution in 1949.

问题是:中国应该有多便宜?过去的证据表明,在危机中,中国可以便宜得多。在2008-09年金融危机中,中国的远期收益为6.6倍,而在2011-2015年的大部分时间里,中国的远期收益都低于10倍。中国也是少数几个历史上曾有过繁荣股市的国家之一,1949 年共产主义革命后,股市一度归零。

Yet, China is remarkably cheap compared with the U.S. The gap between the U.S. and China valuations has only been this wide briefly in 2020 and 2021, according to MSCI data starting in 2003.

然而,根据 MSCI 自 2003 年以来的数据,中美估值差距仅在 2020 年和 2021 年短暂出现过。

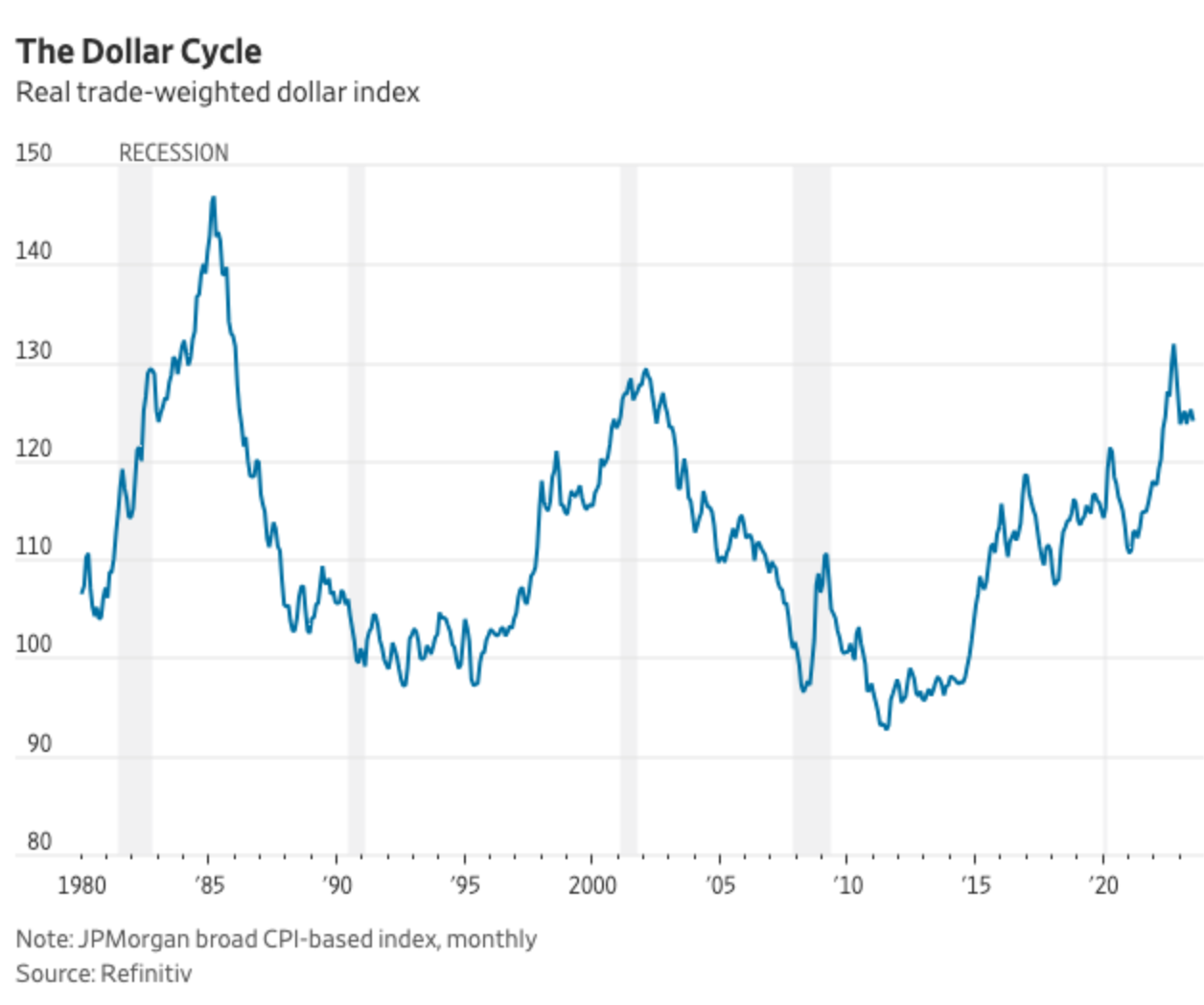

It isn’t only that China is cheap. As an emerging market, it ought to benefit if the dollar begins to weaken. Aside from anything else, a weaker dollar would help China defend the yuan, as it has been trying to do.

中国不仅便宜。作为一个新兴市场,如果美元开始走软,中国理应从中受益。除其他因素外,美元走弱将有助于中国捍卫人民币,这也是中国一直在努力做的事情。

“There’s a strong case to be made that the dollar has peaked and already started to decline,” argues Gustavo Medeiros, head of research at Ashmore Group. “When the dollar weakens, it typically becomes a virtuous circle of inflows and lending” to emerging markets.

"阿什莫尔集团(Ashmore Group)研究主管古斯塔沃-梅德罗斯(Gustavo Medeiros)认为:"有充分的理由表明,美元已经见顶,并已开始走低。"当美元走弱时,流入新兴市场的资金和贷款通常会形成良性循环"。

