Nothing lasts forever, as any student of the business cycle knows. But recognizing that the economy is dynamic, and constantly shape shifting, doesn’t make it any easier to spot trend changes in real time.

正如任何研究商业周期的人都知道的那样,没有什么是永恒的。但认识到经济是动态的、不断变化的,并不能让实时发现趋势变化变得更容易。

Most observers were late to the party in late-2022 and early 2023 in recognizing that last year’s slowdown in US economic activity was reversing. The macro trend in America certainly looked worrisome in the final months of 2022. But there were early hints that change was brewing.

大多数观察家在 2022 年底和 2023 年初才意识到去年美国经济活动放缓的趋势正在扭转。 2022 年最后几个月,美国的宏观趋势确实令人担忧。但早期迹象表明,变化正在酝酿之中。

In early November, CapitalSpectator.com noted that a pair of propriety US business cycle indicators were showing signs of stabilizing and looked set to “stay moderately positive in the immediate future.” It wasn’t fully clear at the time, and CapitalSpectator.com didn’t fully buy into the idea until late-spring 2023. But history now shows that November ended up as a turning point that would evolve into the “resilience” diagnosis for US economic activity in 2023 – resilience that continues, at least for the moment.

11 月初,CapitalSpectator.com 指出,美国的两项商业周期指标正显示出企稳的迹象,并且看起来“在不久的将来将保持适度乐观”。当时情况并不完全清楚,直到 2023 年春末,CapitalSpectator.com 才完全接受这个想法。但现在的历史表明,11 月最终成为一个转折点,并将演变成对经济的“弹性”诊断。 2023 年美国经济活动——至少目前仍将保持韧性。

And yet the clues are adding up that the resilience may be peaking. To be clear: the odds that an NBER-defined recession has started or is imminent remains a low-probability risk, based on reviewing a wide number of economic and financial-markets indicators. The median nowcast for US GDP in Q3, for instance, continues to reflect moderate growth. But the tide may be in the early stages of peaking/turning, again, albeit modestly, like a thief in the night.

然而,越来越多的线索表明,恢复力可能已经达到顶峰。需要明确的是:根据对大量经济和金融市场指标的审查,美国经济研究局定义的衰退已经开始或即将发生的可能性仍然是低概率风险。例如,美国第三季度 GDP 的中值预测继续反映出温和增长。但潮水可能正处于顶峰/转向的早期阶段,尽管幅度不大,但就像夜间的小偷一样。

It’s easy to cherry pick a few indicators to make this point, such as the ongoing slide in job openings, which fell in June to the lowest level since March 2021. A more compelling clue is the ongoing but-still gradual decline in the year-over-year growth of nonfarm payrolls, which eased to a 2.2% through July. That’s still a healthy rise, but as each month posts a softer advance, the tipping point for the labor market at some point in the future draws ever closer and clearer.

很容易挑选一些指标来证明这一点,例如职位空缺的持续下滑,6 月份职位空缺跌至 2021 年 3 月以来的最低水平。一个更引人注目的线索是今年持续但仍然逐渐下降的情况—— 7 月份非农就业人数同比增速放缓至 2.2%。这仍然是一个健康的增长,但随着每个月都出现更温和的增长,劳动力市场在未来某个时刻的临界点越来越近、越来越清晰。

The possibility of interest rates staying elevated, or perhaps going higher, isn’t helping. Last week Federal Reserve Chairman Powell said: “Although inflation has moved down from its peak — a welcome development — it remains too high.” He added that “We are prepared to raise rates further if appropriate, and intend to hold policy at a restrictive level until we are confident that inflation is moving sustainably down toward our objective.”

