(官方中文版标题为:撤离中国的制造商与印度初创企业一拍即合)

中国动态清零政策下发生过的反复封控以及中西方不断加剧的地缘政治紧张局势,促使很多公司开始寻找中国以外的替代选项,而印度趁机努力吸引世界上一些最大的公司开设新工厂。

在地缘政治局势紧张的情况下,印度吸引了众多全球公司前来寻求中国之外的其他选择。SAHIBA CHAWDHARY FOR THE WALL STREET JOURNAL

Aruna Viswanatha 2023年8月29日1华尔街日报

BENGALURU, India— In early 2020, as the pandemic was shutting down global commerce, a Pennsylvania company was having trouble getting its usual steel parts out of China. It stumbled on another possible option—in India.

2020年初,在新冠疫情导致全球商贸停滞之际,宾夕法尼亚州的一家公司难以从中国获得常用的钢铁零部件,却偶然发现了另一个可能的供货渠道——在印度。

Zetwerk, a two-year-old startup connecting customers and manufacturers within the country, had never handled a U.S. order, but tapped its network of suppliers and delivered the parts. It is now a provider of everything from nail clippers to steel frames for U.S. customers, and is valued at $2.7 billion, with funding from Greenoaks Capital, Lightspeed India, Peak XV Partners and others.

初创企业Zetwerk负责给客户与印度国内的制造商牵线搭桥,当时成立已有两年,之前从未处理过来自美国的订单,但它利用自己的供应商网络交付了上述零部件。现在,Zetwerk正为美国客户供应从指甲刀到钢架等各种产品,从Greenoaks Capital、Lightspeed India、Peak XV Partners等投资者处获得了融资,估值达27亿美元。

India has been trying to lure some of the world’s biggest companies to set up new factories after repeated lockdowns under Beijing’s zero-Covid policy and rising geopolitical tensions with the West prompted many firms to look for alternatives to China, in a strategy referred to as “China plus one.”

中国政府动态清零政策下发生过的反复封控以及中西方不断加剧的地缘政治紧张局势,促使很多公司开始寻找中国以外的替代选项,该策略被称为“中国加一”,而印度趁机努力吸引世界上一些最大的公司开设新工厂。

Venture capital in India has taken note. Investors such as Peak XV, which was Sequoia Capital India until in June it announced a split from the U.S. firm, and Lightspeed are increasingly trying to back founders whose businesses involve boosting India’s global exports. Previously, they had focused on generations of Indian startups that primarily targeted the Indian consumer market.

在印度运营的风投机构已经注意到这一点。Peak XV、Lightspeed等投资者越来越青睐麾下企业致力于促进印度出口的创始人,而不是像以往那样,主要关注那些瞄准印度消费者市场的印度初创企业。Peak XV的前身是Sequoia Capital India,今年6月宣布从红杉资本(Sequoia Capital)拆分出来。