Certainly, the dollar became historically strong. It peaked in trade-weighted terms, adjusted for inflation, last October at its strongest level since the 1980s. It has since weakened about 6% as the Federal Reserve moved from aggressive rate increases to a more balanced approach, and inflation in much of the developed world became a bigger problem than in the U.S.

当然,美元变得历史性强势。去年 10 月,经通胀调整后,按贸易加权计算的美元汇率达到 20 世纪 80 年代以来的峰值。此后,随着美联储从激进的加息转向更为平衡的方法,美元贬值了约 6%,发达国家的通胀问题比美国更为严重。

I prefer investments to be cheap in absolute terms, not merely relative to alternatives. And the bull case applies to other investments, too. The U.S. market is very expensive, and makes everywhere else look cheap by comparison—with the U.K. at about 10 times forward earnings.

我更喜欢绝对便宜的投资,而不仅仅是相对于其他投资而言。牛市也适用于其他投资。美国市场非常昂贵,与之相比,其他地方的市场都显得很便宜--英国市场的远期收益约为 10 倍。

But the prospect of a weaker dollar wouldn’t particularly help other developed markets, except in pure currency gain terms. Emerging markets, however, usually benefit much more when the dollar falls. Compared with the rest of the emerging-market universe, China is about as cheap as it has ever been.

但美元走软的前景对其他发达市场并无特别帮助,除了纯粹的货币收益。然而,当美元下跌时,新兴市场通常会受益更多。与新兴市场中的其他国家相比,中国的汇率是有史以来最便宜的。