利率保持在高位或可能走高的可能性无济于事。上周美联储主席鲍威尔表示:“尽管通胀已从峰值回落——这是一个值得欢迎的进展——但它仍然过高。”他补充说,“我们准备在适当的情况下进一步加息,并打算将政策保持在限制性水平,直到我们确信通胀持续下降以实现我们的目标。”

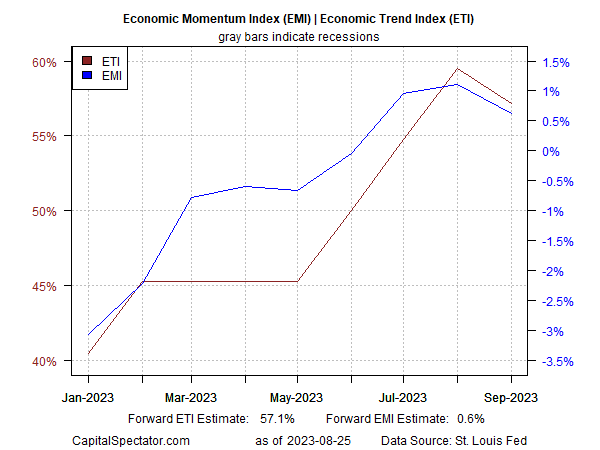

Talk is cheap and your editor prefers to focus on the data, particularly a broad, carefully diversified measure of US economic activity. That includes the Economic Trend Index (ETI) and Economic Momentum Index (EMI) that are part of the core analytics for weekly updates of The US Business Cycle Risk Report. As noted in this week’s edition for subscribers, the forward estimates for ETI and EMI posted modest downturns for September – the first declines vs. the previous month recorded this year.

空谈是廉价的,你的编辑更喜欢关注数据,尤其是对美国经济活动的广泛、谨慎的多元化衡量。其中包括经济趋势指数 (ETI) 和经济动量指数 (EMI),它们是美国商业周期风险报告每周更新的核心分析的一部分。正如本周订户版中所指出的,ETI 和 EMI 的 9 月份远期预测小幅下滑——与上个月相比,今年首次出现下滑。

For context, let’s start with the historical view of ETI and EMI. With the benefit of hindsight, the US economic rebound that started in late-2022 is clear and remains intact through July.

作为背景,让我们从 ETI 和 EMI 的历史观点开始。事后看来,2022 年末开始的美国经济反弹是明确的,并且在 7 月份仍然完好无损。

The challenge, as always, is modeling current conditions and the very-near-term future. (As a digression, the popular art of trying to forecast economic conditions more than a month or two ahead becomes increasingly pointless/hopeless the further out one looks, but I digress). A relatively methodology developed for The US Business Cycle Risk Report is using an ARIMA model to project each of the 14 indicators in ETI and EMI into the immediate future. This approach has proven valuable for quantitatively guesstimating the aggregated data points for ETI and EMI over the next 1-2 months. On that basis, it appears that the US economic resilience for 2023 may be peaking.

与往常一样,挑战在于对当前状况和不久的将来进行建模。 (题外话,试图预测未来一两个月以上经济状况的流行艺术变得越来越毫无意义/无望,但我离题了)。为美国商业周期风险报告开发的相对方法是使用 ARIMA 模型将 ETI 和 EMI 中的 14 个指标中的每一个指标预测到不久的将来。事实证明,这种方法对于定量猜测未来 1-2 个月内 ETI 和 EMI 的聚合数据点非常有价值。在此基础上,2023 年美国经济弹性似乎可能已见顶。

To be fair, it’s premature to take this apparent shift as definitive. Incoming data over the next several weeks may confirm or reject the preliminary trend change. It’s also possible that the moderate growth for the US economy will continue for some period of time, rather than accelerate or decelerate.

公平地说,现在就确定这一明显的转变还为时过早。未来几周的传入数据可能会证实或否定初步趋势变化。美国经济的温和增长也可能会持续一段时间,而不是加速或减速。

Meantime, I’m on peak watch for the US. It could be a false warning, but it’s too soon to tell. While we’re monitoring the numbers in the days and weeks ahead, it’s useful to remember that it’s all too easy to assume that recent economic activity is the best estimate of near-term future activity. That’s true most of the time… until it isn’t.

与此同时,我正在密切关注美国。这可能是一个错误的警告,但现在下结论还为时过早。虽然我们正在监测未来几天和几周的数据,但请记住,我们很容易假设近期的经济活动是对近期未来活动的最佳估计,这一点很有用。大多数时候都是如此……直到事实并非如此。