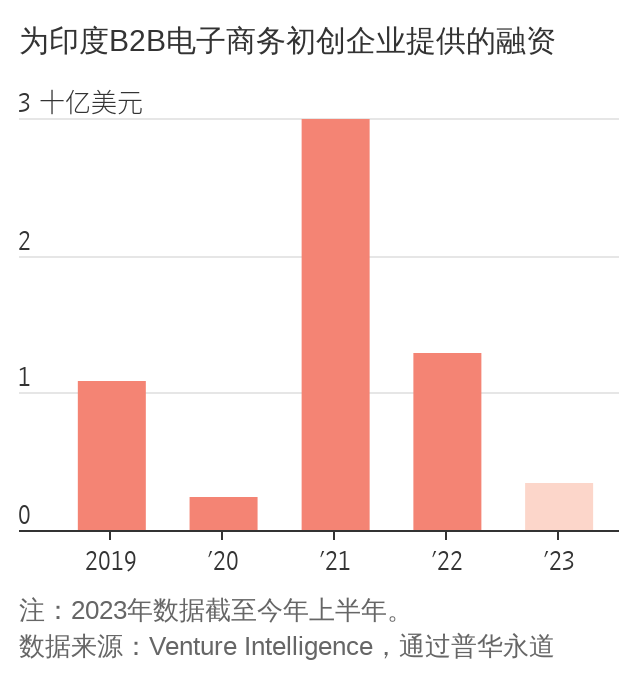

Business-to-business e-commerce startups, such as Zetwerk, have seen increased deal activity in recent years, according to a PwC India report. Funding in that sector was more than three times as high in 2021 and 2022 as in the two years before that, according to data from Tracxn.

普华永道印度(PwC India)的一份报告显示,Zetwerk等B2B电商初创企业的交易活动近些年有所增加。根据Tracxn的数据,2021年和2022年该领域融资额是之前两年的三倍多。

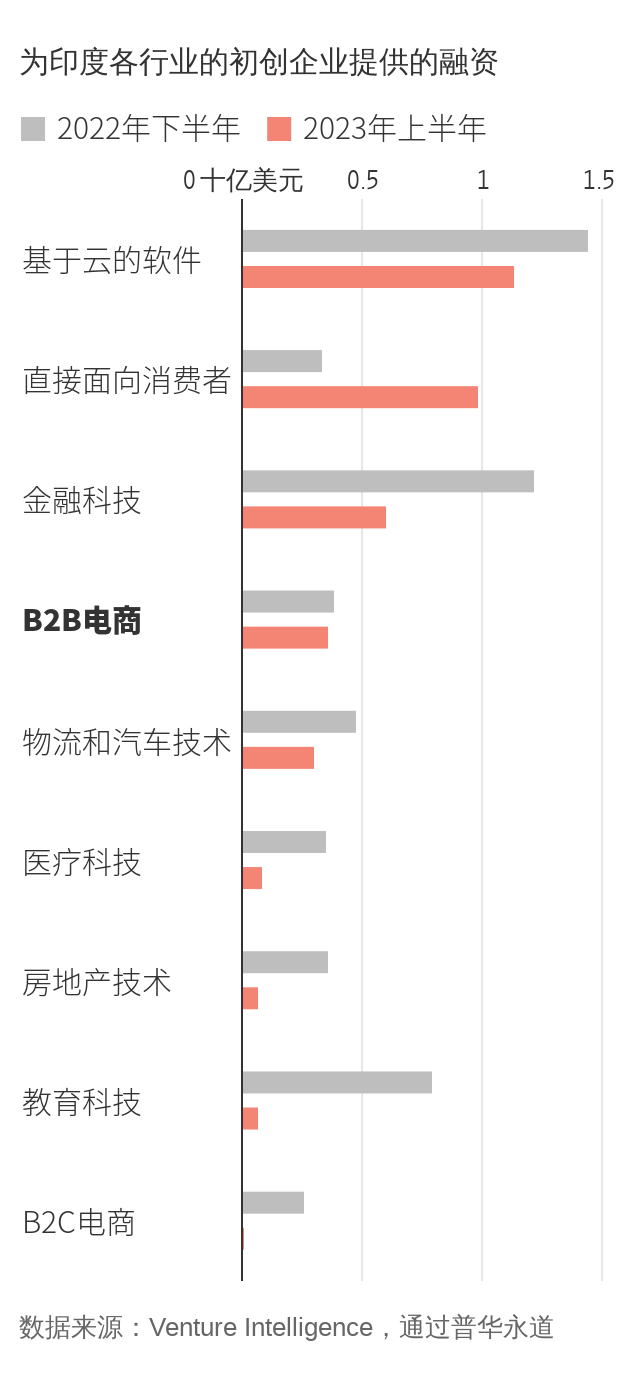

While VC funding has slowed in India in 2023, as it has in the U.S. and Europe, business-to-business investments remain one of the prime areas of financing in India.