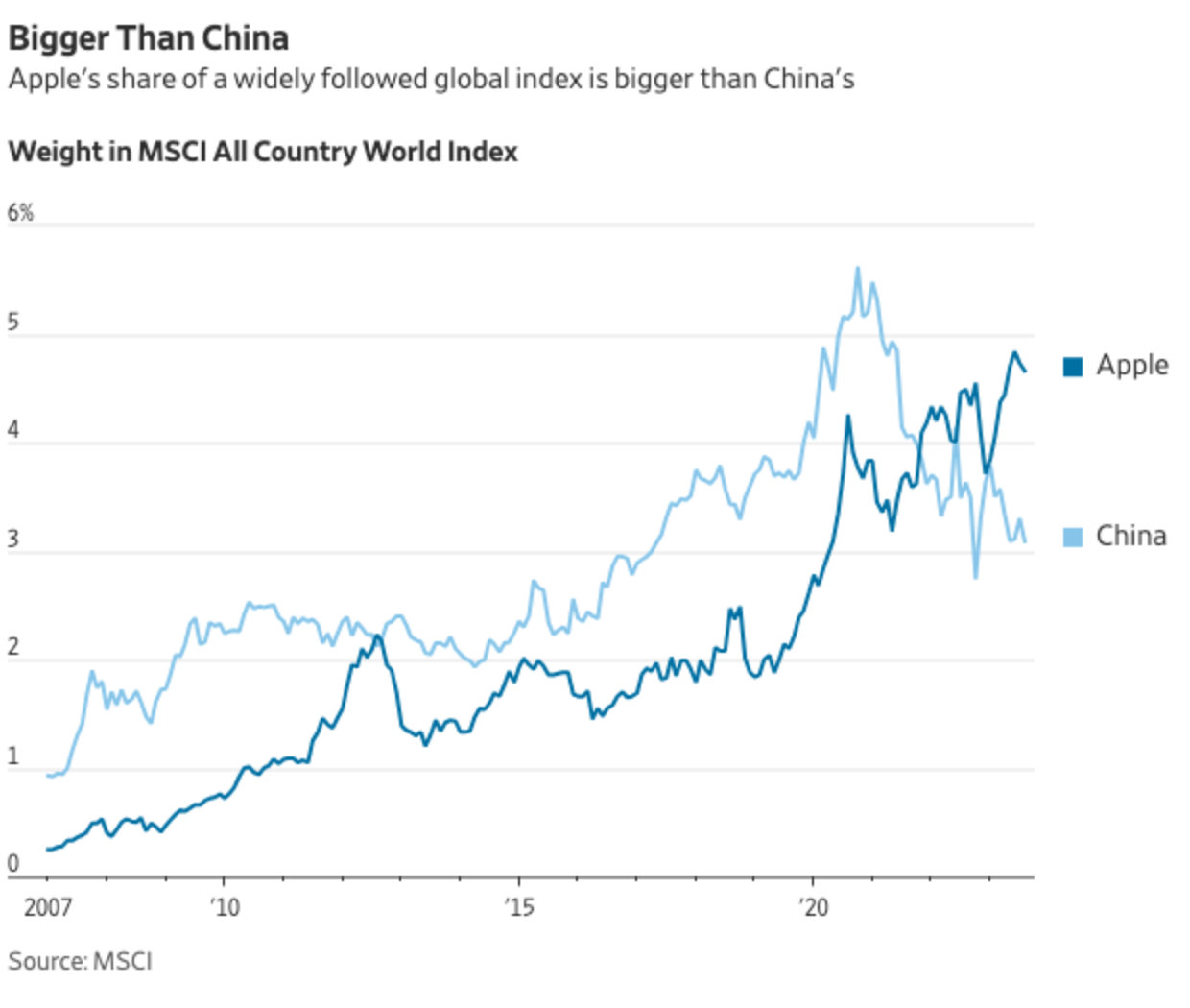

Some investors might still balk at the political and geopolitical risks of China, particularly regarding Taiwan. That’s perfectly reasonable. But there’s a contradiction here. Apple gets a fifth of its sales from China, has a large manufacturing base in the country and is bigger in the MSCI All Country World Index global benchmark than China.

一些投资者可能仍然会对中国的政治和地缘政治风险,尤其是台湾问题表示担忧。这是完全合理的。但这里有一个矛盾。苹果公司五分之一的销售额来自中国,在中国拥有庞大的生产基地,在 MSCI 全球指数中的排名也高于中国。

Investors choosing to steer clear of China because of the political risks at least ought to worry about Apple, the world’s most-valuable company and a very expensive one, at 29 times forward earnings.

因为政治风险而选择避开中国的投资者至少应该担心一下苹果公司,它是世界上最有价值的公司,也是一家非常昂贵的公司,其远期市盈率高达 29 倍。

Contrarians looking for ways to avoid the richly priced U.S. market might have passed over China because of the constant flow of bad news. But the point of being a contrarian is to venture to places that others shun; it has plenty of risks, but they are at least starting to be priced in. I would prefer it to be cheaper still before buying, but who wouldn’t?

寻求避开价格高昂的美国市场的逆向投资者可能会因为不断传来的坏消息而放弃中国市场。但逆向投资的意义就在于到别人避而远之的地方去冒险;它有很多风险,但至少已经开始被定价了。我更希望在买入前价格能再便宜一些,但谁又不是呢?