虽然2023年印度风投活动像美国和欧洲一样放缓,但B2B投资仍是印度的主要融资领域之一。

“The supply-chain shocks were life-threatening,” for global businesses whose operations seized up during the pandemic, said Rahul Taneja, a partner at Lightspeed, which has made around three similar investments in India in the past year. “Founders saw this trend early enough and believed: ‘Why should I not leverage this tailwind?’”

Lightspeed合伙人Rahul Taneja说,对于在新冠疫情期间运营受阻的跨国企业来说,“供应链冲击是生死攸关的”。Lightspeed过去一年在印度进行了约三笔类似的投资。“企业创始人很早就看到了这一趋势,并觉得:‘我为什么不去搭上这个顺风车呢?’”

No one expects India to replace China’s dominance as the global factory floor. India has struggled to expand its manufacturing sector, as firms faced red tape and weak infrastructure, while policy reversals have stung investors in the past. But Indian government incentives coupled with broader efforts to source materials from India—Walmart said in 2020 that it plans to triple its exports from India to $10 billion by 2027, for example—have made the country more attractive for investors.

没人指望印度会取代中国的全球工厂霸主地位。由于存在各种繁琐的手续和基础设施薄弱的问题,印度制造业一直难以扩张,而且过去也不乏印度政府政策逆转致使投资者遭受损失的案例。不过,印度政府提供的激励措施以及鼓励从印度采购原材料的更广泛的行动已经增加了印度对投资者的吸引力,以沃尔玛(Walmart Inc., WMT)为例,该公司在2020年表示,计划到2027年将其从印度的出口增加两倍,至100亿美元。

India’s manufactured exports were barely one-tenth of China’s in 2021, but they exceeded all other emerging markets except Mexico’s and Vietnam’s, according to World Bank data.

世界银行的数据显示,2021年印度的制成品出口额仅为中国的十分之一,但超过除墨西哥和越南以外的所有其他新兴市场。

Beijing’s tensions with the West have given Indian firms an opening to connect with specific industries in the U.S. and other markets, even if they aren’t able to match the prices Chinese providers can offer, executives said.

企业高管们表示,中国与西方的紧张关系为印度企业提供了与美国和其他市场的某些行业建立联系的机会,即使这些印度厂商无法与中国供应商提供的价格相匹敌。

Zetwerk, a contract-manufacturing marketplace, tested its ability to deliver for a global customer with that initial $15,000 contract for shoulder screws and other parts for the Pennsylvania company. The work has since turned into orders from some 300 U.S. companies, several of which happened upon the small company in southern India thanks to Google searches, according to Zetwerk co-founder Amrit Acharya. Around 15% of the company’s $1.5 billion in operating revenue for the year that ended in March came from U.S. customers, Zetwerk said.

Zetwerk是一家代工制造平台,最初获得一笔金额为1.5万美元的合同,为宾夕法尼亚州的一家公司提供肩式螺栓和其他零部件,这笔交易检验了Zetwerk为全球客户供货的能力。据Zetwerk的联合创始人Amrit Acharya称,他们的业务从那之后得到扩展,已接到了约300家美国公司的订单,其中一些公司通过谷歌搜索发现了Zetwerk这家位于印度南部的小公司。Zetwerk表示,截至今年3月的一年,该公司15亿美元的营业收入中约有15%来自美国客户。

At Peak XV’s most recent training program for the new founders it is backing, more than half of them were building companies designed to export products or services to the world, while four years ago, only 10% were planning for that, said the firm’s managing director, Rajan Anandan.

Peak XV的董事总经理Rajan Anandan表示,在Peak XV最近为所投资初创企业的创始人举办的研习会上,半数以上的人都是在打造面向全球出口产品或服务的公司,而在四年前,只有10%的创始人有这样的规划。

A startup, Covvalent, launched last year with $4.3 million in funding to help fill a specific hole left by China. One of the startup’s founders, a chemical engineer working in Silicon Valley, ran into a contact in the paint industry at a 2021 alumni event complaining about his ability to get the ingredients for blues, greens and other pigments from China.

投资者和企业高管称,印度的中小型工厂构成的网络具备一定的潜力,这些工厂通常专门为印度的大客户生产几种产品,但它们还有一些不经常使用的产能。Taneja表示,据Lightspeed估算,在多个行业中,中小工厂闲置产能占到25%-40%,其中服装行业有约80亿美元,化工行业有20亿美元。去年,一家名为Covvalent的初创公司成立,并获得了430万美元的融资,该公司希望帮助填补中国留下的一个特定的供应链缺口。这家初创公司的创始人之一是在硅谷工作的化学工程师Sandeep Singh。他在2021年的一次校友活动中遇到了一位涂料行业的熟人,那人抱怨说他难以从中国获得蓝色、绿色和其他颜色染料的原料。

The founder, Sandeep Singh, contacted a former classmate in India, who asked around. “These small manufacturers, they have their own lab, their own R&D, and with some supervision can create an equivalent,” said the classmate, Arush Dhawan, who launched Covvalent with Singh.

随后,Sandeep Singh联系了他在印度的老同学Arush Dhawan,后者四处打听这方面的信息。Dhawan与Singh此后一起创办了Covvalent。Dhawan说:“这些小型制造商拥有自己的实验室、自己的研发部门,在一定的监督下,它们可以创造出同等的产品。”

Venture-capital firms are betting that a new crop of companies can add a layer of quality checks and logistics planning to help small manufacturers meet the outside demand.

风险投资公司押注,新一批公司可以带来一些质量检查和物流规划方面的助力,帮助小型制造商满足外部需求。

“A lot of startups are coming at it from different angles, trying to ride a wave that India is gearing up to be more export-oriented and more tightly integrated with the global economy,” said Shailesh Rao, who used to run Google’s India operations and Twitter’s international business, and now runs a new venture-capital firm, Escape Velocity.

Shailesh Rao曾负责管理谷歌的印度业务和Twitter的国际业务,他现在运营一家新的风投公司Escape Velocity。他表示:“印度目前准备加强出口对经济的引导作用并进一步融入全球经济,在这种情况下,许多初创企业正出于不同的理由和目的,试图搭上这股潮流。”

The firm is raising a $100 million fund to specifically invest in such manufacturing, software and other companies, and has made eight investments to date, including in Covvalent, he said.

Rao称,Escape Velocity正在募集规模1亿美元的基金,专门投资于此类从事制造、软件和其他业务的公司,迄今为止已经进行了八项投资,其中包括对Covvalent的投资。

Anand Datta, of one of India’s largest domestic venture-capital firms, Nexus, said they had decided to back an electronics design and manufacturing startup, Elecbits, and an auto components startup, Capgrid, after the Indian government limited the import from China of televisions and other products, and placed tariffs on automotive parts.

印度国内最大的风投公司之一Nexus的Anand Datta说,在印度政府限制从中国进口电视机和其他产品并且对汽车零部件征收关税后,他们决定投资一家电子设计和制造初创公司Elecbits和一家汽车零部件初创公司Capgrid。

“They are now supplying for India, but they will be for export,” Datta said.

Datta称:“这两家公司现在是对印度国内供应产品,但它们将来会走向对外出口的。”

Covvalent’s Dhawan said that on a recent sales trip to the U.S., the No. 1 topic at all of his meetings was how to avoid being caught up in escalating geopolitical risks. “The urgency was the most important thing; they want to reduce their dependence on China,” he said.

Covvalent的Dhawan表示,在最近一次赴美国推介的旅行中,他参加的所有会谈的首要议题都是如何避免陷入不断升级的地缘政治旋涡。他说:“最重要的是大家都有紧迫感;他们想要减少对中国的依赖。”